CashNews.co

Global Consumer Credit Market

Dublin, Oct. 10, 2024 (GLOBE NEWSWIRE) — The “Consumer Credit – Global Strategic Business Report” report has been added to ResearchAndMarkets.com’s offering.

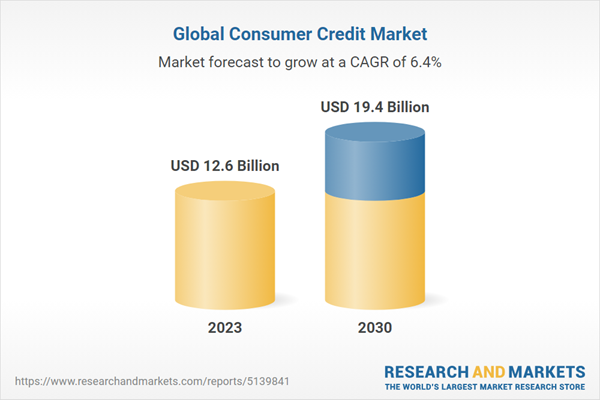

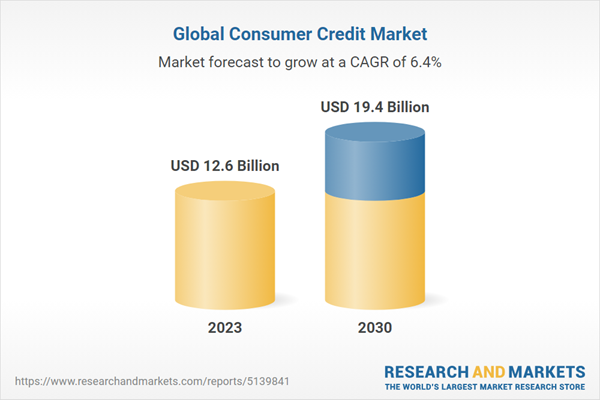

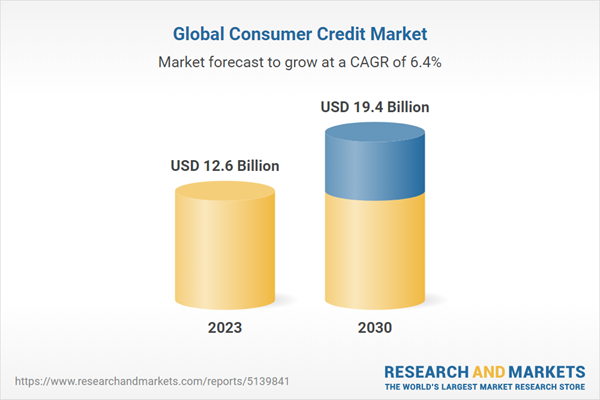

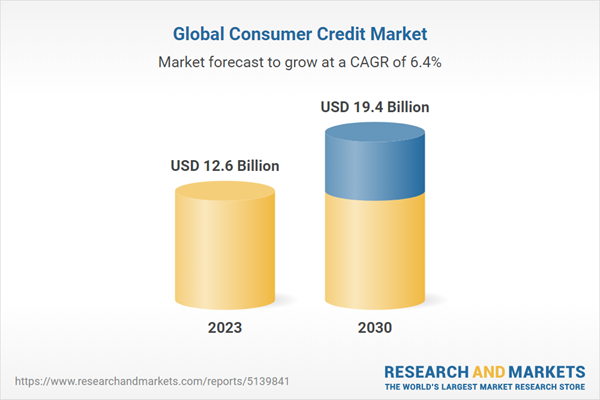

The global market for Consumer Credit was estimated at US$12.6 Billion in 2023, and is projected to reach US$19.4 Billion by 2030, growing at a CAGR of 6.4% from 2023 to 2030. This comprehensive report provides an in-depth analysis of market trends, drivers, and forecasts, helping you make informed business decisions.

The growth in the consumer credit market is driven by several factors. Key among these is the increasing integration of technology in the financial sector, which simplifies the process of applying for and managing credit. As consumers become more digitally savvy, there is a growing preference for mobile and online platforms that offer convenient, fast, and transparent credit services. Additionally, economic expansion and the resulting increase in consumer confidence typically stimulate demand for credit. Changes in consumer behavior, particularly among younger demographics who favor immediate access to goods and services even if it means incurring debt, also contribute to market growth.

Moreover, the introduction of stricter credit regulations post-2008 has restored trust in the credit system, encouraging more consumers to take on credit. The global trend towards urbanization and an increase in the middle-class population in emerging markets are also significant growth drivers, as more individuals gain access to banking services and credit products. Collectively, these factors ensure a dynamic expansion of the consumer credit market, adapting to evolving economic landscapes and consumer needs.

Gain insights into the U.S. market, estimated at $3.3 Billion in 2023, and China, forecasted to grow at an impressive 9.8% CAGR to reach $4.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Report Features:

-

Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2023 to 2030.

-

In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

-

Company Profiles: Coverage of major players such as Bank of America Corporation, Barclays plc, BNP Paribas SA, and more.

-

Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Key Questions Answered:

-

How is the Global Consumer Credit Market expected to evolve by 2030?

-

What are the main drivers and restraints affecting the market?

-

Which market segments will grow the most over the forecast period?

-

How will market shares for different regions and segments change by 2030?

-

Who are the leading players in the market, and what are their prospects?

Key Attributes

|

Report Attribute |

Details |

|

No. of Pages |

187 |

|

Forecast Period |

2023 – 2030 |

|

Estimated Market Value (USD) in 2023 |

$12.6 Billion |

|

Forecasted Market Value (USD) by 2030 |

$19.4 Billion |

|

Compound Annual Growth Rate |

6.4% |

|

Regions Covered |

Global |

Market Overview

-

Influencer Market Insights

-

World Market Trajectories

-

Global Economic Update

-

Consumer Credit – Global Key Competitors Percentage Market Share in 2024 (E)

-

Competitive Market Presence – Strong/Active/Niche/Trivial for Players Worldwide in 2024 (E)

Market Trends and Drivers

-

Innovations in Fintech Propel Accessibility and Efficiency of Consumer Credit Services

-

Rising Consumer Spending Bolsters Demand for Credit Products

-

Credit Scoring Innovations Enhance Lending Decisions and Market Expansion

-

Digital Transformation in Banking Spurs Growth in Online and Mobile Credit Services

-

Consumer Demand for Flexible Repayment Options Generates Product Innovations

-

Integration of Blockchain for Secure and Transparent Credit Transactions Gains Traction

-

Growth in E-commerce and Online Shopping Drives Demand for Instant Credit Solutions

-

Shift Towards Personalized Credit Offers Based on Consumer Data Analysis

-

Emergence of Peer-to-Peer Lending Platforms Expands Consumer Credit Market

-

Adoption of AI in Credit Risk Assessment Enhances Loan Processing Efficiency

-

Global Increase in Entrepreneurial Activities Bolsters Need for Personal and Business Credit

Select Competitors (Total 69 Featured):

-

Bank of America Corporation

-

Barclays PLC

-

BNP Paribas SA

-

China Construction Bank Corp.

-

Citigroup, Inc.

-

Deutsche Bank AG

-

HSBC Holdings PLC

-

Industrial and Commercial Bank of China Limited

-

JPMorgan Chase & Co.

-

Mitsubishi UFJ Financial Group, Inc.

-

Wells Fargo & Company

For more information about this report visit https://www.researchandmarkets.com/r/v7wuwx

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager [email protected] For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900