Financial Insights That Matter

Majority believe slumping currency poses a risk to their personal finances in 2025

Article content

Article content

Article content

A weaker Canadian dollar has even more consumers jumping on the made-in-Canada bandwagon as they worry about how to stretch the limping loonie, a new survey suggests.

The EQ Bank survey, released on Thursday, said 68 per cent of Canadians believe the weaker dollar poses a risk to their personal finances in 2025, spurring 80 per cent of that group to come up with strategies to mitigate the currency’s impact by swearing off products from the United States to opting to travel within Canada.

Advertisement 2

Article content

The bank took the pulse of 1,500 Canadian adults before and after U.S. President Donald Trump signed his executive order on tariffs. It found the share of people looking at reducing their spending on U.S. goods “to manage a weaker (Canadian dollar)” jumped to 65 per cent from 56 per cent.

And 54 per cent indicated that they would reduce discretionary spending, up from 46 per cent during the same timeframe. There was also a drop in the number of those who would consider investing in U.S. dollar-denominated assets.

The loonie has had a wild ride recently.

On Jan. 31, it closed at 68.8 cents U.S., its lowest close since early 2016, in anticipation of Trump imposing 25 per cent tariffs on Canadian and Mexican goods on Feb. 1. A last-minute reprieve — at least until early March — revived the Canadian dollar’s fortunes.

The loonie was trading around 70.5 cents U.S. on Thursday, which is still down about five per cent against the greenback since Sept. 24, when Trump’s prospects to win the election started to improve.

EQ’s survey also said the lower loonie has rerouted travel plans.

Article content

Advertisement 3

Article content

Among those planning to travel, 62 per cent said they intended to prioritize vacationing at home versus 50 per cent in early January.

Two other new surveys also said people are rejecting U.S. products in favour of made-in-Canada goods to express their national pride and dismay at the new U.S. administration.

The numbers make the case that people are angry.

For example, 98 per cent of those surveyed by Angus Reid Group indicated they are shopping for made-in-Canada products, while 85 per cent said they planned to replace U.S. products. Four in five said they were committed to buying more local goods, while three in five said they intended to boycott U.S. products.

“For the four in five Canadians who are planning to buy more Canadian products, the grocery store appears to be ground zero for this trend,” Angus Reid Institute said in a press release about the data from a survey of more than 3,300 adults from Feb. 16 to Feb. 18.

Some of the other main targeted products include snacks and pop, clothing and alcohol.

Nearly half of Canadians also said they are cancelling or delaying travel to the U.S.

Advertisement 4

Article content

Interac Corp. also tracked more support for local shopping, according to its survey of 1,500 Canadians conducted Feb. 6 to Feb. 9, with 79 per cent saying that buying local “feels more important” than it did a year ago. Just over half indicated “patriotism” as among their motivations to purchase made-in-Canada products.

Slightly more than half of respondents said they would be willing to pay $5 more to purchase a local product, while just over a third indicated they would be willing to shell out $10 more to buy local.

“Amid the current climate of economic uncertainty and evolving tariff threats, Canadians are looking at their spending in a new light,” Debbie Gamble, chief strategy and marketing officer at Interac, said in a press release.

“Our survey results confirm that Canadians are very intentionally exercising their spending power — choosing to support local businesses even if they may need to spend more to do so.”

Recommended from Editorial

-

This mortgage could pay off if tariffs ‘torpedo the economy’

-

Why Trump’s tariffs could hit Canada harder this time around

Sign up here to get Posthaste delivered straight to your inbox.

Advertisement 5

Article content

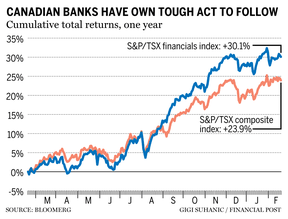

The economic uncertainty stemming from U.S. President Donald Trump’s proposed tariffs could compel Canada’s biggest banks to report provisions for credit losses that are higher than what analysts had previously expected when the lenders release their quarterly results next week.

- Bank of Canada governor Tiff Macklem speaks at an event hosted by the Mississauga Board of Trade and Oakville Chamber of Commerce

- Today’s Data: Statistics Canada releases retail sales for December, U.S. existing home sales

- Earnings: Emera Inc., Onex Corp.

Advertisement 6

Article content

Tax season officially begins on Monday with the opening of the Canada Revenue Agency’s online filing portal to submit 2024 personal income tax returns. Tax expert Jamie Golombek reviews the key filing dates, and what’s new on the 2024 tax return to get you ready for the 2025 tax filing season. Find out more here

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Read them here

Canada is at an economic crossroads. The FP Economy: Trade Wars newsletter brings you the latest developments from the Financial Post and across the Postmedia network every weekday at 7 p.m. ET. Sign up for free here.

Advertisement 7

Article content

Financial Post on YouTube

Visit Financial Post’s YouTube channel for interviews with Canada’s leading experts in economics, housing, the energy sector and more.

Today’s Posthaste was written by Gigi Suhanic, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at [email protected].

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

#1a73e8;">Boost Your Financial Knowledge and Achieve Stability

Discover a growing online community dedicated to delivering financial news, tips, and strategies designed to help you manage money effectively, save smarter, and grow your investments with confidence.

#1a73e8;">Top Financial Tips for Saving and Investing

- Personal Finance Management: Master the art of budgeting, expense tracking, and building a strong financial foundation.

- Investment Opportunities: Stay updated on market trends, learn about stocks, and explore secure ways to grow your wealth.

- Expert Money-Saving Advice: Access proven techniques to reduce expenses and maximize your financial potential.

Comments