CashNews.co

Bangladeshi Embedded Finance Market

Dublin, Sept. 11, 2024 (GLOBE NEWSWIRE) — The “Bangladesh Embedded Finance Business and Investment Opportunities Databook – 75+ KPIs on Embedded Lending, Insurance, Payment, and Wealth Segments – Q2 2024 Update” report has been added to ResearchAndMarkets.com’s offering.

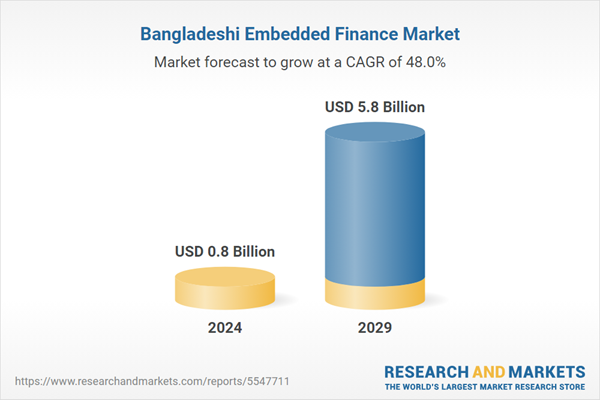

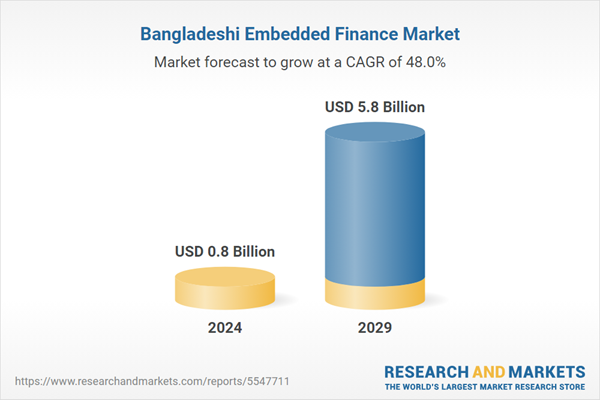

The embedded finance industry in Bangladesh is poised for remarkable growth, with projections indicating an annual increase of 28.5% leading to a market size of US$817.1 million by 2024. The industry is forecasted to sustain a compounded annual growth rate (CAGR) of 48.0% from 2024 to 2029, suggesting an expansion to a value of US$5.80 billion by the end of the forecast period.

This growth is underpinned by comprehensive sector analysis, covering key segments such as embedded lending, insurance, payment, and wealth management. The report elucidates the nature of market opportunities and risks associated with different sectors, providing an extensive breakdown of the market prospects for various business models, consumer segments, and distribution models.

Revenue Foresights and Market Dynamics

With the embedding of financial services into non-financial platforms, businesses have an opportunity to leverage more than 75 in-depth key performance indicators (KPIs) to gain insights into end market dynamics, which facilitate the understanding of this burgeoning market.

Scope of Embedded Finance in Bangladesh

The ample scope of the embedded finance market encompasses contributions from various key sectors, including retail, logistics, telecommunications, manufacturing, and consumer health. The segmentation extends across business models ranging from platforms to regulatory entities and includes a comprehensive outlook on distribution models through own and third-party platforms.

Embedded Insurance Market Reshaping the Industry

Embedded insurance emerges as a significant player within the financial ecosystem, with potential growth across consumer products, travel, automotive, and healthcare sectors. The report provides forecasts split by consumer segments and types of offerings, mapping out the trajectory for both product and service segments in embedded insurance.

Fostering Innovation in Embedded Lending

Embedded lending demonstrates diversification across both business and consumer sectors, indicated by market size projections and emerging opportunities in various B2B and B2C sectors, including IT, real estate, and healthcare. This segment encapsulates varied lending solutions from buy now, pay later (BNPL) schemes to point of sale (POS) lending.

Revolutionizing Payments through Embedded Solutions

The embedded payment sector offers innovations for both B2B and B2C segments, disrupting traditional payment infrastructures in sectors ranging from retail to health & wellness. The emergence of embedded payment solutions substantiates the shift towards streamlined, integrated payment experiences.

Prospects in Asset Based Finance Management

Asset Based Finance Management is also expected to undergo substantial growth, with significant opportunities identified for both hard and soft assets, fragmented across SMEs and large enterprises.

Conclusion

This detailed and systematic analysis of the embedded finance industry in Bangladesh underscores the substantial growth opportunities in the region. Business leaders, stakeholders, and market participants can leverage these insights to carve a niche in an evolving financial landscape, driving strategies that align with market-specific trends and consumer demands. The country’s thriving embedded finance ecosystem offers a tapestry of dynamic opportunities that promise significant transformation in the delivery of financial services.

Key Attributes:

|

Report Attribute |

Details |

|

No. of Pages |

130 |

|

Forecast Period |

2024 – 2029 |

|

Estimated Market Value (USD) in 2024 |

$0.8 Billion |

|

Forecasted Market Value (USD) by 2029 |

$5.8 Billion |

|

Compound Annual Growth Rate |

48.0% |

|

Regions Covered |

Bangladesh |

For more information about this report visit https://www.researchandmarkets.com/r/7m20pe

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager [email protected] For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900