CashNews.co

The Zacks Oil and Gas – Drilling industry is contending with multiple challenges. First, the U.S. rig count has fallen year over year, slowing drilling activity and impacting service companies’ operations. Second, the sector faces overcapacity and pricing pressures, with margins squeezed despite prioritizing pricing over utilization. Third, Saudi Arabia’s decision to maintain its Maximum Sustainable Capacity and halt planned expansion has hurt investor sentiment, triggering a sell-off in oilfield services stocks. Nevertheless, strong international demand for drilling services presents opportunities, with companies like Valaris Limited VAL, Helmerich & Payne HP, and Nabors Industries NBR positioned to benefit from the growing global market due to their strong fundamentals and operational efficiencies.

Industry Overview

The Zacks Oil and Gas – Drilling industry consists of companies that provide rigs (or specialized vehicles) on a contractual basis to explore and develop oil and natural gas. These operators offer drilling rigs (both land-based/onshore and offshore), equipment, services and manpower to exploration and production companies throughout the world. Drilling for hydrocarbons is costly and technically difficult, and its future primarily depends on contracting activity and the total number of available rigs at a given time rather than the price of oil or natural gas. Within the industry, it’s interesting to note that the volatility associated with offshore drilling companies is significantly higher than their onshore counterparts, and their share prices are more correlated to the price of oil. Overall, drilling stocks are among the most volatile in the entire equity market.

4 Trends Defining the Oil and Gas – Drilling Industry’s Future

Declining U.S. Rig Count Raises Concerns: After a strong recovery post-pandemic, the U.S. oil and natural gas rig count has steadily declined over the past year. This drop, around 6% from a year ago, has slowed drilling activity, a critical factor for services companies. Given the sector’s heavy reliance on U.S. operations, this steady decline in rig count poses concerns for future contracting activity, impacting revenue streams and operational outlooks.

Overcapacity Limits Profit Margins: Overcapacity and pricing pressures present major challenges for oil and gas drillers. Despite prioritizing pricing overutilization, excess capacity in the industry curtails potential gains. These pricing pressures shrink profit margins, making it difficult for companies to sustain profitability in a highly competitive market. Reduced drilling activity worsens the situation, putting additional strain on the company’s financial performance.

International Surge Drives Revenue Growth: Oil and gas drilling companies are witnessing a sharp rise in international activity, marking the strongest demand environment in over a decade. This heightened demand is supported by increased tendering and rig award negotiations, signaling a sustained need for global drilling services. The expansion of international operations is poised to be a crucial driver of revenue growth and long-term stability for sector operators.

Saudi Capacity Freeze Hits Oil Drilling Sector: Saudi Arabia’s decision to maintain its Maximum Sustainable Capacity at 12 million barrels per day and cancel its planned expansion to 13 million bbl/day by 2027 has sent ripples through the oil drilling industry. This move triggered a sell-off in oilfield services stocks, as investors viewed it as signaling the end of the capex boom in the Middle East. The sharp market reaction highlights concerns over future revenue potential from Saudi-led projects.

Zacks Industry Rank Indicates Bearish Outlook

The Zacks Oil and Gas – Drilling industry is an 11-stock group within the broader Zacks Oil – Energy sector. It currently carries a Zacks Industry Rank #223, which places it in the bottom 12% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates challenging near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s position in the bottom 50% of the Zacks-ranked industries is a result of a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are becoming pessimistic about this group’s earnings growth potential. As a matter of fact, the industry’s earnings estimates for 2024 have gone down 43.9% in the past year.

Despite the dim near-term prospects of the industry, we will present a few stocks that you may want to consider for your portfolio. But it’s worth taking a look at the industry’s shareholder returns and current valuation first.

Industry Underperforms Sector & S&P 500

The Zacks Oil and Gas – Drilling industry has fared worse than the broader Zacks Oil – Energy sector as well as the Zacks S&P 500 composite over the past year.

The industry has gone down 25.5% over this period compared with the broader sector’s increase of 6.1%. Meanwhile, the S&P 500 has gained 32.2%.

One-Year Price Performance

Industry’s Current Valuation

Since oil and gas drilling companies are debt-laden, it makes sense to value them based on the EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization) ratio. This is because the valuation metric takes into account not just equity but also the level of debt. For capital-intensive companies, EV/EBITDA is a better valuation metric because it is not influenced by changing capital structures and ignores the effect of non-cash expenses.

On the basis of the trailing 12-month enterprise value-to-EBITDA (EV/EBITDA), the industry is currently trading at 16.18X, slightly lower than the S&P 500’s 19.28X. It is, however, well above the sector’s trailing 12-month EV/EBITDA of 3.25X.

Over the past five years, the industry has traded as high as 24.81X, as low as 7.28X, with a median of 14.71X, as the chart below shows.

Trailing 12-Month Enterprise Value-to-EBITDA (EV/EBITDA) Ratio (Past Five Years)

3 Oil and Gas – Drilling Stocks to Watch

Valaris Limited: Valaris possesses a varied fleet of rigs, including ultra-deepwater drillships, versatile semisubmersibles, and modern shallow-water jackups. With the industry’s largest and highest specification fleet covering both floaters and jackups, Valaris maintains a significant presence in key offshore basins, fostering deep customer relationships. The company’s robust balance sheet ensures flexibility in capital allocation.

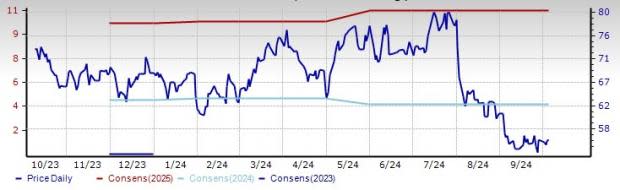

The Zacks Consensus Estimate for 2024 earnings of VAL indicates 290.2% growth. Based in Hamilton, the company has a four-quarter earnings surprise of 69.8%. The company has a market capitalization of $4.1 billion. Valaris stock, carrying a Zacks Rank #3 (Hold), has lost 23.2% in a year.

You can see the complete list of today’s Zacks #1 Rank stocks here.

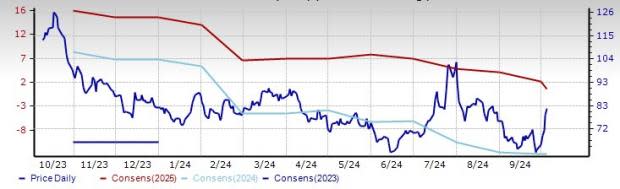

Price and Consensus: VAL

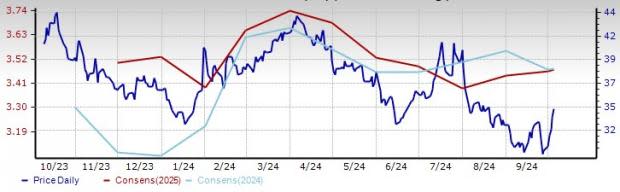

Helmerich & Payne: This #3 Ranked company is a major land and offshore drilling contractor in the western hemisphere, having the youngest and most efficient drilling fleet. The company specializes in shallow to deep drilling in oil and gas-producing basins of the United States and in drilling for oil and gas in international locations. Helmerich & Payne remains relatively unscathed from any economic turmoil, as the company’s major work contracts are with well capitalized oil majors and the larger independent oil companies. Additionally, term contracts and shale drilling demand for its rigs have helped Helmerich & Payne maintain a relatively high level of utilization.

The #3 Ranked firm has a market capitalization of $3.4 billion. Helmerich & Payne, having beaten the Zacks Consensus Estimate for earnings in three of the last four quarters, has a trailing four-quarter earnings surprise of roughly 14.8%, on average. The HP stock has decreased 16.4% in a year.

Price and Consensus: HP

Nabors Industries: It is one of the leading North American land drilling contractor, having a large, high-quality fleet of drilling rigs. The company is well positioned with a sound mix of high-performance rigs and new rigs working in the key shale plays like Bakken and Permian. Nabors is poised for growth with significant international expansion opportunities. The company has capitalized on this strong market with numerous rig awards and deployments. Furthermore, Nabors’ advanced technology adoption, particularly in its Drilling Solutions segment, signifies a competitive edge in the market.

The Zacks Consensus Estimate for 2024 earnings of NBR indicates 12.5% growth. This Hamilton-based firm has a Value and Growth score of A and B, respectively. The #3 Ranked company has a market capitalization of $776.3 million. Nabors Industries stock has lost 28% in a year.

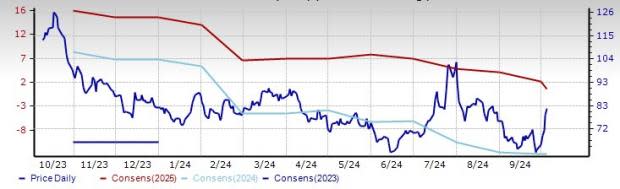

Price and Consensus: NBR

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Valaris Limited (VAL) : Free Stock Analysis Report

Nabors Industries Ltd. (NBR) : Free Stock Analysis Report

Helmerich & Payne, Inc. (HP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research