CashNews.co

It’s been yet another exciting earnings season for investors as megacap tech companies proved that the artificial intelligence (AI) train is moving full steam ahead.

One AI player in particular is yet to publish financial results for the second quarter. On Aug. 28, semiconductor specialist Nvidia (NASDAQ: NVDA) will report earnings, and you can bet that bulls and bears all across Wall Street will be focusing on every last number the company produces.

Let’s dive into what investors should look for and assess if now is a good time to buy shares of Nvidia.

What is Wall Street forecasting for Nvidia earnings?

Nvidia reports revenue in five categories: data centers, gaming, professional visualization, automotive, and original equipment manufacturing (OEM).

Each segment is connected to AI in some form or fashion, but the overwhelming majority of Nvidia’s business stems from data centers. During the company’s first quarter of fiscal 2025 (ended April 28), total revenue was $26 billion. Nearly 87% of that, or $22.7 billion, came from the data center business.

According to consensus analyst estimates, Wall Street is forecasting that second-quarter sales will be around $28.5 billion. Should Nvidia achieve this target, it would represent 111% growth year over year.

In the section below, I’ll break down why I think Nvidia might blow away these estimates and explain some of that tailwinds that could be lifting its important data center operation.

A good proxy for Nvidia

It’s obvious that a common thread stitching the overall fabric of megacap tech right now is AI. But at a more granular level, AI’s integration with cloud computing is a big movement within the technology industry at large.

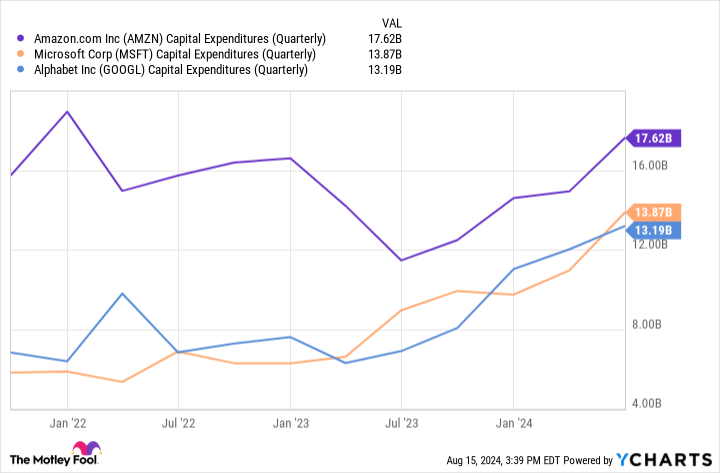

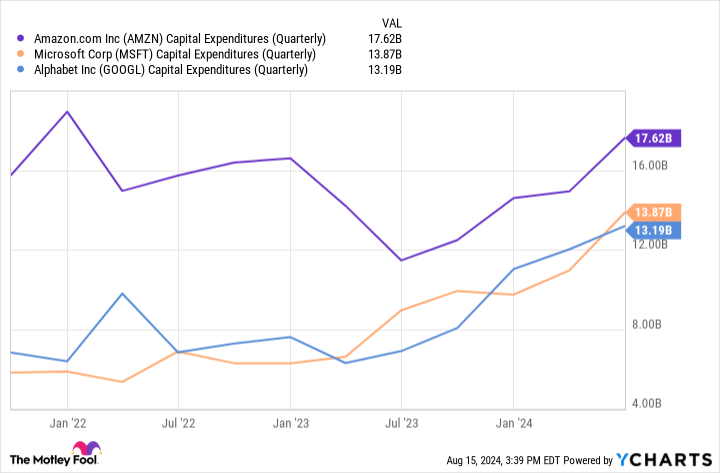

The cloud computing landscape is dominated by Amazon, Microsoft, and Alphabet.

During the second quarter, each of these “Magnificent Seven” members revealed some interesting features. Namely, each is aggressively increasing investments in capital expenditures (capex).

In the case of Amazon, the company’s big initiative is an $11 billion investment into data centers in Indiana as part of a broader rollout to develop its own AI-powered chips. As for Microsoft, the company hasn’t been shy about new investments in nuclear-powered data centers as the company seeks to double down on AI infrastructure in an energy efficient way.

During Alphabet’s second-quarter earnings call, chief financial officer Ruth Porat said that capex spending was “driven overwhelmingly by investment in our technical infrastructure with the largest component for servers followed by data centers.”

Do you see the theme? All of Nvidia’s cohorts are investing tens of billions of dollars into data center infrastructure, and the trends in the chart above suggest it won’t be slowing down anytime soon.

Considering the bulk of Nvidia’s revenue and profits comes from data center services and the company’s sophisticated graphics processing units (GPU), I see the rising capex patterns from others in big tech as a good proxy for what’s to come for Nvidia.

Should you buy Nvidia stock before Aug. 28?

AI emerged as the hottest ticket in the tech realm toward the end of 2022 when OpenAI released ChatGPT.

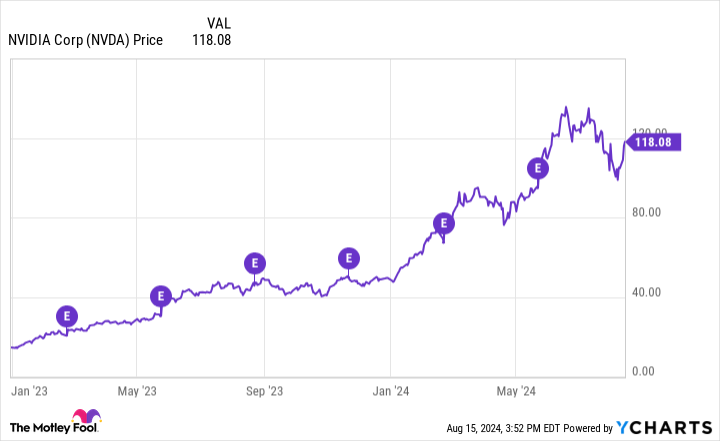

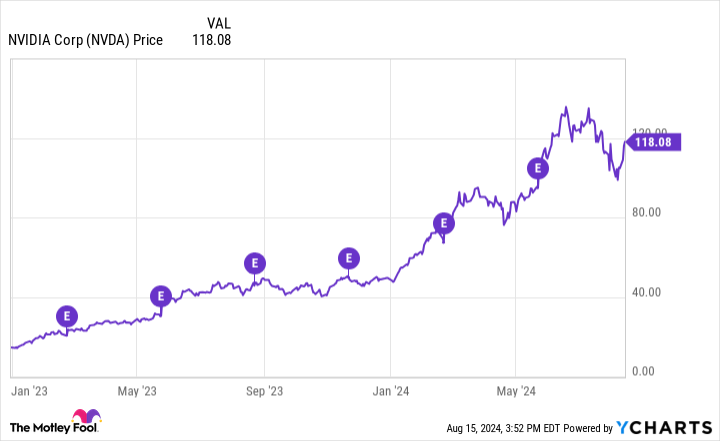

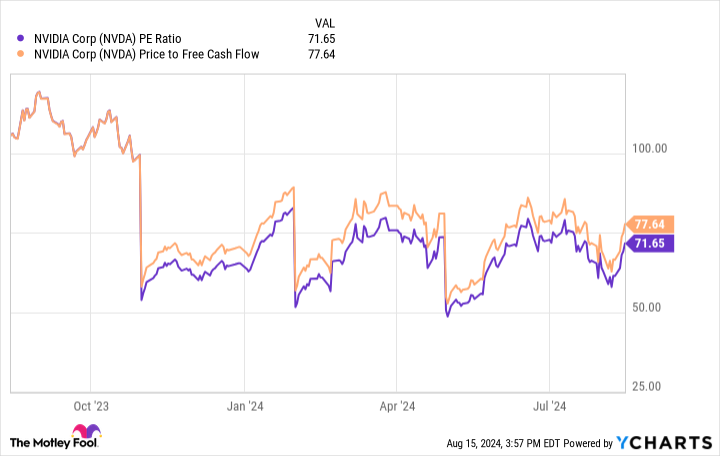

In the chart below, you can see how Nvidia stock reacted following a series of earnings reports since the beginning of last year. The earnings report dates are annotated by the purple circles with “E” in the middle.

It’s clear that Nvidia stock has risen considerably over the last 20 months or so. More specifically, the stock rarely dropped immediately following an earnings report, and when it did, the sell-off was brief.

To me, this helps validate that buying Nvidia stock either before or after its last several earnings reports ended in the same result: gains.

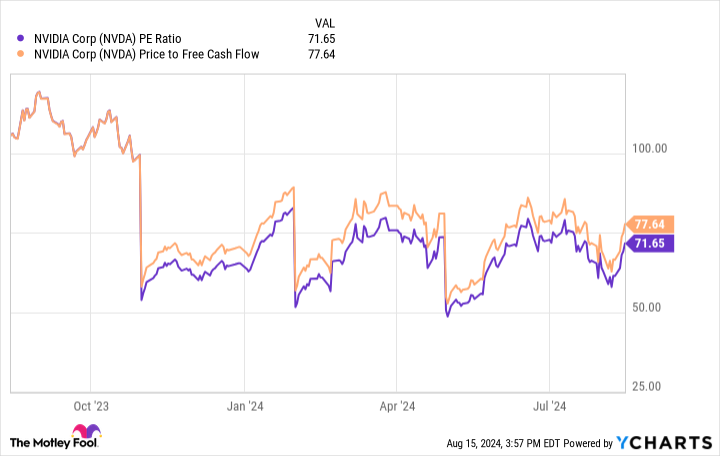

When it comes to valuation, Nvidia stock is less expensive today than it was a year ago on both a price-to-earnings (P/E) and price-to-free-cash-flow (P/FCF) basis. This compression in multiples has occurred because the company’s profits and cash flow are actually rising faster than its sales, a sign of an incredibly healthy and powerful operation.

Given the trends from its Magnificent Seven peers noted above, I’m cautiously optimistic that Nvidia could experience yet another impressive quarter. For these reasons, it might be a good idea to buy some shares now because history suggests Nvidia stock could be headed for further gains.

But I wouldn’t get too caught up in the exact timing. If you prefer to analyze the earnings report first and then decide to buy the stock, perhaps you’ll be investing at a slightly higher valuation. Given the trends in the earnings chart, I’m confident that gains will still be on the horizon for long-term investors whether or not they buy Nvidia stock before Aug. 28.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $779,735!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 12, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Should You Buy Nvidia Stock Before Aug. 28? was originally published by The Motley Fool

#cashnews #UnitedStates #newsfinace #finance #FollowsCashnews