CashNews.co

It’s Nvidia‘s (NASDAQ: NVDA) world, investors are just living in it. At least, that’s what it has felt like in 2023 and 2024. The chipmaker and leading provider of artificial intelligence (AI) computing infrastructure now has a market cap topping $3 trillion, making it the third-largest company in the world. Up close to 3,000% in the last five years, it is now one of the best performing stocks ever, making longtime shareholders incredibly wealthy.

I predict this monster run is close to over. No, it has nothing to do with the company’s upcoming earnings release on Aug. 28. But it does have to do with a widening competitive set that could impact Nvidia’s pricing power over the long term. Here’s why I think Nvidia’s monster stock gains are set to end within the next few years.

Cloud vertical integration

Nvidia’s operating income is up more than 2,000% in the last five years to $48 billion. This growth has come because Nvidia chips are the premier computing vehicle for new AI tools taking over the technology sector. As the only scaled supplier of these premier chips and with a technological lead over competitors such as Intel, Nvidia has seen a surge in revenue and profit margins as it sells these scarce resources at sky-high prices.

Three of its largest customers are Amazon, Alphabet (Google), and Microsoft. These are the three big cloud-computing providers that are the infrastructure backbone for new AI algorithms and software. Combined, these three are likely spending over $10 billion a year, perhaps $20 billion, on Nvidia chips. Now, it looks like Nvidia has angered the cloud hornets nest.

In a move that is being underfollowed by Wall Street, these cloud providers have announced huge investments to make their own AI chips. For example, Amazon is now making its own chips called Inferentia and Trainium that directly compete with Nvidia. The products are behind Nvidia right now in computing capabilities, but with so much money spent on Nvidia chips, it makes sense for Amazon to pour billions of dollars into research and development to try and improve these offerings.

Google has its own tensor processing units (TPUs), and Microsoft has announced its investments into internal chip development. They may take years to scale, but supply is only going to go up and create more competition for Nvidia, not less. Even worse, the competition is coming from Nvidia’s own customers.

Competition eliminates pricing power

A key for Nvidia’s stock gains in the past two years has been operating-margin expansion. From a low at close to 15%, Nvidia’s operating margin was around 60% over the past 12 months. This has actually contributed more to Nvidia’s earnings growth than revenue. Revenue is up 228% in the last three years, while operating margin is up close to 4 times off of its lows.

Nvidia is able to have absurd profit margins because of the minimal current competition it faces for AI computer chips. This leads to pricing power, which accelerates revenue growth and expands margins — a wonderful set of catalysts for a stock. However, this can reverse if competition increases, which is happening with the three largest cloud providers. If they keep replacing more and more of their Nvidia chips with their own brands, Nvidia’s revenue and earnings growth will be impacted.

To be clear, the timeline on this competition is not in 2024. It may take multiple years for Amazon, Microsoft, and Google to make a dent in Nvidia’s AI chip business. But the companies have a huge incentive to do so because of the price hikes Nvidia has implemented on them. All three of the big cloud providers have plenty of cash to spend in order to get these divisions to scale. And they are working on them.

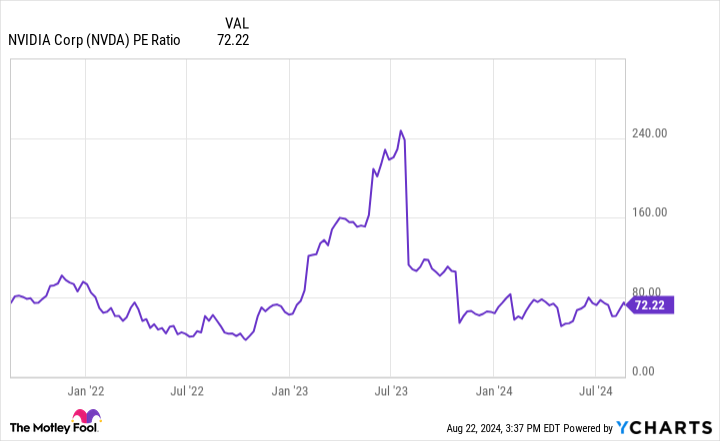

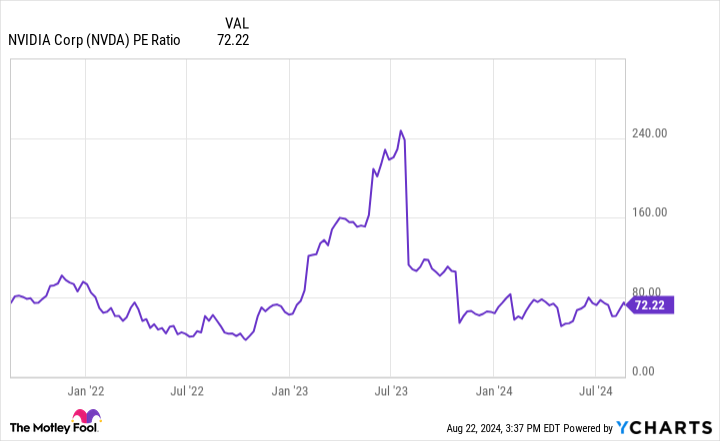

NVDA PE Ratio data by YCharts.

Risks for Nvidia stock

Nvidia stock has insane momentum right now. That is because earnings and revenue are growing at an insane rate. A growing supply of AI chips from competitors — whether Amazon or anyone else — could be a double-whammy headwind for Nvidia’s financials.

Growing competition means increasing the supply of chips that cloud providers and other AI chip purchasers can buy. The simple law of supply and demand dictates that prices will come down if supply increases but demand remains the same. This would lead to a revenue slowdown and a margin decrease, which both negatively affect Nvidia’s earnings power.

Today, Nvidia trades at a price-to-earnings ratio (P/E) of 73, which is close to triple the S&P 500 index average. And this is based on trailing earnings with sky-high 60% profit margins. If pricing power comes down, it will impact revenue and profit margins. From a numbers basis, this means even if Nvidia sells more computer chips in the coming years, profits could actually be significantly lower.

Stocks with declining earnings don’t trade at a P/E of 73. And don’t forget that this P/E would climb to more than 100 compared to its current market cap of $3 trillion if profit margins decline to “just” 40%. This makes Nvidia stock incredibly risky, which is why I predict its monster stock run is coming to a close. It is still a quality business but not one that deserves to trade at a market cap of $3 trillion right now.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 22, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Alphabet and Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Prediction: This Is What Will Finally End Nvidia’s Monster Stock Gains was originally published by The Motley Fool

#cashnews #UnitedStates #newsfinace #finance #FollowsCashnews