Financial Insights That Matter

- The SEC acknowledged Bitwise’s XRP ETF filing from Cboe BZX.

- XRP ETF may disappoint due to weak revenue, poor institutional interest and heavy supply pressure.

- XRP could suffer a major decline if it fails to bounce off a lower symmetrical triangle boundary.

Ripple’s XRP is down 3% on Tuesday despite the Securities and Exchange Commission (SEC) acknowledgment of Bitwise XRP ETF. Unchained Crypto noted that XRP ETF could underperform due to key fundamental issues.

Bitwise XRP ETF receives SEC acknowledgment

In a filing on Tuesday, the SEC acknowledged the Cboe BZX Exchange XRP ETF application on behalf of asset manager Bitwise.

The filing notes that investors can comment on the application 21 days after it is published in the SEC’s federal register. This action also opens a 240-day window at the end of which the SEC must decide whether to approve the products or not.

The SEC had previously acknowledged XRP ETF applications from Grayscale and 21Shares. WisdomTree and Canary Capital’s applications are the only remaining ones the SEC has yet to acknowledge.

In a recent issue, Unchained Crypto noted that altcoin ETFs like XRP will likely underperform as institutional investors are still trying to “wrap their heads around” Bitcoin and Ethereum ETFs.

Additionally, from a valuation perspective, the XRP Ledger’s revenue in 2024 was $1.15 million compared to over $1 billion in fees generated in Ethereum.

The issue also argued that Ripple Treasury’s 4.485 billion XRP holdings with an additional 38.9 billion XRP in escrows could prove a huge selling pressure that may deter investors.

However, Bloomberg analysts James Seyfarrt and Eric Balchunas had predicted that XRP ETFs have a 65% chance of getting approved by the SEC amid the agency’s ongoing legal battle with Ripple.

XRP could suffer a breakdown if a key symmetrical triangle support fails

XRP experienced $10.91 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of long and short liquidations accounted for $8.70 million and $2.21 million, respectively.

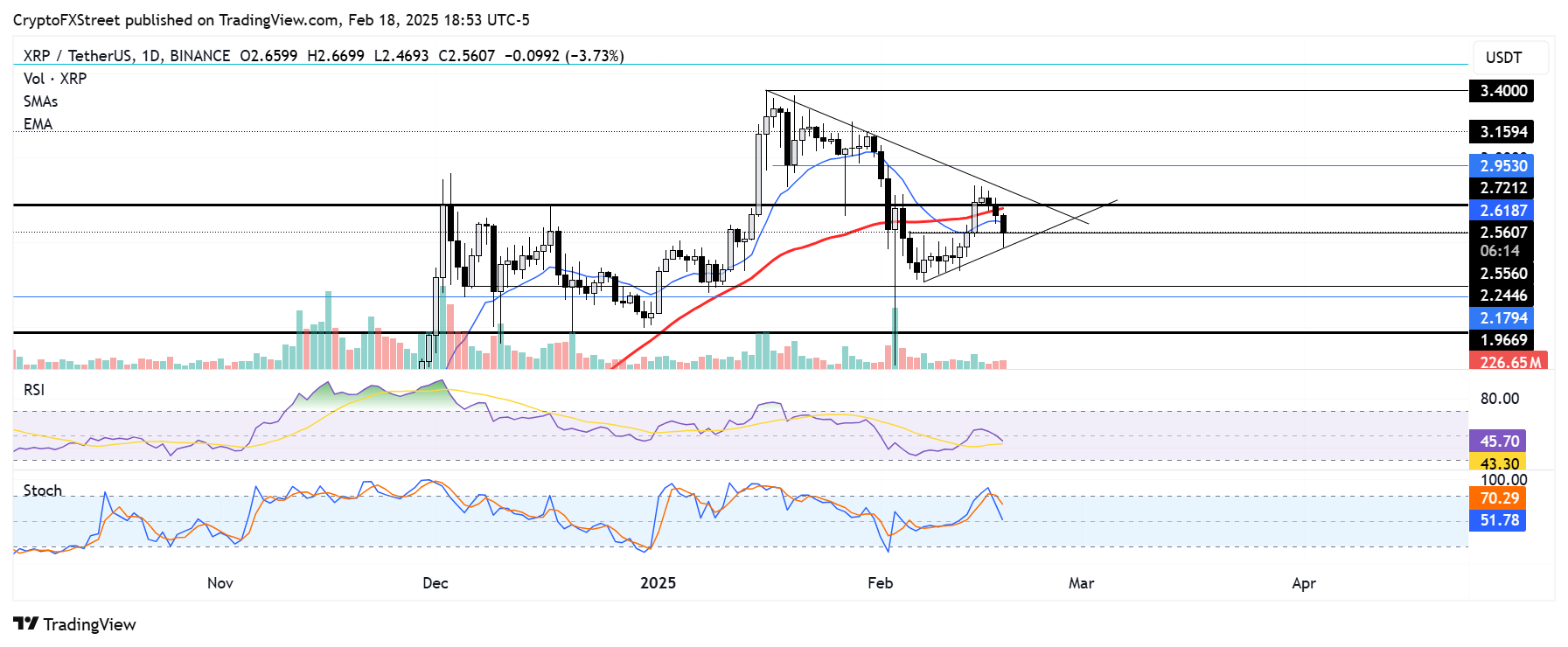

XRP has declined nearly 10% in the past three days following a rejection near the upper boundary of a symmetrical triangle pattern. The decline saw XRP crossing below the 50-day Simple Moving Average (SMA) and 14-day Exponential Moving Average (EMA).

XRP/USDT daily chart

The symmetrical triangle lower boundary line could provide support to initiate a bounce for XRP to tackle the $2.72 resistance. A firm extended decline below the triangle’s support could signal a breakdown that could send XRP toward the $1.96 level if the support at $2.17 fails.

The Relative Strength Index (RSI) declined below its neutral level and is testing its moving average yellow line. A cross below the yellow line could heighten XRP’s downward pressure. The Stochastic Oscillator also temporarily crossed below its neutral level, signaling dominant bearish momentum.

A daily candlestick close below $1.96 will invalidate the thesis.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14, 2023: For institutional investors or over-the-counter sales, XRP is a security. For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token. While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and had to pay a $125 million civil fine.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at. Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say. Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation. While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.

#1a73e8;">Boost Your Financial Knowledge and Achieve Stability

Discover a growing online community dedicated to delivering financial news, tips, and strategies designed to help you manage money effectively, save smarter, and grow your investments with confidence.

#1a73e8;">Top Financial Tips for Saving and Investing

- Personal Finance Management: Master the art of budgeting, expense tracking, and building a strong financial foundation.

- Investment Opportunities: Stay updated on market trends, learn about stocks, and explore secure ways to grow your wealth.

- Expert Money-Saving Advice: Access proven techniques to reduce expenses and maximize your financial potential.