CashNews.co

Japan’s stock markets experienced significant volatility recently, driven by a rebounding yen and concerns over global growth. However, dovish comments from the Bank of Japan have helped stabilize the situation, offering some relief to investors. In this fluctuating environment, companies with high insider ownership often signal strong internal confidence and alignment with shareholder interests. Here are three growth companies on the Japanese exchange that boast up to 39% insider ownership.

Top 10 Growth Companies With High Insider Ownership In Japan

|

Name |

Insider Ownership |

Earnings Growth |

|

Hottolink (TSE:3680) |

27% |

62.8% |

|

Micronics Japan (TSE:6871) |

15.3% |

32.9% |

|

Kasumigaseki CapitalLtd (TSE:3498) |

34.8% |

43.3% |

|

Medley (TSE:4480) |

34% |

28.7% |

|

SHIFT (TSE:3697) |

35.4% |

32.8% |

|

ExaWizards (TSE:4259) |

21.8% |

91.1% |

|

Money Forward (TSE:3994) |

21.4% |

66.9% |

|

Astroscale Holdings (TSE:186A) |

20.9% |

90% |

|

Loadstar Capital KK (TSE:3482) |

33.8% |

24.3% |

|

free KK (TSE:4478) |

32.8% |

72.8% |

Click here to see the full list of 102 stocks from our Fast Growing Japanese Companies With High Insider Ownership screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rakuten Group, Inc. offers e-commerce, fintech, digital content, and communications services to users in Japan and internationally, with a market cap of ¥1.87 trillion.

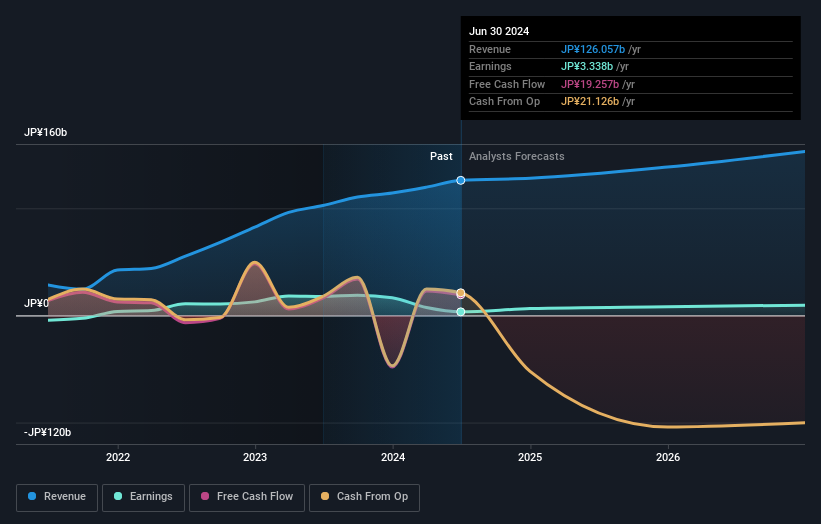

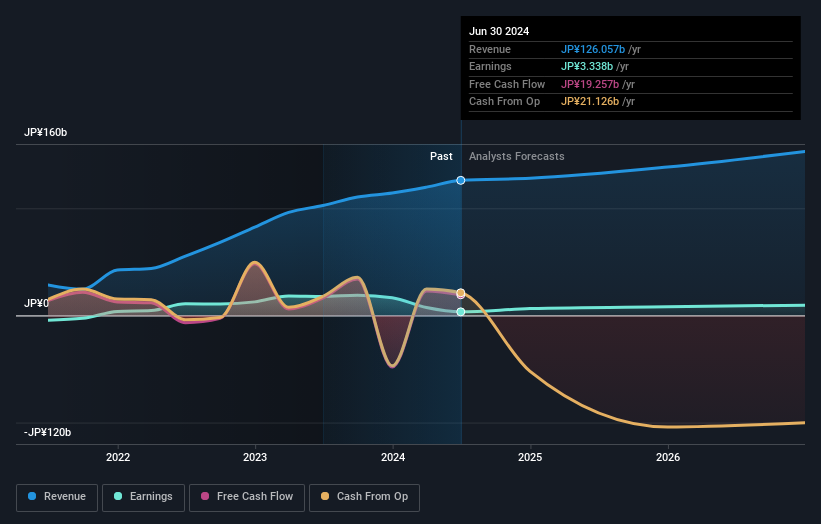

Operations: Rakuten Group generates revenue from mobile services (¥382.95 million), fintech operations (¥772.29 million), and internet services (¥1.24 billion).

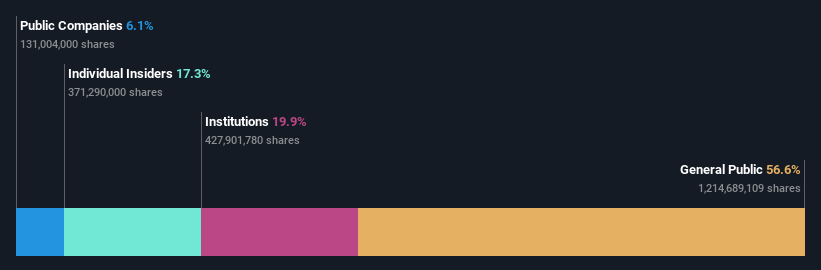

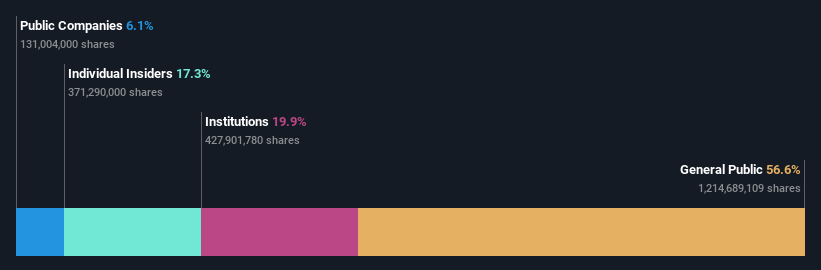

Insider Ownership: 17.3%

Rakuten Group, a growth company with high insider ownership, is forecast to become profitable within three years and expects revenue to grow 7.7% annually, outpacing the Japanese market’s 4.3%. Despite low return on equity projections (10.2%), earnings are anticipated to rise by 82.86% per year. Recent guidance confirmed double-digit growth in consolidated operating results for fiscal year 2024, excluding securities business impacts from stock market conditions.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lasertec Corporation designs, manufactures, and sells inspection and measurement equipment in Japan and internationally, with a market cap of ¥2.49 trillion.

Operations: The company’s revenue primarily comes from its inspection and measurement equipment segment, which generated ¥213.51 billion.

Insider Ownership: 12.1%

Lasertec, characterized by high insider ownership, is forecast to see revenue grow 16.4% annually and earnings rise nearly 20% per year, both outpacing the Japanese market. Recent sales figures for its ACTIS Series reached ¥76.56 billion in the first three quarters of fiscal year 2024, significantly surpassing last year’s total. Despite a volatile share price recently, Lasertec’s return on equity is projected to be very high at 42.4% in three years.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: J Trust Co., Ltd. offers a range of financial services in Japan and has a market cap of ¥52.04 billion.

Operations: The company generates revenue through domestic and overseas financial business operations, totaling ¥69.91 billion, credit guarantee and consumer credit services amounting to ¥1.50 billion, real estate-related business contributing ¥3.22 billion, and amusement business providing ¥5.36 billion.

Insider Ownership: 40%

J Trust, with substantial insider ownership, is expected to see earnings grow significantly at 33.53% annually over the next three years, outpacing the Japanese market’s growth rate of 8.6%. Despite trading at a significant discount to its estimated fair value, the company has an unstable dividend track record and lower profit margins compared to last year. Recent activities include a buyback of 1.72 million shares for ¥731.84 million completed by June 2024.

Where To Now?

Interested In Other Possibilities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:4755 TSE:6920 and TSE:8508.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]