CashNews.co

It’s been another excellent year so far for the Nasdaq Composite. Year to date, the index has generated a 19% return.

Yet by digging just a little deeper, investors could do even better. Here’s one more-focused exchange-traded fund (ETF) worth considering.

What is the Fidelity MSCI Information Technology Index ETF?

The Fidelity MSCI Information Technology Index ETF (NYSEMKT: FTEC) is a technology-focused ETF, that tracks a basket of companies across the software and hardware industries.

In terms of holdings, the fund is top heavy. Microsoft, Appleand Nvidia make up almost half of its total exposure. Its top 10 holdings are:

|

Company |

Ticker |

Share of FTEC Portfolio* |

|

Apple |

AAPL |

17.08% |

|

Microsoft |

MSFT |

15.57% |

|

Nvidia |

NVDA |

15.51% |

|

Broadcom |

AVGO |

4.93% |

|

Salesforce |

CRM |

1.74% |

|

Adobe |

ADBE |

1.71% |

|

Advanced Micro Devices |

AMD |

1.65% |

|

Oracle |

ORCL |

1.49% |

|

Accenture |

ACN |

1.37% |

|

Cisco Systems |

CSCO |

1.35% |

*Percentages as of Aug. 21, 2024.

Notably absent from the fund’s holdings list are some familiar names for tech investors: Meta Platforms, Alphabet, and Amazon. That’s because Meta Platforms and Alphabet — the parent companies of Facebook and Google, respectively — are classified as communication services businesses. As such, they are lumped in with telecom providers, entertainment and media conglomerates, and other associated businesses — rather than information technology companies. Meanwhile, Amazon is classified as a consumer goods stock, even though the company operates the largest cloud services business in the world — Amazon Web Services (AWS).

At any rate, those exclusions shouldn’t be seen as a negative for this fund. Indeed, their exclusion provides investors with a more concentrated set of holdings focused purely on the hardware and software industries, which may appeal to some investors. The heavy weightings of semiconductor makers like Nvidia, Broadcom, and Advanced Micro Devices ensure that fund owners have plenty of exposure to a cutting-edge industry that is supplying the physical parts needed for the AI revolution. Furthermore, large holdings in software giants like Microsoft and Adobe mean that investors also gain exposure to companies that are producing innovative AI-powered tools.

How has the fund performed over time?

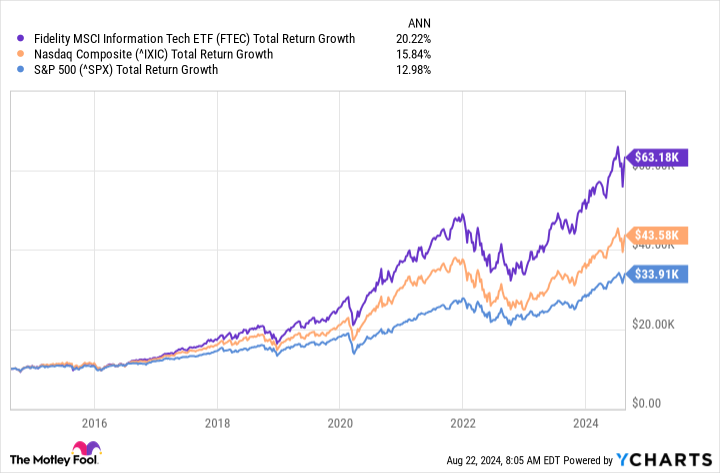

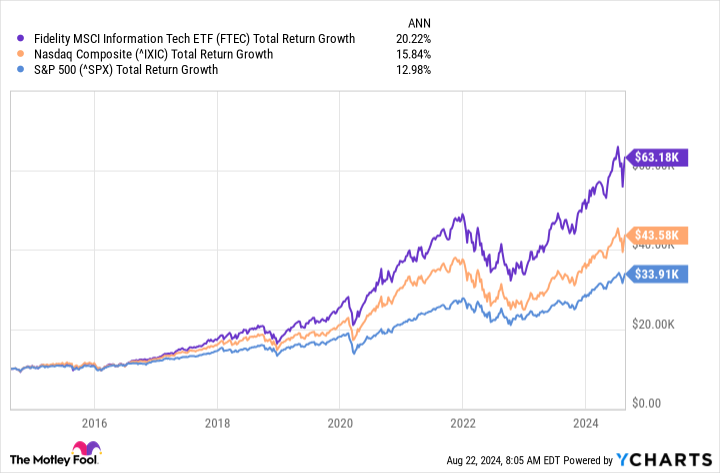

Without a doubt, tech stocks have performed well over the last decade, so it’s no surprise that the Fidelity MSCI Information Technology Index ETF has too.

Indeed, as you can see above, a $10,000 investment in the fund made in 2014 would have grown to nearly $63,000 today. In fact, the fund has generated compound annual growth of 20.2%. That’s well ahead of the compound growth rates of either the S&P 500 (13%) or the Nasdaq Composite (15.8%) over the same period.

Nevertheless, there are risks in owning this — or any other — ETF. For one, the fund is highly concentrated in the “big three” — Apple, Microsoft, and Nvidia. That concentration has benefited the Fidelity MSCI Information Technology Index ETF in the past, but it could harm its performance in the future.

Similarly, as noted earlier, the fund lacks exposure to several other “Magnificent Seven” stocks such as AmazonAlphabet, and Meta Platforms. Future outperformance from those companies wouldn’t be captured by the Fidelity fund.

Last, the fund’s overall focus on the tech industry presents its own problems. For one thing, few of the companies in its portfolio pay significant dividends — or any dividends, for that matter. Overall, the fund has a dividend yield of only 0.7%, which makes it a poor choice for income-focused investors. In addition, the fund’s laser-like focus on the tech industry presents a sector concentration risk. Potential challenges like increased regulation, decreased enterprise spending, or an overall slump in economic growth could hit the tech sector harder than other more resilient segments of the economy.

All that said, investors who are willing to assume the higher risk that comes from owning a basket of tech stocks may be handsomely rewarded. For that reason, investors may want to consider the Fidelity MSCI Information Technology Index ETF.

Should you invest $1,000 in Fidelity Covington Trust – Fidelity Msci Information Technology Index ETF right now?

Before you buy stock in Fidelity Covington Trust – Fidelity Msci Information Technology Index ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Fidelity Covington Trust – Fidelity Msci Information Technology Index ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $769,685!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 26, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Alphabet, Amazon, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Forget the Nasdaq — Buy This Magnificent ETF Instead was originally published by The Motley Fool