CashNews.co

Get Detailed Stock Report

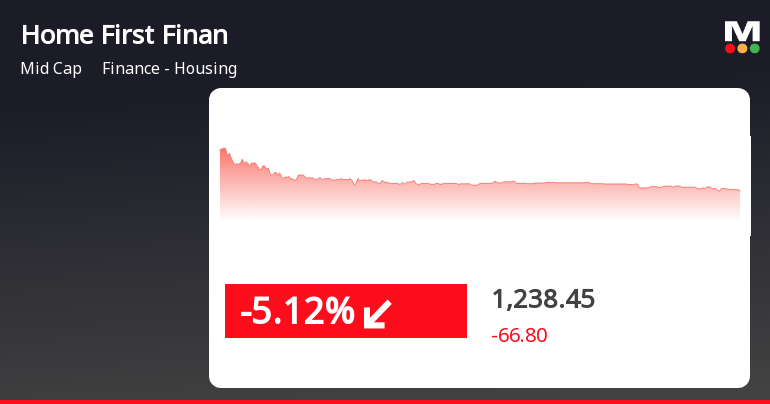

Home First Finance Company India, a midcap finance company specializing in housing loans, has seen a slight dip in its stock price on October 10th, 2024. The stock closed at Rs 1239.95, down by -5.15% from the previous day’s closing price.

Despite this dip, MarketsMOJO has given a ‘Buy’ call for Home First Finance Company India, indicating a positive outlook for the company. The stock has also outperformed the sector by -5.26% on the same day.

It is worth noting that the stock has fallen after four consecutive days of gains, suggesting a possible trend reversal. However, Home First Finance Company India is still trading higher than its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a strong performance in the recent past.

In comparison to the overall market performance, Home First Finance Company India has underperformed the Sensex by -4.99% in the past day and has outperformed by 15.99% in the past month.

Home First Finance Company India is a leading player in the housing finance industry, catering to the midcap segment. With its strong performance and positive outlook, it continues to be a promising player in the finance sector. Investors can consider this stock for potential growth in the long term.