CashNews.co

Argentinian Embedded Finance Market

Dublin, Sept. 11, 2024 (GLOBE NEWSWIRE) — The “Argentina Embedded Finance Business and Investment Opportunities Databook – 75+ KPIs on Embedded Lending, Insurance, Payment, and Wealth Segments – Q2 2024 Update” report has been added to ResearchAndMarkets.com’s offering.

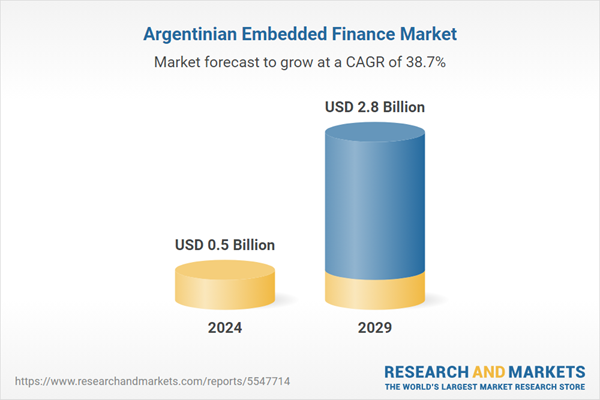

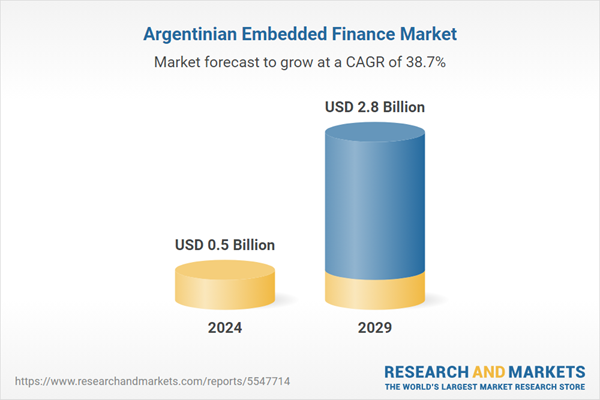

The embedded finance industry in the country is expected to grow by 21.3% annually to reach US$543.4 million in 2024. The embedded finance industry is expected to grow steadily over the forecast period, recording a CAGR of 38.7% from 2024 to 2029. The country’s embedded finance revenues will increase from US$543.4 million in 2024 to reach US$2.79 billion by 2029.

This report offers a comprehensive, data-centric analysis of the embedded finance industry. It covers lending, insurance, payment, wealth and asset-based finance sectors and provides a detailed breakdown of market opportunities and risks across various sectors. With over 75+ KPIs at the country level, this report ensures a thorough understanding of embedded finance market dynamics, market size, and forecast.

The embedded finance sector in Argentina has demonstrated impressive growth over the past few months, fueled by the integration of financial services into non-financial platforms and the expansion of the fintech ecosystem. Innovations in areas such as embedded payments and lending, along with notable product launches and strategic partnerships, highlight the sector’s dynamic evolution.

Looking ahead, the sector is well-positioned to continue its upward trajectory, supported by favorable regulatory changes and government initiatives promoting fintech innovation. The anticipated growth is bolstered by significant mergers and acquisitions, such as Naranja X’s acquisition of Uala, and promising market projections that suggest substantial expansion in the coming years.

Recent regulatory developments, including reforms in anti-money laundering, personal data protection, and AI transparency, underscore Argentina’s commitment to fostering a secure and transparent financial environment. These changes aim to enhance market stability and consumer confidence, paving the way for continued innovation and growth in the embedded finance sector. As Argentina advances in this field, it is set to play a pivotal role in reshaping how consumers engage with financial services, driving greater financial inclusion and accessibility.

This growth is expected to continue, supported by regulatory advancements such as open banking initiatives and a favorable government stance on fintech innovation. With more companies adopting embedded finance strategies, Argentina is set to enhance financial inclusion and revolutionize how consumers interact with financial services.

Product & Innovations

Banco Galicia and Mercado Pago’s BNPL Service

Banco Galicia and Mercado Pago have expanded their “Buy Now, Pay Later” (BNPL) services, enabling consumers to purchase and pay in installments directly through the Mercado Libre platform. This integration enhances the shopping experience by offering immediate financing options at the point of sale.

ICBC’s Embedded Financing Solutions

The Industrial and Commercial Bank of China (ICBC) introduced new embedded financing solutions within its ICBC Mall marketplace. This initiative allows customers to access financing options seamlessly while shopping, integrating financial services directly into the retail experience.

New Embedded Insurance Products

Several insurtech companies have launched embedded insurance products, allowing users to purchase coverage directly through digital platforms like e-commerce sites and travel booking applications, simplifying access to insurance without traditional processes. These innovations reflect the growing trend of embedding financial services into everyday applications, improving user experience and accessibility in Argentina’s evolving embedded finance sector.

Regulatory Changes

Anti-Money Laundering Reforms

National Law was passed, reforming the Anti-Money Laundering (AML) framework to align with international standards and ensure proper oversight of financial transactions, including those involving embedded finance solutions. This reform is expected to increase transparency and security in the sector, thereby boosting consumer confidence and market stability.

Personal Data Protection Legislation

A draft bill proposed in June 2023 aims to enhance personal data protection, introducing stricter obligations for companies and new rights for data owners. This legislation is crucial for safeguarding consumer privacy in the embedded finance space, potentially leading to more secure and trusted financial transactions.

Artificial Intelligence Transparency and Data Protection Program

In September 2023, a program was established to protect personal data in artificial intelligence applications. While initial and general objectives were outlined, this program may lead to more specific regulations relevant as embedded finance increasingly leverages AI technologies. These regulations could enhance data security and transparency, fostering trust and confidence in AI-powered embedded finance solutions. These regulatory advancements demonstrate Argentina’s commitment to creating a secure and transparent environment for the growth of embedded finance, balancing innovation with consumer protection and market stability.

Key Attributes:

|

Report Attribute |

Details |

|

No. of Pages |

130 |

|

Forecast Period |

2024 – 2029 |

|

Estimated Market Value (USD) in 2024 |

$0.5 Billion |

|

Forecasted Market Value (USD) by 2029 |

$2.8 Billion |

|

Compound Annual Growth Rate |

38.7% |

|

Regions Covered |

Argentina |

Scope

Argentina Embedded Finance Market Size and Forecast

-

Embedded Finance by Key Sectors

-

Retail

-

Logistics

-

Telecommunications

-

Manufacturing

-

Consumer Health

-

Others

-

Embedded Finance by Business Model

-

Platforms

-

Enabler

-

Regulatory Entity

-

Embedded Finance by Distribution Model

-

Own Platforms

-

Third Party Platforms

Argentina Embedded Insurance Market Size and Forecast

-

Embedded Insurance by Industry

-

Embedded Insurance in Consumer Products

-

Embedded Insurance in Travel & Hospitality

-

Embedded Insurance in Automotive

-

Embedded Insurance in Healthcare

-

Embedded Insurance in Real Estate

-

Embedded Insurance in Transport & Logistics

-

Embedded Insurance in Others

-

Embedded Insurance by Consumer Segments

-

B2B

-

B2C

-

Embedded Insurance by Type of Offering

-

Embedded Insurance in Product Segment

-

Embedded Insurance in Service Segment

Embedded Insurance by Business Model

-

Platforms

-

Enabler

-

Regulatory Entity

-

Embedded Insurance by Distribution Model

-

Own Platforms

-

Third Party Platforms

-

Embedded Insurance by Distribution Channel

-

Embedded Sales

-

Bancassurance

-

Broker’s/IFA’s

-

Tied Agents

-

Embedded Insurance by Insurance Type

-

Embedded Insurance in Life Segment

-

Embedded Insurance in Non-Life Segment

-

Embedded Insurance in Non-Life Segment

-

Motor Vehicle

-

Fire and Property

-

Accident and Health

-

General Liability

-

Marine, Aviation and other Transport

-

Other

Argentina Embedded Lending Market Size and Forecast

-

Embedded Lending by Consumer Segments

-

Business Lending

-

Retail Lending

-

Embedded Lending by B2B Sectors

-

Embedded Lending in Retail & Consumer Goods

-

Embedded Lending in IT & Software Services

-

Embedded Lending in Media, Entertainment & Leisure

-

Embedded Lending in Manufacturing & Distribution

-

Embedded Lending in Real Estate

-

Embedded Lending in Other

-

Embedded Lending by B2C Sectors

-

Embedded Lending in Retail Shopping

-

Embedded Lending in Home Improvement

-

Embedded Lending in Leisure & Entertainment

-

Embedded Lending in Healthcare and Wellness

-

Embedded Lending in Other

-

Embedded Lending by Type

-

BNPL Lending

-

POS Lending

-

Personal Loans

-

Embedded Lending by Business Model

-

Platforms

-

Enabler

-

Regulatory Entity

-

Embedded Lending by Distribution Model

-

Own Platforms

-

Third Party Platforms

Argentina Embedded Payment Market Size and Forecast

-

Embedded Payment by Consumer Segments

-

B2B

-

B2C

-

Embedded Payment by End-Use Sector

-

Embedded Payment in Retail & Consumer Goods

-

Embedded Payment in Digital Products & Services

-

Embedded Payment in Utility Bill Payment

-

Embedded Payment in Travel & Hospitality

-

Embedded Payment in Leisure & Entertainment

-

Embedded Payment in Health & Wellness

-

Embedded Payment in Office Supplies & Equipment

-

Embedded Payment in Other

-

Embedded Payment by Business Model

-

Platforms

-

Enabler

-

Regulatory Entity

-

Embedded Payment by Distribution Model

-

Own Platforms

-

Third Party Platforms

Argentina Embedded Wealth Management Market Size and Forecast

Argentina Asset Based Finance Management Industry Market Size and Forecast

For more information about this report visit https://www.researchandmarkets.com/r/rrcm1g

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager [email protected] For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900