CashNews.co

As the European markets show signs of resilience, with France’s CAC 40 Index advancing 2.48%, investors are increasingly looking towards small-cap stocks for potential high-growth opportunities. In this environment, Société Industrielle et Financière de l’Artois Société anonyme and two other hidden French small-cap gems offer intriguing prospects. Identifying a good stock in current market conditions involves looking at companies that demonstrate strong fundamentals, resilience in their sector, and the ability to capitalize on economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals In France

|

Name |

Debt To Equity |

Revenue Growth |

Earnings Growth |

Health Rating |

|---|---|---|---|---|

|

Regional Agricultural Credit Mutuel Fund Brie Picardie Cooperative Society |

34.89% |

3.23% |

3.61% |

★★★★★★ |

|

Goof off |

0.25% |

10.64% |

20.33% |

★★★★★★ |

|

EssoF |

1.19% |

11.14% |

41.41% |

★★★★★★ |

|

VIEL & Cie public limited company |

63.16% |

5.00% |

16.26% |

★★★★★☆ |

|

Exacompta Clairefontaine |

30.44% |

6.92% |

31.73% |

★★★★★☆ |

|

ADLPartner |

86.83% |

9.59% |

11.00% |

★★★★★☆ |

|

The Equatorial Forest |

0.00% |

-50.76% |

49.41% |

★★★★★☆ |

|

Regional Fund of Agricultural Credit Mutuel Alpes Provence Cooperative Society |

391.01% |

4.67% |

17.31% |

★★★★☆☆ |

|

Cannes Municipal Casino Farm Company |

11.60% |

6.69% |

10.30% |

★★★★☆☆ |

|

Industrial and Financial Society of Artois Public limited company |

2.93% |

-1.09% |

8.31% |

★★★★☆☆ |

Click here to see the full list of 36 stocks from our Euronext Paris Undiscovered Gems With Strong Fundamentals screener.

Here’s a peek at a few of the choices from the screener.

Simply Wall St Value Rating: ★★★★☆☆

Overview: Société Industrielle et Financière de l’Artois Société anonyme designs, manufactures, markets, and sells terminals, bollards, access control, and automatic identification systems with a market cap of €1.44 billion.

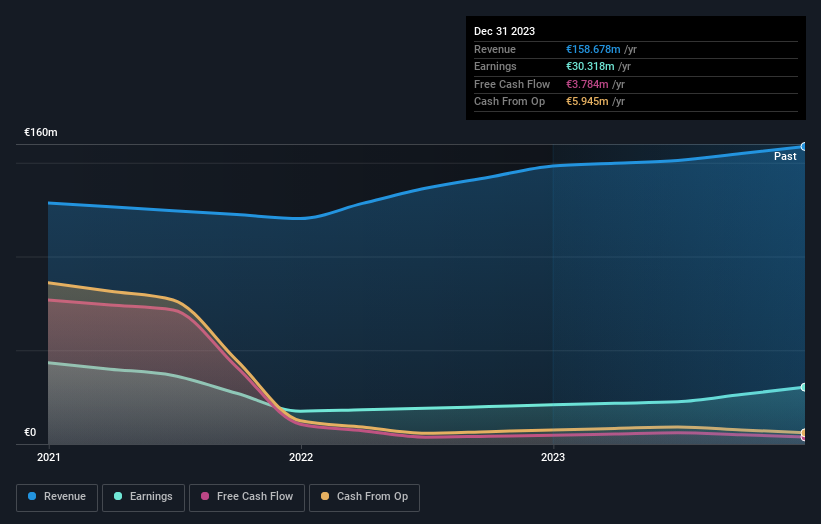

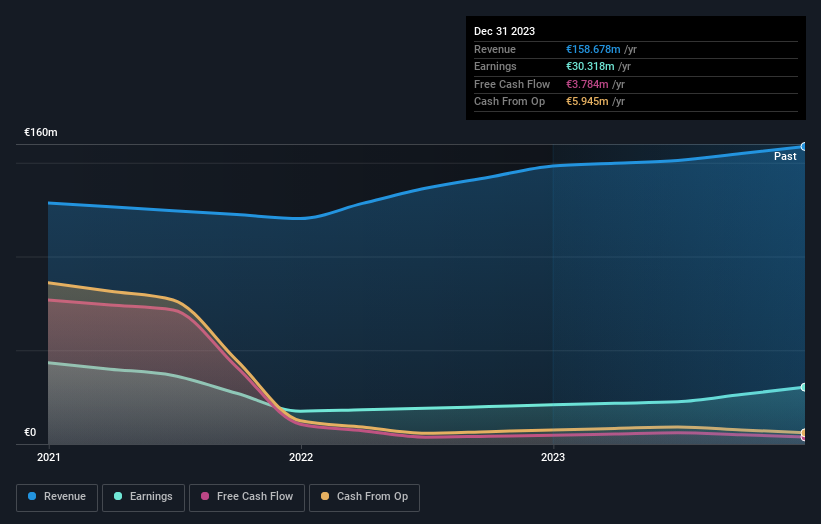

Operations: The company generates revenue primarily from the industrial sector, amounting to €158.68 million.

Société Industrielle et Financière de l’Artois Société anonyme has shown promising financial health, with its debt to equity ratio decreasing from 4.4% to 2.9% over the past five years. Earnings have grown at a steady rate of 8.3% annually, and the company remains free cash flow positive. Despite not outperforming the tech industry’s earnings growth of 45.1%, ARTO’s high-quality earnings and more cash than total debt position it well for future stability and potential growth in France’s market landscape.

Simply Wall St Value Rating: ★★★★★★

Overview: Esso S.A.F. refines, distributes, and markets refined petroleum products in France and internationally with a market cap of approximately €1.72 billion.

Operations: Esso S.A.F. generates revenue primarily from its refining and distribution segment, amounting to €18.93 billion. The company’s cost structure and profit margins are influenced by the dynamics of the petroleum market, impacting its overall financial performance.

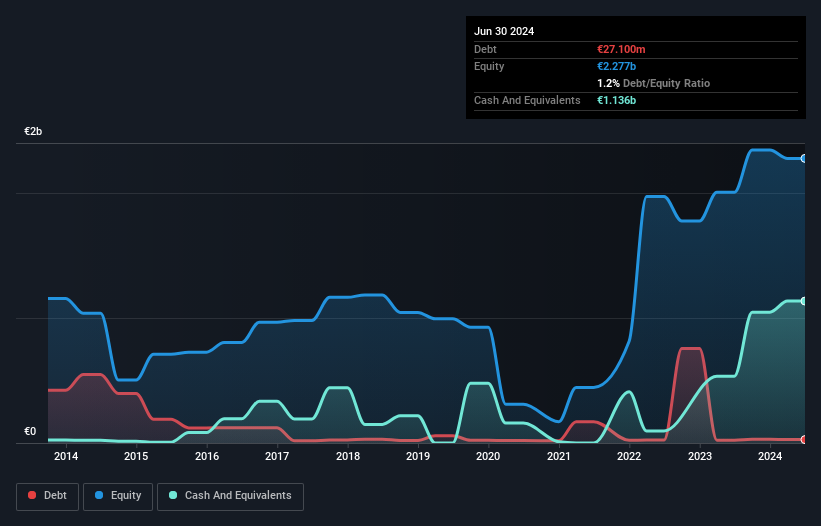

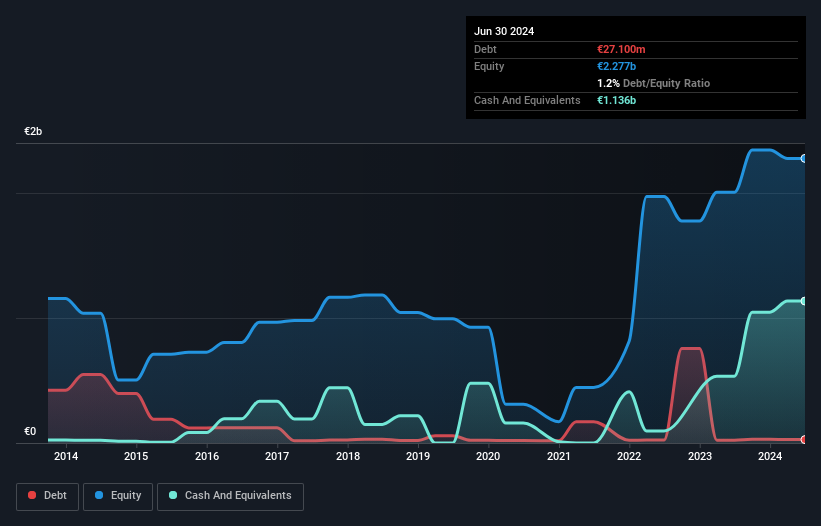

EssoF, a smaller player in the French market, has recently reported earnings for the half year ending June 30, 2024. Sales were €9 billion compared to €9.32 billion last year, while net income dropped from €265.6 million to €116 million. The company’s P/E ratio stands at an attractive 3.3x versus the broader market’s 14.7x, and its debt-to-equity ratio has improved from 5.8% to 1.2% over five years, indicating better financial health despite recent volatility in share price.

Simply Wall St Value Rating: ★★★★★★

Overview: Financière Moncey Société anonyme is a holding company that manages a portfolio of investments in France, with a market cap of €1.51 billion.

Operations: Financière Moncey Société anonyme generates revenue through its portfolio of investments in France. The company has a market cap of €1.51 billion.

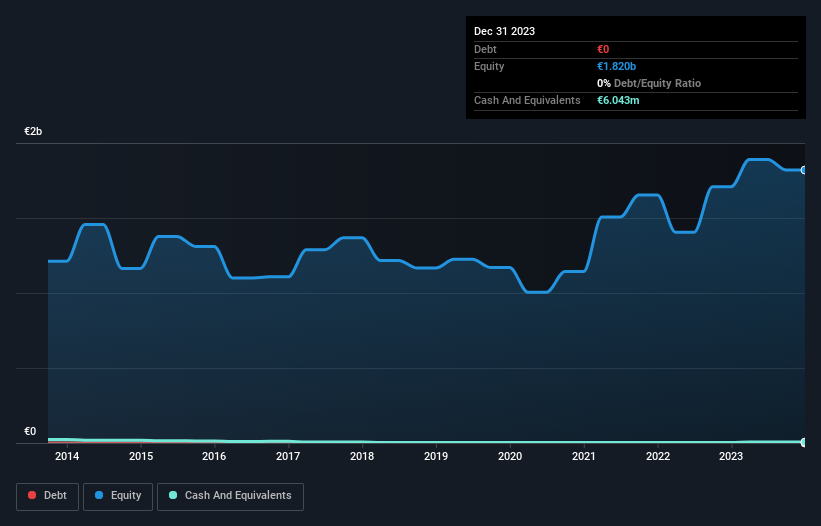

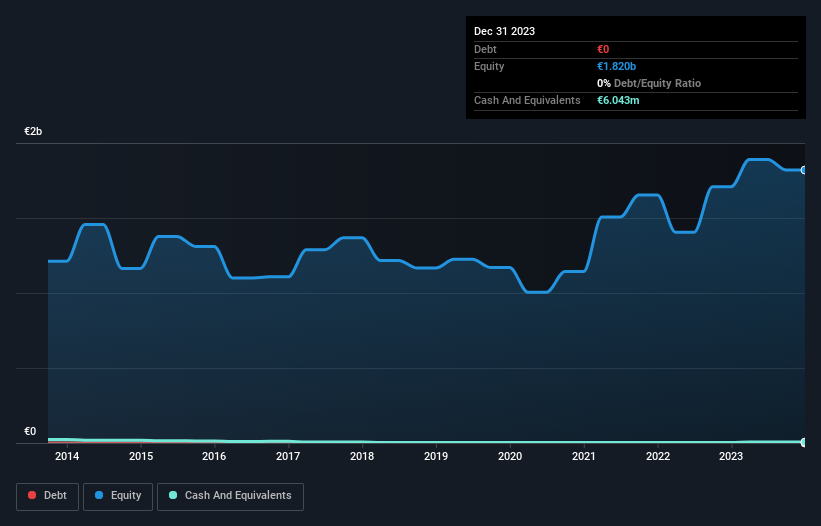

Financière Moncey Société anonyme, a small player in the diversified financial sector, has seen its earnings grow by 41.7% over the past year, outpacing the industry average of -3.9%. The company operates debt-free, a significant improvement from five years ago when its debt-to-equity ratio was 0.02%. Despite generating less than US$1 million in revenue (€0), it boasts high-quality earnings and positive free cash flow at US$8.18 million as of August 2024.

Next Steps

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:ARTO ENXTPA:ES and ENXTPA:FMONC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]