CashNews.co

The Zacks Leisure and Recreation Services industry faces challenges due to high inflation and elevated interest rates. The industry is benefiting from the optimization of business processes, consistent strategic partnerships and digital initiatives. Moreover, robust demand for concerts, strong bookings for cruise operators and higher per capita spending at theme parks are supporting the industry. Firms like Royal Caribbean Cruises Ltd. RCL, Norwegian Cruise Line Holdings Ltd. NCLH and Cinemark Holdings, Inc. CNK.

Industry Description

The Zacks Leisure and Recreation Services industry comprises various recreation providers, such as cruise, entertainment and media owners, golf-related leisure and entertainment venue businesses, theme park makers, resort operators and event organizers. Some industry players have ski and sports businesses, while some operate health and wellness centers onboard cruise ships and at destination resorts. Many companies are engaged in hospitality and related businesses. A few industry participants also provide weight management products and services. These companies primarily thrive on overall economic growth, which fuels consumer demand for products. Demand, which is highly dependent on business cycles, is driven by a healthy labor market, rising wages and a growing disposable income.

3 Trends Shaping the Leisure & Recreation Services Industry’s Future

High Interest Rates: The prolonged inflation, culminating in the highest U.S. interest rates, hurt the industry. Interest rates are at record-high levels. The Federal Reserve hiked interest rates by 525 basis points since March 2022 in its fight to bring down 40-year high inflation. The annual inflation rate in the United States slowed for a fourth successive month to 2.9% in July 2024, the lowest since March 2021, compared with 3% in June and below forecasts of 3%. However, the figure is still above the Federal Reserve’s target of 2%.

Robust Demand Aids Cruise Operators: The cruise industry is benefiting from strong demand for cruising and accelerating booking volumes. The industry is benefiting from solid bookings concerning North American and European sailings. Also, strong pricing (on closer-in-demand) and solid onboard spending bode well for the industry. According to the Cruise Lines International Association (CLIA), the number of passengers embarking on cruises is projected to reach 35.7 million in 2024, suggesting an increase from 31.7 million in 2023.

Theme Park Operators & Live Entertainment Companies Bouncing Back: The theme park industry is benefiting from robust demand. Theme park operators have been gaining from improving visitation. Consumer spending at theme parks continues to rise. The theme park sector is experiencing a boost from integrating technology, particularly through augmented and virtual reality. By incorporating innovative motion simulators, hydraulics and pneumatics and centering on enhancing customer experiences, there’s anticipation of a surge in market demand in the coming years. Live entertainment firms have benefited from pent-up live event demand and robust ticket sales.

Zacks Industry Rank Indicates Dismal Prospects

The Zacks Leisure and Recreation Services industry is grouped within the broader Zacks Consumer Discretionary sector. It carries a Zacks Industry Rank #164, which places it in the bottom 35% of 251 Zacks industries.

The group’s Zacks Industry Rank, which is the average of the Zacks Rank of all the member stocks, indicates dull near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than two to one.

The industry’s position in the bottom 50% of the Zacks-ranked industries results from a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually losing confidence in the group’s earnings growth potential. Since Apr. 30, 2024, the industry’s earnings estimates for 2024 have declined 4.3%.

Before we present a few stocks that investors can consider, let’s analyze the industry’s recent stock-market performance and valuation picture.

Industry Underperforms the S&P 500

The Zacks Leisure and Recreation Services industry has underperformed the Zacks S&P 500 composite and its sector in the past year. Stocks in the industry have gained 4.4% in the past year compared with the broader sector’s increase of 7.6%. The S&P 500 has risen 27% in the said time frame.

One-Year Price Performance

Valuation

On the basis of the forward 12-month EV/EBITDA (Enterprise Value/Earnings before Interest Tax Depreciation and Amortization), which is a commonly used multiple for valuing debt-laden leisure service stocks, the industry trades at 56.41X compared with the S&P 500’s 25.11X and the sector’s 13.76X. In the past five years, the industry has traded as high as 61.59X and as low as 6.47X, with the median being 9.49X, as the charts show.

EV/EBITDA Ratio (F12M) Compared With S&P

3 Leisure and Recreation Services Stocks to Keep an Eye On

Royal Caribbean Cruises: Based in Miami and incorporated in 1985, Royal Caribbean Cruises is a cruise company. It has been benefiting from strong cruising demand from new and loyal guests and robust booking trends. Also, strength in consumer spending onboard and pre-cruise purchases bodes well. The company emphasized investing in a modern digital travel platform to streamline the vacation booking process for customers and expand wallet share.

Shares of this Zacks Rank #1 (Strong Buy) company have surged 64.8% in the past year. In 2024, the company’s sales and earnings are expected to witness growth of 18.1% and 69.9%, respectively, from the prior year’s reported levels. You can see the complete list of today’s Zacks #1 Rank stocks here.

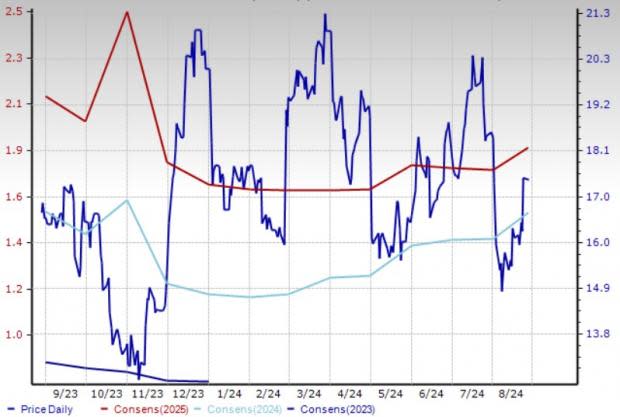

Price and Consensus: RCL

Norwegian Cruise: The company is benefiting from strong demand, high pricing and increased booking volumes, leading to record advance ticket sales. Its focus on fleet expansion efforts and digital initiatives bodes well. These factors showcase that NCLH’s strategy is well-aligned with its growth goals and 2026 financial and sustainability targets. Given the substantial progress made so far and current demand expectations, the company raised its 2024 full-year guidance.

Shares of this Zacks Rank #1 company have moved up 5.4% in the past three months. In the fiscal 2024, the company’s earnings and sales are expected to witness growth of 122.9% and 9.8% year over year, respectively.

Price and Consensus: NCLH

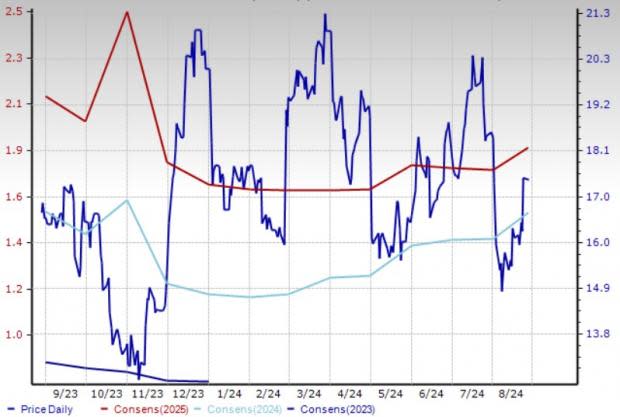

Cinemark Holdings: The company, together with its subsidiaries, engages in the motion picture exhibition business. Cinemark’s growth prospects are optimistic, driven by encouraging trends in consumer moviegoing, film volume recovery and strong content appeal. The company believes it is uniquely positioned to succeed due to its competitive strengths and various strategies for value creation.

Shares of this Zacks Rank #2 company have surged 64.8% in the past three months. In the past 30 days, earnings estimates for 2024 have witnessed upward revisions of 23.9%.

Price and Consensus: CNK

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Norwegian Cruise Line Holdings Ltd. (NCLH) : Free Stock Analysis Report

Cinemark Holdings Inc (CNK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research