CashNews.co

Defiance ETFs has introduced three new ETF, expanding its lineup in the single-stock ETF market with both inverse and leveraged options.

The Daily Target 1.5X Short MSTR ETF (SMST) targets the inverse of MicroStrategy’s daily performance, providing investors with a way to profit potentially from declines in MicroStrategy’s stock price, or hedge existing long positions, the issuer said in a press release. MicroStrategy has invested heavily in bitcoin, the largest cryptocurrency by market value.

“SMST offers a strategic tool for investors to manage risk or capitalize on downward trends in Bitcoin,” Sylvia Jablonski, Defiance ETFs CEO, said in the release.

Defiance has also unveiled two leveraged ETFs tracking other technology companies, with the Defiance Daily Target 2X Long AVGO ETF (AVGX) aiming to deliver twice the daily performance of Broadcom Inc., and the Defiance Daily Target 2X Long SMCI ETF (SMCX) seeking double the daily returns of Super Micro Computer Inc, according to a separate press release,

Tech Giants in the ETF Spotlight

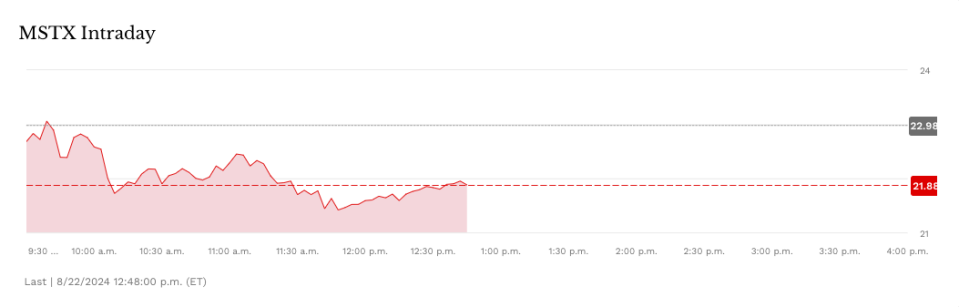

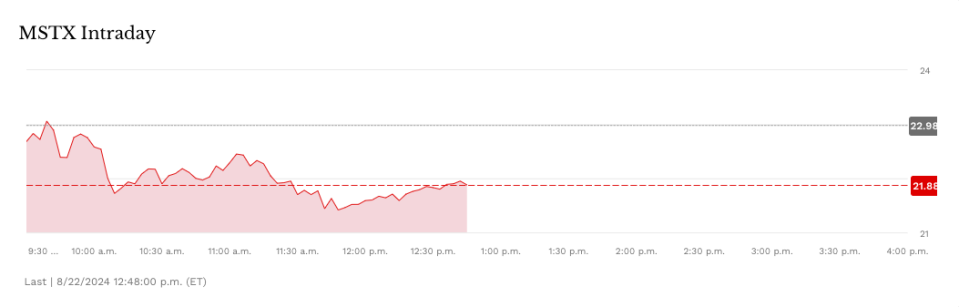

These new offerings come amid growing interest in single-stock ETFs and products offering amplified exposure to individual companies. The start of SMST follows Defiance’s recent introduction of the Defiance Daily Target 1.75X Long MSTR ETF (MSTX)providing investors with flexible options to capitalize on MicroStrategy’s stock movements in either direction.

MicroStrategy has gained attention in recent years for its significant bitcoin holdings. As of July 31, the company held 226,331 bitcoins at a market value of more than $14 billion, according to its second quarter filing. In Thursday trading, bitcoin was changing hands at about $60,500, up 1.4% over the past 24 hours.

The new ETFs are designed for investors who actively monitor and manage their portfolio, the release notes. Due to their leveraged and inverse nature, these products carry higher risk than traditional ETFs and are primarily intended for short-term trading, rather than long-term investing.

These offerings add to Defiance’s existing nine ETFs traded on the U.S. markets with total assets under management of $1.3 billion, according to etf.com data. The firm’s largest ETF is the Defiance Connective Technologies ETF (SIXG) with $562.90M in assets.

Permalink | © Copyright 2024 etf.com. All rights reserved