CashNews.co

Australian Embedded Finance Business and Investment Market

Dublin, Sept. 09, 2024 (GLOBE NEWSWIRE) — The “Australia Embedded Finance Business and Investment Opportunities Databook – 75+ KPIs on Embedded Lending, Insurance, Payment, and Wealth Segments – Q2 2024 Update” report has been added to ResearchAndMarkets.com’s offering.

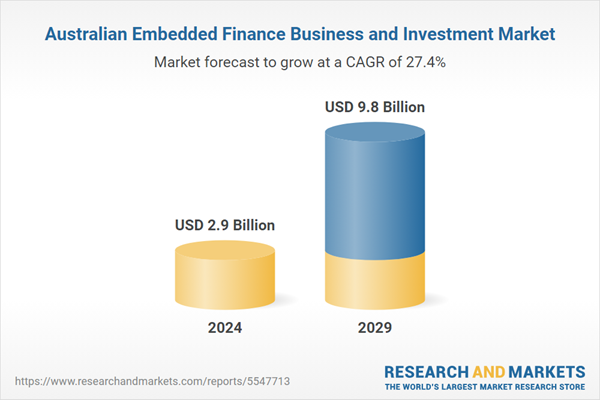

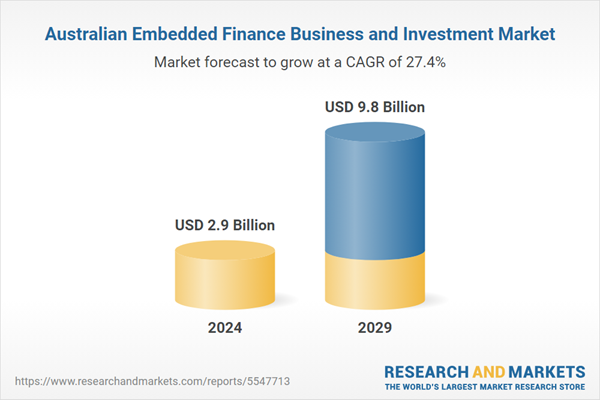

The embedded finance industry in Australia is expected to grow by 14.7% annually to reach US$2.92 billion in 2024. The embedded finance industry is expected to grow steadily over the forecast period, recording a CAGR of 27.4% from 2024 to 2029. The country’s embedded finance revenues will increase from US$2.92 billion in 2024 to reach US$9.81 billion by 2029.

The embedded finance sector in Australia is rapidly expanding, driven by evolving consumer preferences, fintech innovation, and supportive regulatory changes. The market’s growth is bolstered by significant product launches, strategic partnerships, and a regulatory environment conducive to cashless payments and fintech advancement.

Growth in the Embedded Finance Sector

Embedded finance has been gaining momentum in Australia over the last few months. This growth is fueled by shifting consumer behavior, the increasing innovation in fintech, and updated compliance regulations that simplify the offering of integrated financial services for both financial institutions and fintech companies.

In the next 6 months, the embedded finance market in Australia is expected to grow significantly. The growth is driven by the increasing demand for seamless financial experiences in industries like retail, e-commerce, healthcare, and software platforms.

Key Developments in the Embedded Finance Sector

Product Launches and Innovations

Douugh’s Stakk Platform: Dough launched its Stakk platform, a comprehensive embedded finance solution offering various services, including digital banking, online account opening, identity verification, and payment processing. This platform is designed for B2B clients, allowing other businesses to integrate these financial services seamlessly into their offerings.

Embedded Payment Solutions: Various fintech companies have introduced new embedded payment solutions that enable businesses to integrate payment processing directly into their software platforms. This development is aimed at enhancing user experience and streamlining transactions for both B2B and B2C markets.

Douugh Pay: Douugh is also in the beta testing phase for its “Douugh Pay” solution, which aims to provide a merchant payment gateway. This product is expected to facilitate easier transactions for businesses and expand Douugh’s footprint in the embedded finance space.

Strategic Partnerships

Zip and various e-commerce platforms: Zip has partnered with multiple e-commerce platforms to embed its payment solutions directly into their checkout processes. This initiative is designed to provide a seamless payment experience for consumers while expanding Zip’s reach in the online retail space.

Revolut and local businesses: Revolut has engaged in partnerships with various Australian businesses to offer embedded financial services, including spending analytics and budgeting tools, directly within their platforms. This strategy aims to enhance customer engagement and provide added value through integrated financial management tools.

Regulatory Changes

Updated Compliance Regulations: The Australian government has implemented new compliance regulations that facilitate innovation in embedded finance. These changes aim to streamline the integration of financial services within non-financial platforms, enhancing the ability of fintech companies and traditional financial institutions to offer embedded financial products.

Focus on Cashless Payments: The demand for cashless payments has prompted regulatory bodies to support the growth of embedded payment solutions. This shift is aligned with the broader trend towards digital transactions, which has been accelerated by the pandemic, leading to a more favorable regulatory environment for embedded finance initiatives.

Support for Fintech Innovation: The Australian government continues to promote fintech innovation through various initiatives, including funding and support programs for startups in the embedded finance space. This regulatory support is crucial for fostering a competitive landscape and encouraging the development of new financial products and services.

This report offers a comprehensive, data-centric analysis of the embedded finance industry. It covers lending, insurance, payment, wealth and asset-based finance sectors and provides a detailed breakdown of market opportunities and risks across various sectors. With over 75+ KPIs at the country level, this report ensures a thorough understanding of embedded finance market dynamics, market size, and forecast.

It breaks down market opportunities by type of business model, consumer segment, and distribution model. In addition, it provides detailed information across various segments in each sector of embedded finance. KPI revenue helps in getting an in-depth understanding of end market dynamics.

Reasons to buy

-

In-depth Understanding of Embedded Finance Market Dynamics: Understand market opportunities and key trends along with forecast (2019-2028).

-

Insights into Opportunity by end-use sectors – Get market dynamics by end-use sectors to assess emerging opportunity across various end-use sectors.

-

Develop Market Specific Strategies: Identify growth segments and target specific opportunities to formulate embedded finance strategy; assess market specific key trends, drivers, and risks in the industry.

-

Get Sector Insights: Drawing from proprietary survey results, this report identifies opportunities across embedded lending, embedded insurance, embedded finance, and embedded wealth sectors.

Key Attributes:

|

Report Attribute |

Details |

|

No. of Pages |

130 |

|

Forecast Period |

2024 – 2029 |

|

Estimated Market Value (USD) in 2024 |

$2.9 Billion |

|

Forecasted Market Value (USD) by 2029 |

$9.8 Billion |

|

Compound Annual Growth Rate |

27.4% |

|

Regions Covered |

Australia |

Scope

Australia Embedded Finance Market Size and Forecast

-

Embedded Finance by Key Sectors

-

Retail

-

Logistics

-

Telecommunications

-

Manufacturing

-

Consumer Health

-

Others

-

Embedded Finance by Business Model

-

Platforms

-

Enabler

-

Regulatory Entity

-

Embedded Finance by Distribution Model

-

Own Platforms

-

Third Party Platforms

Australia Embedded Insurance Market Size and Forecast

-

Embedded Insurance by Industry

-

Embedded Insurance in Consumer Products

-

Embedded Insurance in Travel & Hospitality

-

Embedded Insurance in Automotive

-

Embedded Insurance in Healthcare

-

Embedded Insurance in Real Estate

-

Embedded Insurance in Transport & Logistics

-

Embedded Insurance in Others

-

Embedded Insurance by Consumer Segments

-

B2B

-

B2C

-

Embedded Insurance by Type of Offering

-

Embedded Insurance in Product Segment

-

Embedded Insurance in Service Segment

Embedded Insurance by Business Model

-

Platforms

-

Enabler

-

Regulatory Entity

-

Embedded Insurance by Distribution Model

-

Own Platforms

-

Third Party Platforms

-

Embedded Insurance by Distribution Channel

-

Embedded Sales

-

Bancassurance

-

Broker’s/IFA’s

-

Tied Agents

-

Embedded Insurance by Insurance Type

-

Embedded Insurance in Life Segment

-

Embedded Insurance in Non-Life Segment

-

Embedded Insurance in Non-Life Segment

-

Motor Vehicle

-

-Fire and Property

-

-Accident and Health

-

-General Liability

-

-Marine, Aviation and other Transport

-

-Other

Australia Embedded Lending Market Size and Forecast

-

Embedded Lending by Consumer Segments

-

Business Lending

-

Retail Lending

-

Embedded Lending by B2B Sectors

-

Embedded Lending in Retail & Consumer Goods

-

Embedded Lending in IT & Software Services

-

Embedded Lending in Media, Entertainment & Leisure

-

Embedded Lending in Manufacturing & Distribution

-

Embedded Lending in Real Estate

-

Embedded Lending in Other

-

Embedded Lending by B2C Sectors

-

Embedded Lending in Retail Shopping

-

Embedded Lending in Home Improvement

-

Embedded Lending in Leisure & Entertainment

-

Embedded Lending in Healthcare and Wellness

-

Embedded Lending in Other

-

Embedded Lending by Type

-

BNPL Lending

-

POS Lending

-

Personal Loans

-

Embedded Lending by Business Model

-

Platforms

-

Enabler

-

Regulatory Entity

-

Embedded Lending by Distribution Model

-

Own Platforms

-

Third Party Platforms

Australia Embedded Payment Market Size and Forecast

-

Embedded Payment by Consumer Segments

-

B2B

-

B2C

-

Embedded Payment by End-Use Sector

-

Embedded Payment in Retail & Consumer Goods

-

Embedded Payment in Digital Products & Services

-

Embedded Payment in Utility Bill Payment

-

Embedded Payment in Travel & Hospitality

-

Embedded Payment in Leisure & Entertainment

-

Embedded Payment in Health & Wellness

-

Embedded Payment in Office Supplies & Equipment

-

Embedded Payment in Other

-

Embedded Payment by Business Model

-

Platforms

-

Enabler

-

Regulatory Entity

-

Embedded Payment by Distribution Model

-

Own Platforms

-

Third Party Platforms

Australia Embedded Wealth Management Market Size and Forecast

Australia Asset Based Finance Management Industry Market Size and Forecast

For more information about this report visit https://www.researchandmarkets.com/r/t0yjfw

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager [email protected] For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900