CashNews.co

With AI becoming essential in financial services, Info-Tech Research Group’s latest resource equips credit unions and small banks with the insights needed to modernize their core systems. This research outlines actionable strategies for industry IT leaders to navigate core system challenges, enhance data readiness, develop AI-driven solutions, and elevate both operational efficiency and customer engagement in a competitive marketplace.

TORONTO, Sept. 6, 2024 /PRNewswire/ – Credit unions and small banks are confronting significant IT challenges as they contend with outdated core banking systems and the mounting pressure to adopt AI technologies that are reshaping the financial services industry. Recognizing this critical need, Info-Tech Research Group has published its latest research-backed industry blueprint, Explore AI and AI-Related Use Cases for Credit Unions and Small Banksdesigned to guide IT leaders in smaller financial institutions in leveraging AI to revolutionize their operations and improve customer experiences. This resource offers strategic insights into AI road mapping and data maturation, empowering these institutions to navigate the complexities of AI adoption and optimize their service delivery.

“AI has quickly made an extensive impact on financial services. The time for AI adoption is now, and organizations should consider the many use cases where AI can transform internal operations and positively impact customers,” says David Tomljenovicprincipal research director at Info-Tech Research Group. “Small banks and credit unions must keep pace with the broader adoption of AI throughout the financial services industry or jeopardize their long-term viability.”

The firm’s latest resource highlights the challenges small banks and credit unions face in adopting AI despite the significant opportunities it presents. One of the key obstacles found in the research is that many of these institutions do not have the data needed to support AI initiatives in the industry. Info-Tech emphasizes IT leaders need to advance their data practices as they begin integrating AI technologies, as effective AI implementation relies heavily on robust data. The successful implementation of AI also requires new skillsets, such as those of data scientists, which means organizations may need to hire new talent or retrain their existing workforce.

“The number of potential use cases for AI in both the credit union and small bank markets is growing daily, and AI enablement is rapidly becoming democratized,” explains Tomljenovic. “Initially, only the largest and most sophisticated banks had the resources required to implement and support AI. However, AI has rapidly been scaled and is now within reach for many smaller financial organizations.”

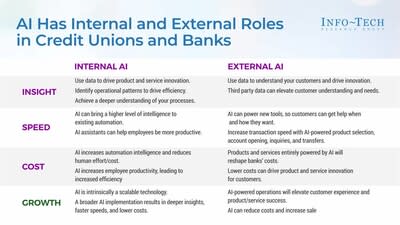

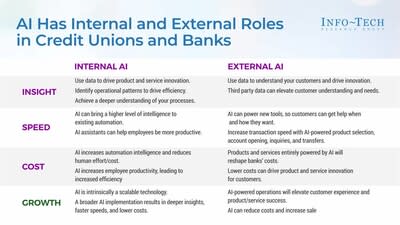

In the blueprint, Info-Tech outlines the internal and external roles AI can play in smaller banks. The firm details that internal AI applications are designed to enhance noncustomer-facing elements, such as operations, while external AI focuses on improving customer interactions and experiences.

Info-Tech highlights several benefits of AI adoption in Explore AI and AI-Related Use Cases for Credit Unions and Small Banksincluding:

Insights:

-

Internal AI: Leverage data to drive innovation in products and services while identifying operational patterns that enhance efficiency.

-

External AI: Use data to gain deeper insights into customers, driving innovation and elevating customer understanding through third-party data integration.

Speed:

-

Internal AI: Elevate the intelligence of existing automation, enabling AI assistants to help employees become more productive.

-

External AI: Power new tools that allow customers to get assistance whenever and however they need it while also speeding up transactions through AI-driven product selection, account opening, inquiries, and transfers.

Cost:

-

Internal AI: Increase automation intelligence, reducing human effort and costs, which in turn boosts employee productivity and operational efficiency.

-

External AI: AI-driven products and services have the potential to reshape costs, leading to lower expenses and enabling further product and service innovation.

Growth:

-

Internal AI: As a scalable technology, broader AI implementation results in deeper insights, faster processes, and reduced costs.

-

External AI: Enhance customer experience and boost the success of products and services, leading to reduced costs and increased sales.

Info-Tech’s comprehensive blueprint provides credit unions and small banks with valuable insights into AI’s transformative potential, offering a strategic advantage in a competitive market. The firm suggests IT leaders at these types of financial institutions start their AI efforts with internal applications, as noncustomer-facing use cases carry lower risk and offer an ideal environment to develop AI skills and capabilities. This resource equips IT with the guidance and tools required to overcome challenges and capitalize on AI opportunities.

For exclusive and timely commentary from David Tomljenovican expert in the financial sector, and access to the complete Explore AI and AI-Related Use Cases for Credit Unions and Small Banks blueprint, please contact [email protected].

Info-Tech LIVE 2024 Conference

Registration is now open for Info-Tech Research Group’s annual IT conference, Info-Tech LIVE 2024taking place September 17 to 19, 2024at the iconic Bellagio in Las Vegas. This premier event offers journalists, podcasters, and media influencers access to exclusive content, the latest IT research and trends, and the opportunity to interview industry experts, analysts, and speakers. To apply for media passes to attend the event or gain access to research and expert insights on trending topics, please contact [email protected].

About Info-Tech Research Group

Info-Tech Research Group is one of the world’s leading research and advisory firms, proudly serving over 30,000 IT and HR professionals. The company produces unbiased, highly relevant research and provides advisory services to help leaders make strategic, timely, and well-informed decisions. For nearly 30 years, Info-Tech has partnered closely with teams to provide them with everything they need, from actionable tools to analyst guidance, ensuring they deliver measurable results for their organizations.

To learn more about Info-Tech’s divisions, visit McLean & Company for HR research and advisory services and SoftwareReviews for software buying insights.

Media professionals can register for unrestricted access to research across IT, HR, and software and hundreds of industry analysts through the firm’s Media Insiders program. To gain access, contact [email protected].

For information about Info-Tech Research Group or to access the latest research, visit infotech.com and connect via LinkedIn and X.

View original content to download multimedia:https://www.prnewswire.com/news-releases/ai-adoption-for-credit-unions-and-small-banks-addressed-in-new-industry-blueprint-by-info-tech-research-group-302240816.html

SOURCE Info-Tech Research Group