CashNews.co

Japan’s stock markets have experienced notable fluctuations recently, influenced by political developments and monetary policy shifts under the new leadership of Prime Minister Shigeru Ishiba. As the Nikkei 225 and TOPIX indices navigate these changes, investors are keenly observing high-growth tech stocks in Japan, which may offer potential opportunities amid the evolving economic landscape.

Top 10 High Growth Tech Companies In Japan

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

Hottolink |

50.99% |

61.55% |

★★★★★★ |

|

Cyber Security Cloud |

20.71% |

25.73% |

★★★★★☆ |

|

eWeLLLtd |

26.52% |

27.53% |

★★★★★★ |

|

Medley |

24.98% |

30.36% |

★★★★★★ |

|

Bengo4.com Inc |

20.76% |

46.76% |

★★★★★★ |

|

Kanamic NetworkLTD |

20.75% |

28.25% |

★★★★★★ |

|

Mental Health TechnologiesLtd |

27.88% |

79.61% |

★★★★★★ |

|

ExaWizards |

21.96% |

75.16% |

★★★★★★ |

|

freee KK |

18.18% |

74.08% |

★★★★★☆ |

|

Money Forward |

20.68% |

68.12% |

★★★★★★ |

Click here to see the full list of 120 stocks from our Japanese High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Simply Wall St Growth Rating: ★★★★★☆

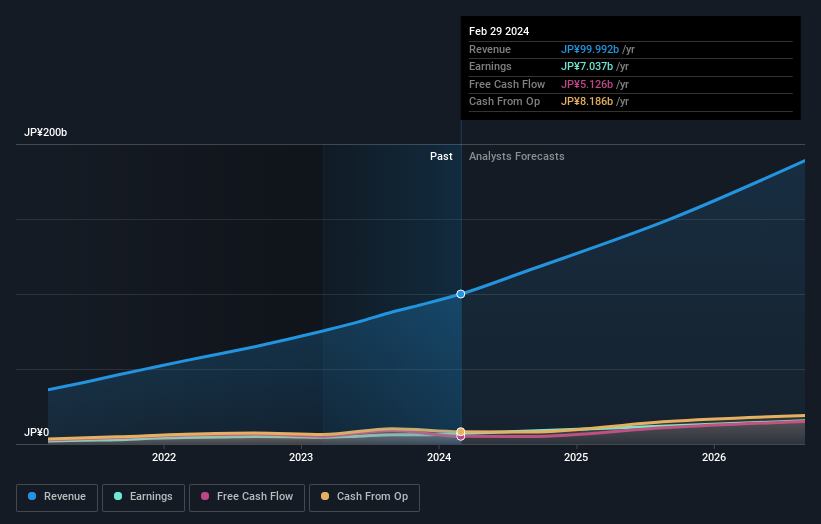

Overview: SHIFT Inc. is a Japanese company specializing in software quality assurance and testing solutions, with a market capitalization of ¥260.13 billion.

Operations: SHIFT Inc. generates revenue primarily from software testing and development-related services, with software testing contributing ¥68.64 billion and software development adding ¥33.55 billion. The company operates within the Japanese market, focusing on ensuring quality in software through its specialized services.

SHIFT, a Japanese tech firm, recently announced a share repurchase program, highlighting its strategy to enhance shareholder value. This move comes at a time when the company reports significant financial metrics; its revenue is expected to grow by 19.5% annually, outpacing the Japanese market average of 4.2%. Moreover, SHIFT’s earnings have seen an impressive annual increase of 32.2%, suggesting robust profit growth potential compared to the broader market’s 8.7%. These figures underscore SHIFT’s commitment to growth and innovation in a competitive landscape. Despite not outperforming the IT industry’s earnings growth last year, SHIFT maintains strong future prospects with expected earnings expansion significantly above industry standards at an annual rate of about 32%. The company has also demonstrated high-quality past earnings and forecasts a substantial Return on Equity (RoE) of approximately 25.9% in three years’ time. Such financial health is pivotal for sustaining development and indicates that SHIFT is strategically positioning itself as a resilient player in Japan’s tech sector amidst global economic fluctuations.

Simply Wall St Growth Rating: ★★★★★☆

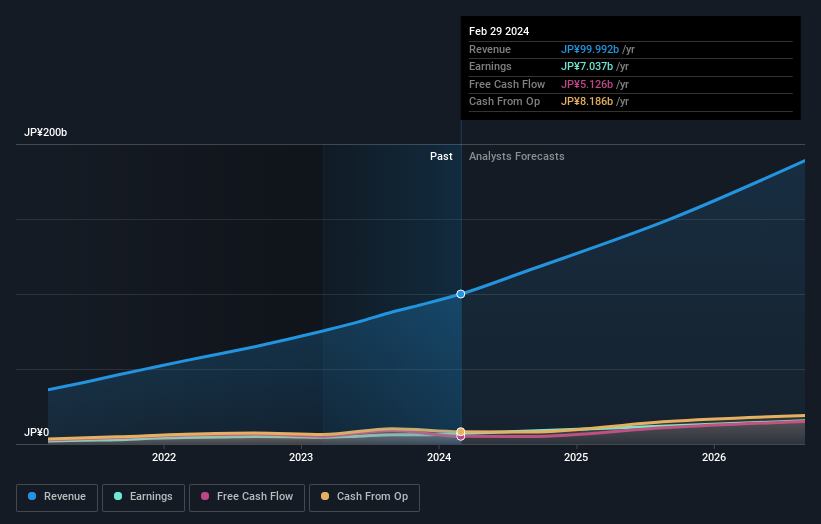

Overview: Sansan, Inc. specializes in the planning, development, and sale of cloud-based solutions in Japan with a market capitalization of ¥277.13 billion.

Operations: Sansan, Inc. generates revenue primarily from its Sansan/Bill One Business, contributing ¥29.95 billion, and the Eight Business segment at ¥3.55 billion. The company focuses on cloud-based solutions within Japan’s market.

Sansan, a Japanese tech enterprise, has demonstrated a robust growth trajectory with its revenue forecast to surge by 16.2% annually, significantly outpacing the domestic market’s average of 4.2%. This growth is underpinned by a strategic emphasis on R&D, with expenses marking an impressive allocation that reflects the company’s commitment to innovation and sector leadership. Additionally, Sansan recently completed a share repurchase program valued at ¥300 million, reinforcing shareholder value amidst its expansion efforts. The firm’s earnings are also expected to climb by 35.6% annually, showcasing its potent revenue-generating capabilities and operational efficiency in a competitive landscape.

Simply Wall St Growth Rating: ★★★★★☆

Overview: freee K.K. provides cloud-based accounting and HR software solutions in Japan, with a market cap of ¥188.99 billion.

Operations: The company generates revenue primarily through its cloud-based accounting and HR software solutions targeted at businesses in Japan. Its business model focuses on subscription fees for these digital services, which cater to the financial and administrative needs of small to medium-sized enterprises.

Freee K.K., navigating through a transformative phase, anticipates a revenue growth of 18.2% annually, showcasing its adaptability in the competitive tech landscape of Japan. This growth is complemented by an aggressive R&D investment strategy, with expenses aimed at fostering innovation and securing a technological edge in the market. Despite current unprofitability, the firm is poised for profitability within three years, reflecting an optimistic future outlook underscored by recent executive changes and strategic amendments to its business purposes aimed at expanding operations.

Next Steps

Searching for a Fresh Perspective?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:3697 TSE:4443 and TSE:4478.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]