CashNews.co

There’s no denying Nvidia has been the centerpiece of the artificial intelligence (AI) revolution thus far. Its technology is used in the vast majority of the world’s AI platforms simply because it offers the most computing power. And Nvidia shares have performed accordingly since the movement got going in earnest early last year.

As is the case with any other industry, however, time is driving changes on the AI front. Nvidia is no longer the market’s top opportunity. This title is shifting toward Taiwan Semiconductor Manufacturing Company (NYSE: TSM), which is arguably better positioned to capitalize on the next chapter of AI’s growth story.

Taiwan Semiconductor is behind the scenes… all of them

Nvidia isn’t doomed. But it would be naïve to not recognize that most of AI’s easy money has already been made. Competition is heating up. Intel and Advanced Micro Devices are stepping up their games. Price wars are underway.

There’s an often overlooked but important detail about the AI hardware business you must understand, however. That is, chipmakers like the aforementioned Nvidia and AMD usually don’t manufacture their own chips. They typically outsource such work to third-party “contract” manufacturers that are capable of fabricating this silicon to its designers’ specifications.

Taiwan Semiconductor is one of these contract manufacturers. Indeed, it’s the biggest name in the business. It’s estimated to manufacture on the order of two-thirds of the world’s semiconductors and associated circuitry, and an even greater share when just looking at the planet’s high-performance chip market.

This might help drive the point home: Advanced Micro Devices as well as Nvidia are both confirmed customers of Taiwan Semiconductor. Intel continues to invest in the construction of its own foundries, although it’s forged a developmental partnership with Taiwan Semiconductor to do so.

Connect the dots. Taiwan Semiconductor may actually be the technological heart and soul of the global AI revolution.

And it’s not limited to data centers. As time marches on, AI computing work is making its way toward end users, and end users’ mobile phones in particular. Apple‘s newest processor — the A17 found in the iPhone 15 Pro and Pro Max — is capable of handling generative AI tasks on the device itself rather than in the cloud, where most generative AI work is presently done.

It’s not just Apple wading into on-device artificial intelligence waters, either. Qualcomm‘s newest high-performance Snapdragon 8 (Gen 3) mobile processors can handle the same kind of load on mobile devices.

Apple as well as Qualcomm both also utilize Taiwan Semiconductor’s chip-manufacturing services.

Still plenty of opportunity ahead

Taiwan Semiconductor Manufacturing doesn’t make every chip used by the aforementioned outfits, for the record, nor does it manufacture every AI chip the world’s currently using or will use in the future. It’s likely losing market share as other players ramp up their capacity to crank this silicon out, in fact. Intel in particular is showing the potential to become a serious competitor to Taiwan Semiconductor.

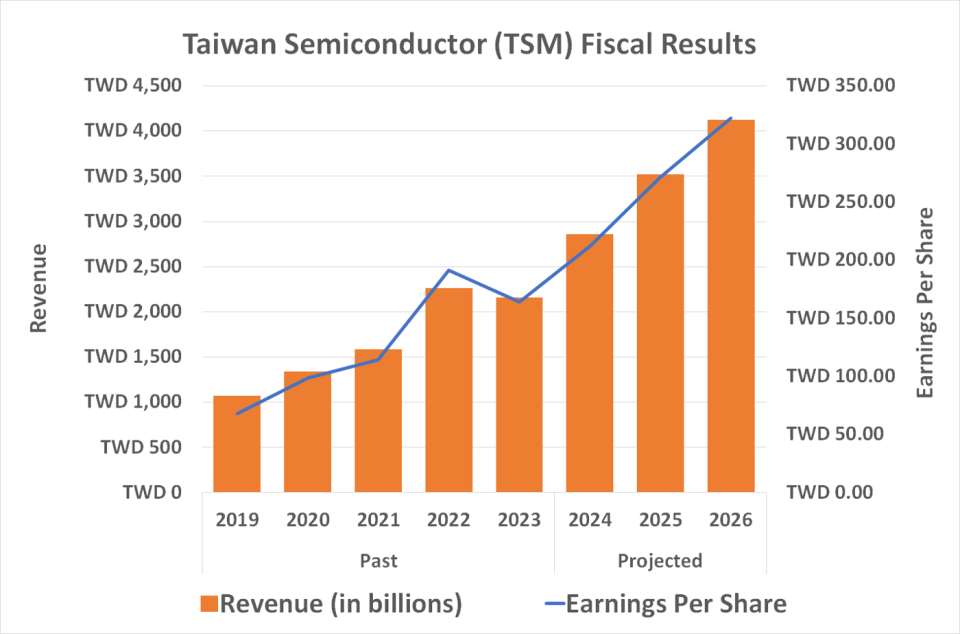

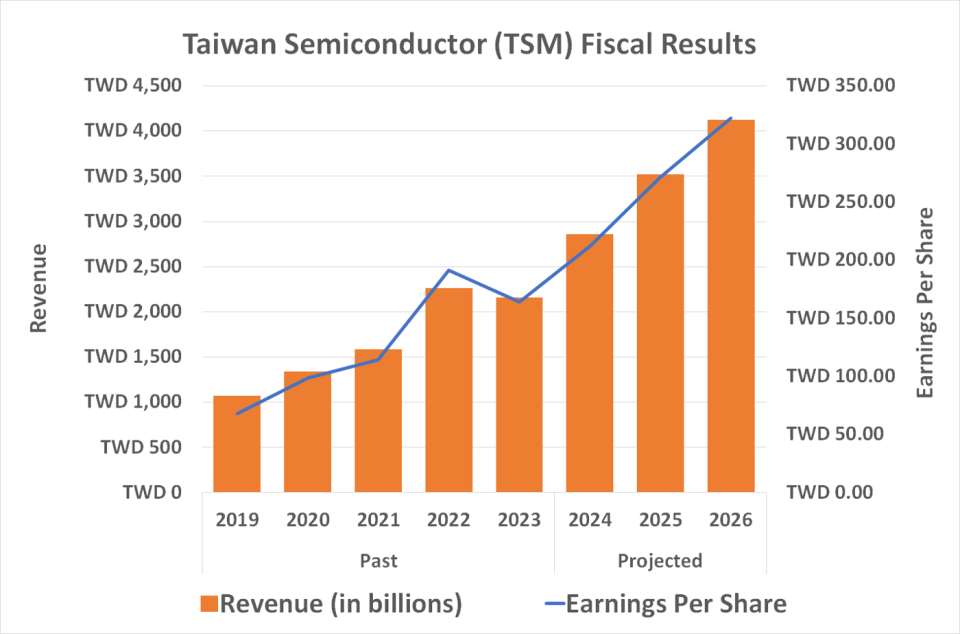

There’s still more upside here than not, however, despite the prospect of shrinking market share. Market research outfit Skyquest suggests the artificial intelligence hardware market is set to grow at an annualized pace of 15.5% through 2031, while the mobile AI market is likely to grow at a compound yearly rate of nearly 27% for the same time frame. In this vein, the analyst community believes Taiwan Semiconductor’s top line is set to nearly double between last year and 2026, as the AI chipmaking industry gels.

So why is this stock down more than 20% just since its July peak (with many other artificial intelligence names down similarly)? That’s got more to do with the market environment than anything else. Investors finally began realizing last month that a few too many stocks had reached too-frothy valuations. The disappointing jobs report for July released on Friday of last week didn’t help either, leading the crowd to presume lingering economic weakness is on the horizon.

And maybe it is.

Don’t lose perspective, though. Even in a tough economic environment most chip brands are still going to need new silicon. And most of them are still in no position to make much (if any) of it themselves. They’ll still need Taiwan Semiconductor to make it for them. Indeed, economic weakness might even stifle capital expenditures on new foundries, making a proven, cost-effective foundry like Taiwan Semiconductor Manufacturing all the more important to the AI business’s biggest players.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $641,864!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 6, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.

Forget Nvidia: Buy This Magnificent Artificial Intelligence (AI) Stock Instead was originally published by The Motley Fool

#cashnews #UnitedStates #newsfinace #finance #FollowsCashnews