CashNews.co

Nvidia (NASDAQ: NVDA) stock sent investors on a wild ride so far in 2024. It was trading at a stock split-adjusted price of around $48 at the start of the year. The price got as high as $140.76 at one point in mid-June, then plunged to $99 by early August before recovering enough to trade around $130 a share by mid-August. It then fell 21% over a few weeks to trade around $103 in early September before recovering somewhat this past week, and it now trades around $118.

Whew. A wild ride indeed.

It’s somewhat understandable, of course. As the focal point of the artificial intelligence (AI) boom, Nvidia carries a lot on its shoulders, and expectations are sky-high for this tech stock. Even after beating consensus estimates in its last earnings report, the stock price still slipped. Apparently, Wall Street felt it didn’t beat their estimates by enough. While the stock’s price trajectory is currently on the upswing, investors are hyper-tuned to its performance and any indication of where it may be headed.

It might interest investors, then, that Nvidia’s CEO, Jensen Huang, has been selling some of his Nvidia holdings. In the last month alone, Huang sold 720,000 shares totaling about $78 million.

What does it mean that Nvidia’s chief is offloading shares?

This latest sale isn’t his first cashing in on shares. Since just the start of July, Huang has sold over 4 million shares worth roughly $500 million. At first glance, this might be seen as a sign that the person who knows the business the most intimately thinks the stock price is going to drop (or that there’s trouble ahead). But a more thorough analysis shows it’s not. Although I can’t know Huang’s exact thinking, there’s no reason to take these sales as a cause for worry.

The simpler explanation comes down to the cost of living. The vast majority of Huang’s net worth is tied up in Nvidia stock. Unfortunately, you can’t buy a hamburger (or a super yacht) with stock — at least not easily. Cash is king, as they say. It is far more likely that Huang is simply liquifying a tiny portion of his massive net worth — valued at around $100 billion today — to have some cash on hand.

The Securities and Exchange Commission (SEC) has rules around executives buying and selling their own company’s stock. To avoid any suspicion of insider trading (as well as tamp down potential transaction-related public panic), SEC rule 10b5-1 allows executives to release public plans that outline predetermined, automated stock transactions handled by a neutral entity. While it may look like Huang just sold this stock, he actually decided to do so months ago and did it in a way that suggests he had very little influence on the price.

Tracking insider trading can be interesting, but most of the time it means a lot less than it might first seem to.

Nvidia is steaming ahead

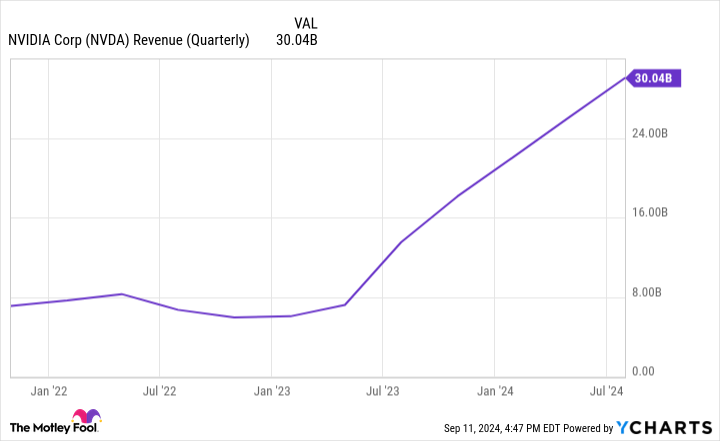

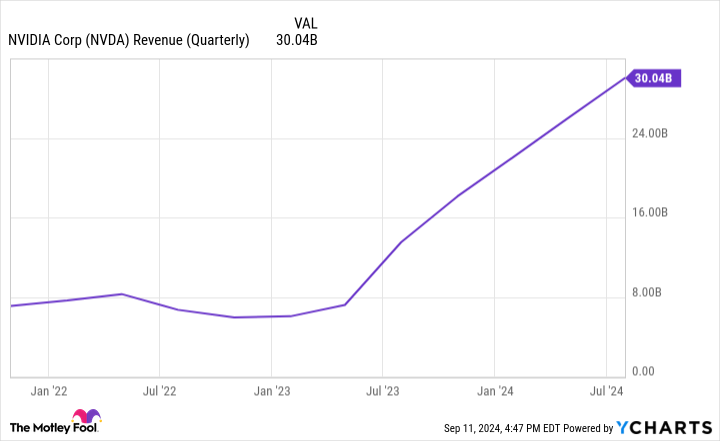

As far as Nvidia’s future stock performance, the path ahead has gotten far more complicated, but I still think it’s in a strong position. The company’s latest quarterly earnings report showed continued growth — it more than doubled its revenue year over year. The thing investors have to remember is that the major inflection point for Nvidia was the second quarter of last year, so it’s natural that the year-over-year growth has cooled a bit from the 200%-plus growth we saw in the last three quarters. Just look at the revenue explode in 2023 in this chart below.

While there was some concern that Nvidia could keep the growth going, many of the fears people had didn’t materialize. Concern over a delay in Nvidia shipping its latest generation of superchips was overblown, and demand for its current generation remains extremely strong. Rising concerns around a lack of real-world value for AI potentially hurting Nvidia’s clients and reducing their spending has also not yet happened. Companies like Amazon, Meta Platforms, and Alphabet are still locked in an AI arms race, and most are expecting to increase their spending, not reduce it.

More customers may be around the corner, too. Though Nvidia’s data center revenue is highly concentrated in big tech, we could soon see a broader set of commercial clients and even governments begin to invest in earnest. This would be a boon for Nvidia. Government-related contracts can be an extremely lucrative source of revenue and one that is slow to change once the relationship is formalized, providing an additional level of stability.

Finally, the company’s push into the automotive industry is only just ramping up. In the short term, AI-powered infotainment and safety features will drive revenue, but further on the horizon lies the real prize: Self-driving cars.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $730,103!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 9, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.

The CEO of Nvidia Just Sold $78 Million Worth of His Company’s Stock. Here’s What Investors Need to Know. was originally published by The Motley Fool

#cashnews #UnitedStates #newsfinace #finance #FollowsCashnews