CashNews.co

Companies in the Zacks Beverages – Soft Drinks industry are well-positioned for long-term market share growth through innovation, adaptability, and a focus on consumer well-being. Increased digital investments in e-commerce and direct-to-consumer channels are proving advantageous. Key industry drivers include health consciousness, sustainability, and product innovation. Participants are expected to benefit from expanding into new and adjacent categories. Leading companies like Coca-Cola KO, PepsiCo PEP, Keurig Dr Pepper KDP, Monster Beverage MNST, and Vita Coco COCO are poised to capitalize on these strategies.

However, industry players continue to face cost pressures from inflation, particularly in transportation and commodities like steel and aluminum. Strategies such as price increases, reducing reliance on imported cans, and shifting production closer to markets are helping to mitigate these challenges. Additionally, higher operating costs due to increased marketing and advertising aimed at capturing market share may impact margins in the short term.

About the Industry

The Zacks Beverages – Soft Drinks industry comprises companies that manufacture, source, develop, market and sell non-alcoholic beverages. Soft drinks mainly include sparkling drinks, natural juices, enhanced water, sports and energy drinks, dairy, and RTD tea and coffee beverages. Some industry players like PepsiCo produce and sell handy food with flavored snacks, complementing their beverage portfolio. The companies sell products through a network of wholesalers and retailers, including supermarkets, department stores, mass merchandisers, club stores and other retail outlets. Some also offer products via company-owned or controlled bottling, independent bottling partners and partner brand owners.

What’s Shaping the Future of the Beverages – Soft Drinks Industry?

Evolving Trends: A significant trend in the U.S. soft drinks industry is the rising demand for healthier options. As consumers become more health-conscious, there is a shift toward beverages with natural ingredients, lower sugar content and functional benefits, in addition to offering varied flavors and better taste experiences. Plant-based beverages are gaining traction as alternatives to traditional soft drinks, with botanical extracts and non-dairy milk alternatives becoming popular among those looking to reduce their environmental impacts and make healthier choices. Additionally, functional beverages that provide specific health benefits, such as enhanced hydration, energy boosters and mood enhancers, are creating a niche in the market. Companies in the industry are poised to benefit from expanding into new and adjacent categories, including capturing market share in the rapidly growing RTD alcoholic beverage category through collaborations.

Innovation & Digital Growth: The soft drinks industry is experiencing a surge in flavor and format variety, driven by consumer demand for unique and exotic taste experiences. The sector stands to benefit from ongoing innovations and increased digital investments. Companies are optimizing their portfolios by focusing on core brands and investing in innovation to meet evolving consumer needs. They remain committed to product launches and innovation, with expansion into new markets being a key strategy for increasing market share. Digital and technology-driven investments are expected to pay off as consumer preferences shift toward online shopping. Industry players are accelerating their efforts to build robust digital capabilities, piloting numerous digital-enabled fulfillment options, and expanding digital offerings. Investments in loyalty programs are also being made to capture online demand. These strategies are likely to position soft drink companies for long-term growth.

Raw Material Cost Inflation & Supply Constraints: The beverage industry is troubled with higher costs, including increased commodity input costs and transportation expenses. Packaging costs have risen due to raw material cost inflation, particularly, steel and aluminum. Ongoing supply constraints in the aluminum can industry pose further challenges. Industry players continue to deal with freight inefficiencies and significant increases in domestic and international freight costs. These logistical issues, accompanied by higher input costs, have resulted in higher operating expenses, impacting the gross and operating margins. Most companies expect commodity cost inflation and higher transportation costs to persist through the near term. In response, price increases to counter these cost pressures have significantly boosted sales in recent quarters.

Zacks Industry Rank Indicates Dull Prospects

The Zacks Beverages – Soft Drinks industry is housed within the broader Consumer Staples sector. It currently carries a Zacks Industry Rank #156, which places it in the bottom 38% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is the average of the Zacks Rank of all the member stocks, indicates dull near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries results from a negative aggregate earnings outlook for the constituent companies. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually losing confidence in this group’s earnings growth potential.

Before we present a few stocks that you may want to consider for your portfolio, let us look at the industry’s recent stock-market performance and valuation picture.

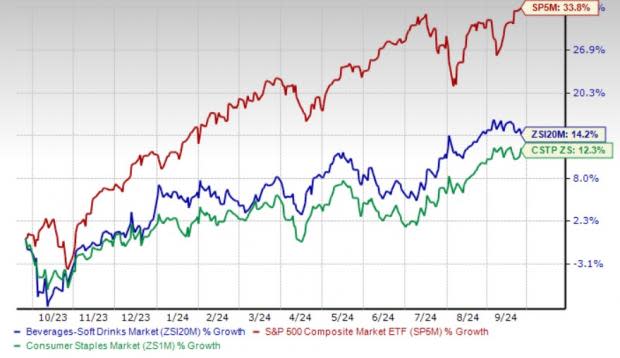

Industry vs. Broader Market

The Zacks Beverages – Soft Drinks industry has outperformed the Consumer Staples sector in a year. However, it has underperformed the S&P 500 Index.

The stocks in the industry have collectively gained 14.2% compared with the sector’s growth of 12.3%. Meanwhile, the S&P 500 has rallied 33.8%.

One-Year Price Performance

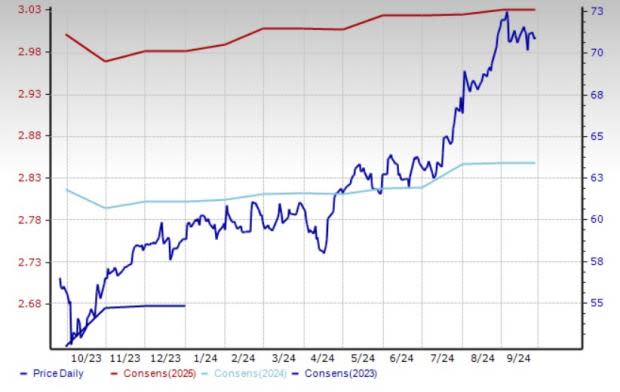

Industry’s Current Valuation

On the basis of the forward 12-month price-to-earnings (P/E) ratio, commonly used for valuing soft drink stocks, the industry is currently trading at 21.46X compared with the S&P 500’s 21.9X and the sector’s 18.23X.

Over the last five years, the industry traded as high as 23.97X and as low as 19.51X, with a median of 22.07X, as the chart below shows.

Price-to-Earnings Ratio (Past 5 Years)

5 Soft Drink Stocks to Watch

None of the stocks in the Zacks Beverages – Soft Drinks industry currently sports a Zacks Rank #1 (Strong Buy), whereas two stocks have a Zacks Rank #2 (Buy). We have also highlighted three stocks with a Zacks Rank #3 (Hold) from the same industry. You can see the complete list of today’s Zacks #1 Rank stocks here.

Let us take a look.

Coca-Cola: The soft drink behemoth is poised to gain from strategic transformation and ongoing worldwide recovery. The streamlining of its portfolio and accelerating investments to expand the digital presence position the company for growth in the long term. It has been witnessing a splurge in e-commerce, with the growth rate of the channel doubling in many countries. KO is strengthening consumer connections and piloting numerous digital-enabled initiatives through fulfillment methods to capture the online demand for at-home consumption.

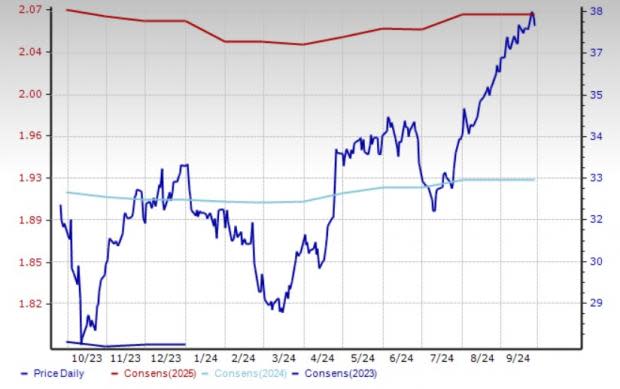

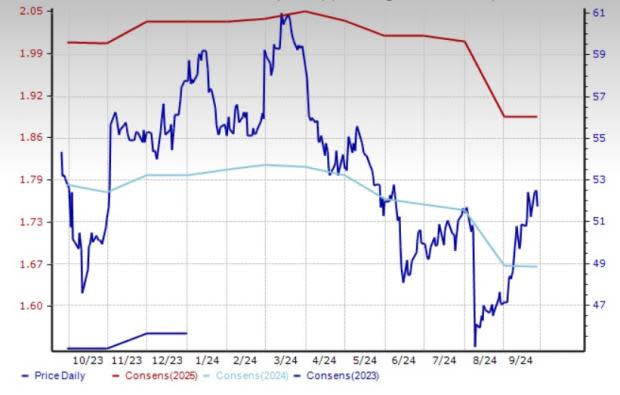

Coca-Cola is diversifying its portfolio to tap into the rapidly growing RTD category. The company has been gaining from the elasticity in the marketplace, an improved price/mix, and concentrated sales and underlying share gains in at-home and away-from-home channels. The Zacks Consensus Estimate for KO’s 2024 sales and earnings suggests growth of 0.6% and 6%, respectively. The consensus mark for earnings has been unchanged in the past 30 days. The company’s shares have gained 27.7% in the past year. The company currently has a Zacks Rank #2.

Price and Consensus: KO

Keurig Dr Pepper: The beverage and coffee company in the United States and Canada is poised to gain from continued momentum in the Refreshment Beverages segment and solid market share growth. Keurig Dr Pepper’s consumer-centric innovation model, portfolio expansion into high-growth categories and solid route-to-market capabilities appear encouraging. These endeavors are supported by the constant focus on cost efficiency and capital discipline. The company’s International segment is also performing well.

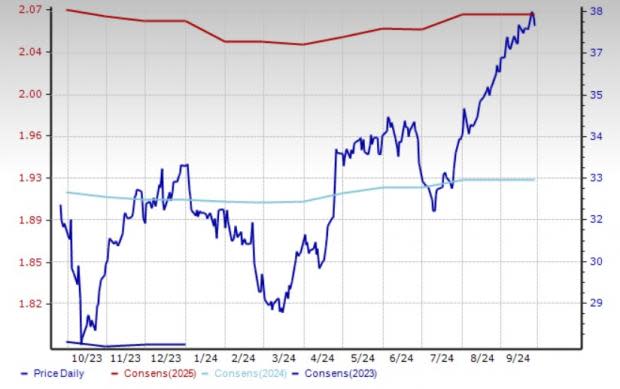

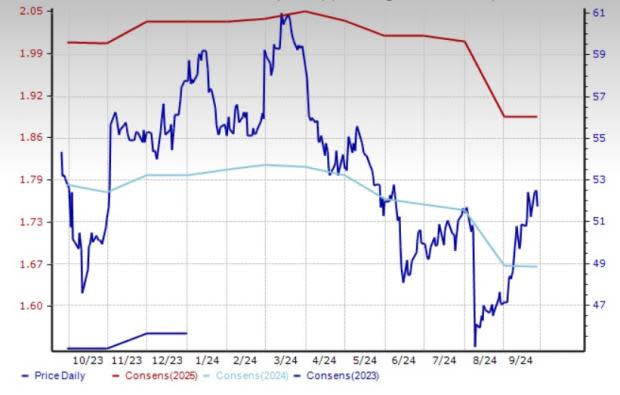

The Zacks Consensus Estimate for KDP’s 2024 sales and earnings suggests growth of 4% and 7.3%, respectively. The consensus mark for earnings has been unchanged in the past 30 days. The company’s shares have risen 18.7% in the past year. It currently has a Zacks Rank #2.

Price and Consensus: KDP

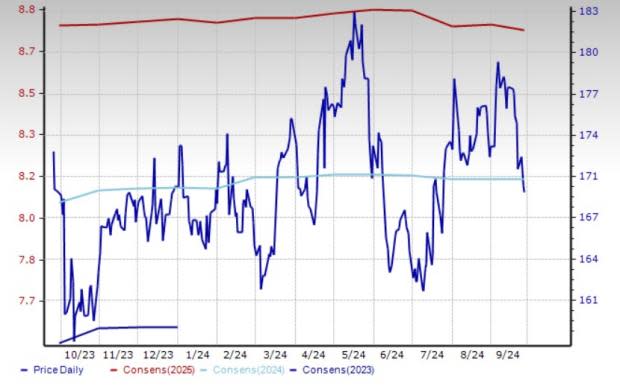

PepsiCo: Resilience and strength in the global beverage and convenience food businesses have been aiding the company’s performance. It expects to benefit from delivering convenience, variety and value proposition to customers through its brands. PEP is poised to benefit from investments in brands, go-to-market systems, supply chain, manufacturing capacity and digital capabilities to build competitive advantages. Its cost-management and revenue-management initiatives bode well amid the ongoing inflationary pressures.

In the beverage business, PepsiCo expects strong growth and market share gains from the liquid refreshment beverage category, with share gains in the carbonated soft drinks, RTD Tea and water categories. The stock of this Purchase, a NY-based leading soft-drink company, has lost 0.1% in the past year. The Zacks Consensus Estimate for PEP’s 2024 sales and earnings suggests year-over-year growth of 2.5% and 7%, respectively. The consensus estimate for this Zacks Rank #3 company’s 2024 earnings per share has been unchanged in the past 30 days.

Price and Consensus: PEP

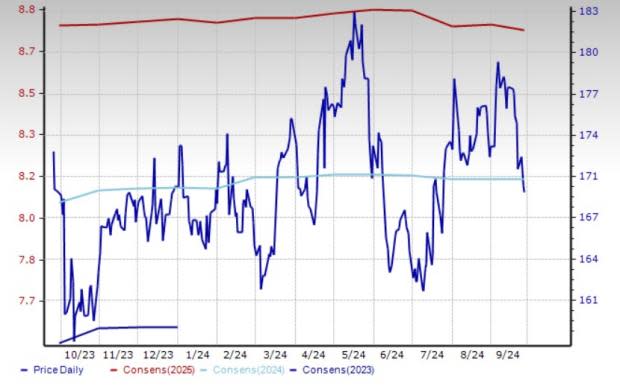

Monster Beverage: The Corona, CA-based company markets and distributes energy drinks and alternative beverages. MNST has been experiencing continued strength in its energy drinks category, which is driving its performance. The company offers a wide range of energy drink brands, such as Monster Energy, Java Monster, Cafe Monster, Espresso Monster, Monster Energy Mule, Juice Monster Pipeline Punch, Juice Monster Pacific Punch, Juice Monster Mango Loco, Monster Ultra Paradise and Monster Hydra Sport. Product innovation also plays a significant role in the company’s success. Monster Beverage is implementing pricing actions to overcome the ongoing cost pressure.

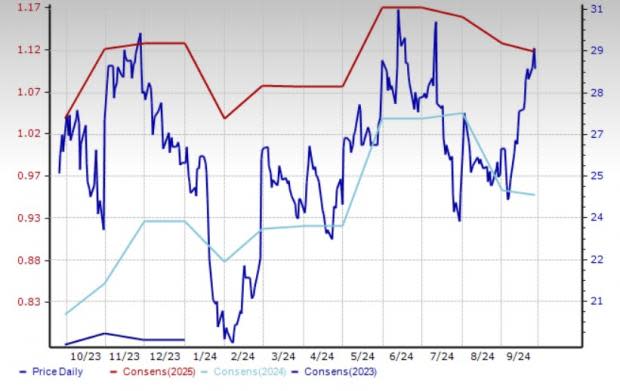

Despite the unending supply-chain challenges, Monster Beverage continues to stand by its strategy to ensure product availability and solidify the long-term growth of its brands. Management is optimistic about strength in the global energy drinks category. It remains poised to gain from growth in the Monster Energy family of brands, and strength in Strategic and Affordable energy brands. Shares of this Zacks Rank #3 company have lost 2.8% in the past year. The Zacks Consensus Estimate for MNST’s 2024 sales and earnings indicates year-over-year increases of 5.4% and 7.1%, respectively. The consensus mark for earnings has been unchanged in the past 30 days.

Price and Consensus: MNST

Vita Coco: The company is a pioneer in the functional beverage category. This New York-based company has been benefiting from its focus and investment to expand consumption occasions of coconut water. This has been contributing to strong volume growth for the category and its flagship Vita Coco Coconut Water brand. The company’s focus on growing the coconut water category resulted in its overall sales growth witnessing a 15% CAGR for the last four years. The company looks well-poised for growth, driven by its ability to drive brand volume growth via strong retail execution and creative marketing programs. Additionally, COCO’s strategies position it to improve profitability and cash generation in the long term.

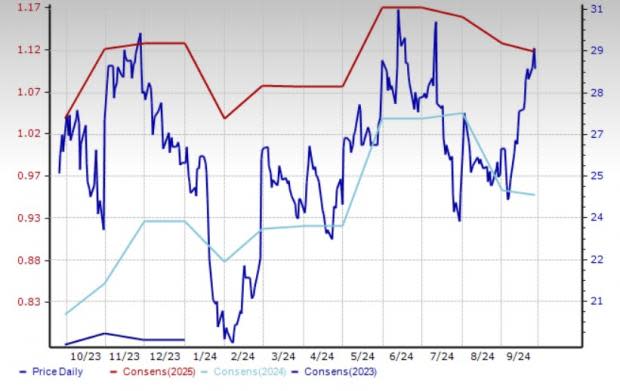

Vita Coco’s shares have risen 11.2% in the past year. The Zacks Consensus Estimate for COCO’s 2024 sales and earnings indicates year-over-year increases of 3.2% and 28.4%, respectively. The consensus mark for earnings has moved down by a penny in the past 30 days. The company currently carries a Zacks Rank #3.

Price and Consensus: COCO

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CocaCola Company (The) (KO) : Free Stock Analysis Report

Vita Coco Company, Inc. (COCO) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Monster Beverage Corporation (MNST) : Free Stock Analysis Report

Keurig Dr Pepper, Inc (KDP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research