CashNews.co

Japan’s stock markets have seen a notable rise recently, with the Nikkei 225 Index gaining 3.1% and the broader TOPIX Index up 2.8%, buoyed by a weaker yen following the U.S. Federal Reserve’s significant rate cut. As economic indicators suggest continued growth potential in Japan, it’s an opportune moment to explore high-growth tech stocks that could capitalize on this favorable market environment. When evaluating potential investments in this sector, consider companies with strong innovation capabilities, robust financial health, and strategic positioning to leverage current economic trends and technological advancements.

Top 10 High Growth Tech Companies In Japan

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

Hottolink |

50.99% |

61.55% |

★★★★★★ |

|

Cyber Security Cloud |

20.71% |

25.73% |

★★★★★☆ |

|

eWeLLLtd |

26.52% |

27.53% |

★★★★★★ |

|

Material Group |

17.82% |

28.74% |

★★★★★☆ |

|

Medley |

24.98% |

30.36% |

★★★★★★ |

|

Bengo4.comInc |

20.76% |

46.76% |

★★★★★★ |

|

Kanamic NetworkLTD |

20.75% |

28.25% |

★★★★★★ |

|

f-code |

22.70% |

22.62% |

★★★★★☆ |

|

ExaWizards |

21.96% |

75.16% |

★★★★★★ |

|

Money Forward |

20.68% |

68.12% |

★★★★★★ |

Click here to see the full list of 123 stocks from our Japanese High Growth Tech and AI Stocks screener.

We’ll examine a selection from our screener results.

Simply Wall St Growth Rating: ★★★★★☆

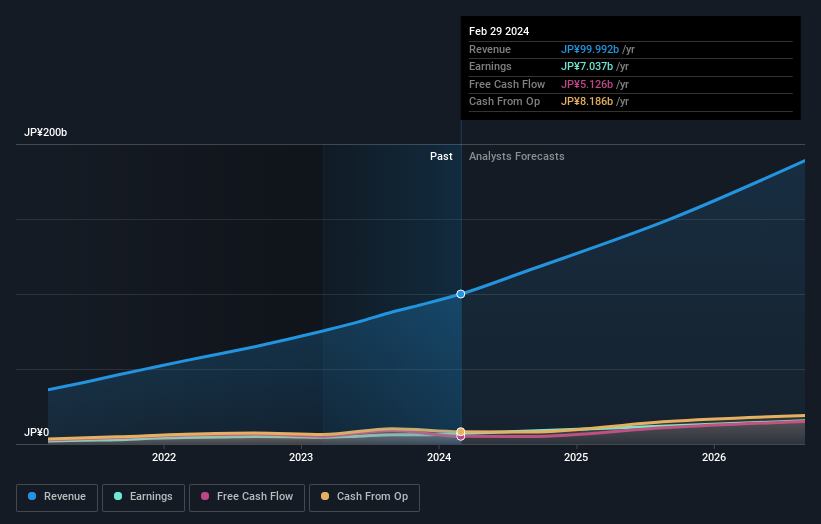

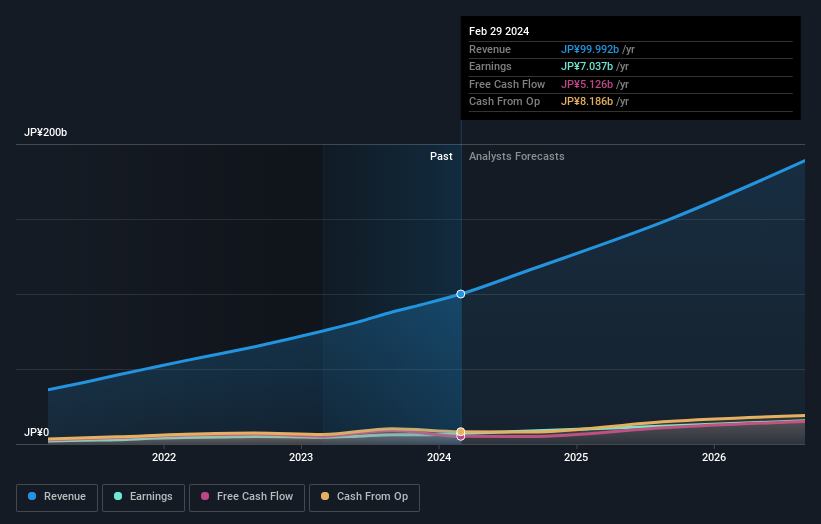

Overview: SHIFT Inc. specializes in providing software quality assurance and testing solutions in Japan, with a market cap of ¥241.91 billion.

Operations: SHIFT Inc. generates revenue primarily from Software Testing Related Services (¥68.64 billion) and Software Development Related Services (¥33.55 billion). The company also offers Nearby Services, contributing ¥7.60 million to its revenue stream.

SHIFT, a Japanese tech firm, demonstrates robust growth potential with its earnings forecast to increase by 32.2% annually, outpacing the broader Japanese market’s average of 8.6%. This significant growth is underpinned by a strong commitment to R&D, which has seen expenses rise to support innovation and competitiveness in software development. Despite a highly volatile share price recently, SHIFT’s strategic focus on enhancing its software solutions could position it well for sustained growth. With revenue projected to grow at 19.5% per year—faster than the market average of 4.3%—the company leverages industry trends such as the shift towards SaaS models, ensuring stable recurring income streams from its diversified client base.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OMRON Corporation operates globally in industrial automation, device and module solutions, social systems, and healthcare sectors with a market cap of ¥1.22 trillion.

Operations: OMRON Corporation’s revenue streams are primarily driven by its Industrial Automation Business (IAB) at ¥373.70 billion, followed by the Social Systems, Solutions and Service Business (SSB) at ¥156.85 billion, and the Healthcare Business (HCB) at ¥150.40 billion. The Devices & Module Solutions Business (DMB) contributes ¥143.69 billion to the total revenue.

OMRON’s trajectory in the tech sector is marked by a strategic emphasis on R&D, with a notable increase in expenses aimed at fostering innovation. This investment has propelled an earnings forecast growth of 46.2% annually, positioning it distinctively within Japan’s competitive landscape. Despite current unprofitability, the company’s revenue growth at 5.6% per year outpaces the broader Japanese market rate of 4.3%, reflecting its potential to leverage industry trends effectively. With recent announcements like its Q1 2025 results expected on August 2, OMRON seems poised for significant transitions that could redefine its market standing and influence future profitability.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Macbee Planet, Inc. operates in analytics consulting and marketing technology businesses in Japan with a market cap of ¥43.79 billion.

Operations: The company generates revenue primarily through its LTV Marketing Business, which accounts for ¥41.43 billion. Cost structures and other financial details are not specified in the provided text.

Macbee Planet’s strategic maneuvers, including a recent share repurchase program and consistent dividend payouts, underscore its commitment to enhancing shareholder value. The company’s revenue growth is projected at an impressive 16.2% annually, surpassing the broader Japanese market’s average of 4.3%. This growth is bolstered by a robust focus on R&D, which has seen expenses rise to foster innovation crucial for staying competitive in high-tech sectors. Additionally, earnings are expected to surge by 21.1% per year, reflecting strong operational efficiencies and market positioning despite a turbulent share price in recent months. These financial dynamics suggest Macbee Planet is navigating its challenges while capitalizing on opportunities to solidify its presence in the tech industry.

Key Takeaways

Interested In Other Possibilities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:3697 TSE:6645 and TSE:7095.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]