CashNews.co

As the German economy faces a forecasted contraction for the second consecutive year, attention turns to the potential opportunities within its stock market, particularly among small-cap companies that might be undervalued or overlooked. Despite recent economic challenges such as a sharp decline in factory orders, there remains potential for discovering promising stocks that could benefit from future economic stabilization and growth initiatives. In this environment, identifying stocks with strong fundamentals and innovative business models can be key to uncovering hidden gems in Germany’s diverse market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

|

Name |

Debt To Equity |

Revenue Growth |

Earnings Growth |

Health Rating |

|---|---|---|---|---|

|

Mineralbrunnen Überkingen-Teinach GmbH KGaA |

19.91% |

0.96% |

-5.02% |

★★★★★★ |

|

FROST |

8.18% |

4.36% |

16.00% |

★★★★★★ |

|

Westag |

THAT |

-1.56% |

-21.68% |

★★★★★★ |

|

Paul Hartmann |

26.29% |

1.12% |

-17.65% |

★★★★★☆ |

|

Southwest German salt works |

0.30% |

4.57% |

25.01% |

★★★★★☆ |

|

EnviTec Biogas |

48.48% |

20.85% |

46.34% |

★★★★★☆ |

|

HOMAG Group |

THAT |

-31.14% |

23.43% |

★★★★★☆ |

|

Bader Bank |

91.28% |

12.42% |

-8.00% |

★★★★★☆ |

|

DFV German family insurance |

THAT |

19.63% |

62.92% |

★★★★★☆ |

|

Wilson |

64.79% |

30.09% |

68.29% |

★★★★☆☆ |

Click here to see the full list of 54 stocks from our German Undiscovered Gems With Strong Fundamentals screener.

Here we highlight a subset of our preferred stocks from the screener.

Simply Wall St Value Rating: ★★★★★☆

Overview: Paul Hartmann AG is a company that manufactures and sells medical and care products across various regions including Germany, the rest of Europe, the Middle East, Africa, Asia-Pacific, and the Americas with a market cap of approximately €760.07 million.

Operations: Paul Hartmann AG generates revenue primarily from its Incontinence Management segment (€769.70 million), followed by Wound Care (€597.39 million) and Infection Management (€516.66 million). The Complementary divisions contribute €499.70 million to the total revenue stream.

Paul Hartmann, a notable name in Germany’s medical equipment sector, showcases robust financial health with its EBIT covering interest payments 6.2 times over. The company has seen an impressive earnings growth of 156.1% over the past year, outpacing the industry average of 16.2%. Despite a rise in debt to equity ratio from 12% to 26.3% over five years, it remains satisfactory at 13.4%. Recent half-year results highlight sales reaching €1.20 billion and net income jumping to €42.8 million from €11.69 million last year, reflecting strong operational performance and potential value for investors seeking hidden gems in the market.

Simply Wall St Value Rating: ★★★★★★

Overview: Eckert & Ziegler SE is a global manufacturer and supplier of isotope technology components, with a market capitalization of approximately €890.10 million.

Operations: Eckert & Ziegler generates revenue primarily from its Isotopes Products segment (€150.97 million) and Medical segment (€132.80 million).

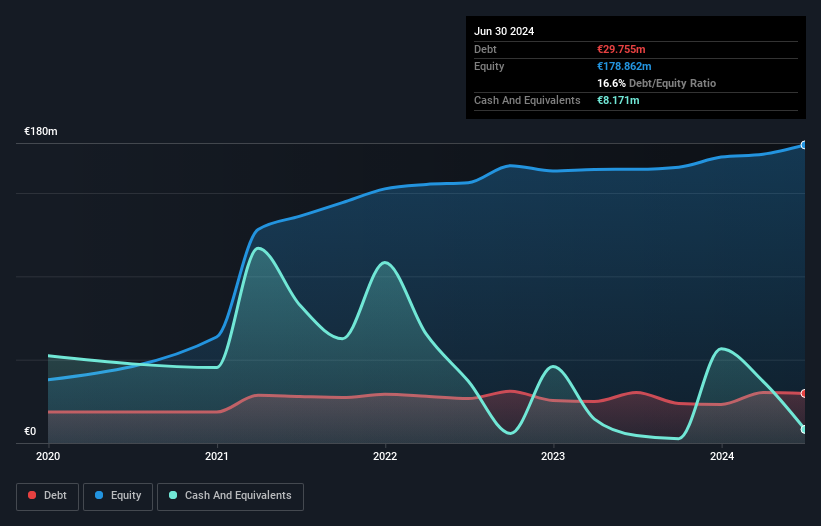

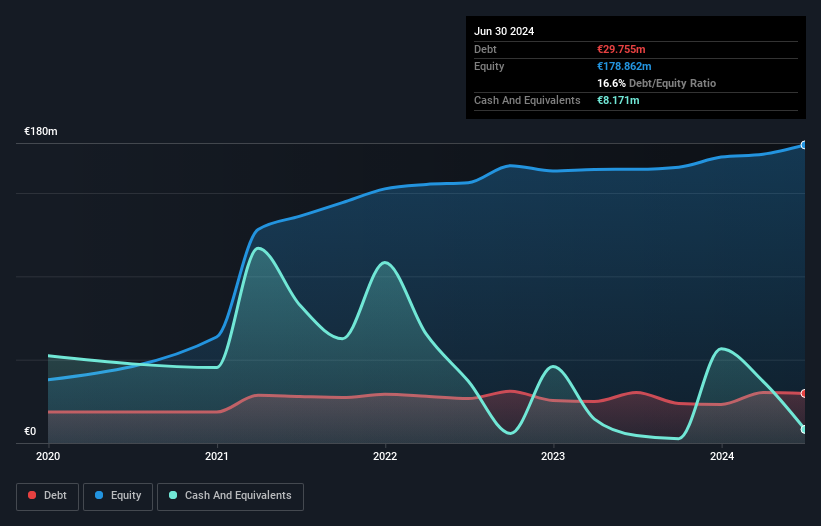

Eckert & Ziegler, a promising player in the medical equipment sector, has demonstrated robust growth with earnings surging 31.6% over the past year, outpacing industry averages. Their debt to equity ratio improved from 14.7 to 9.5 over five years, showing financial prudence. Recent results reveal a strong performance with second-quarter sales reaching €77.76 million and net income climbing to €9.54 million from €6.17 million last year, highlighting their growth trajectory and potential value for investors seeking opportunities in Germany’s market landscape.

Simply Wall St Value Rating: ★★★★★☆

Overview: Friedrich Vorwerk Group SE offers solutions for the transformation and transportation of energy across Germany and Europe, with a market cap of €523 million.

Operations: Friedrich Vorwerk Group SE generates revenue primarily from natural gas (€160.89 million), electricity (€95.30 million), and adjacent opportunities (€117.28 million). Clean hydrogen contributes €28.38 million to the total revenue stream, reflecting a diverse portfolio in energy solutions across Europe.

Friedrich Vorwerk Group, a promising player in Germany’s energy infrastructure sector, has shown robust growth with earnings increasing by 48.6% over the past year. Its net income for Q2 2024 rose to €7.96 million from €2.38 million a year earlier, while revenue reached €121.04 million compared to €96.41 million previously. The company’s debt is well-managed with an EBIT coverage of interest payments at 12.7x and a satisfactory net debt-to-equity ratio of 12%.

Key Takeaways

-

Reveal the 54 hidden gems among our German Undiscovered Gems With Strong Fundamentals screener with a single click here.

-

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St’s portfolio, where intuitive tools await to help optimize your investment outcomes.

-

Simply Wall St is a revolutionary app designed for long-term stock investors, it’s free and covers every market in the world.

Searching for a Fresh Perspective?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include DB:PHH2 XTRA:EUZ and XTRA:VH2.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]