CashNews.co

Red signals are flashing on the state of economy under still-high interest rates

Article content

The chatter around the Bank of Canada supersizing its next cut has grown in volume ever since the United States started its interest rate trimming campaign with a jumbo reduction.

Some economists said the Fed’s 50-basis-point cut blew “the doors wide open” for the Canadian central bank to cut by a similar magnitude because it could make the difference between a soft economic landing and a recession.

Advertisement 2

Article content

Meanwhile, currency analysts at CIBC Capital Markets said interest rates remained too restrictive and that a compelling argument exists for them to come down in larger increments than the standard 25 basis points per meeting.

One economist said more evidence has built up that interest rates need to come down faster, noting that Canada’s small-business sector is flashing all kinds of warning signs, as are other data points.

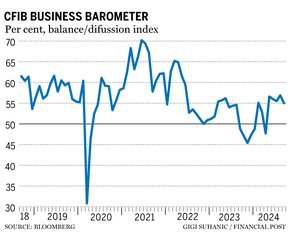

Stephen Brown, deputy chief North America economist at Capital Economics Ltd., said the latest CFIB Business Barometer, released on Sept. 26, showed “worrying signs” regarding the state of commerce for small firms.

“Although the CFIB Business Barometer covers only small firms, in recent years, the survey indicators have provided a fairly accurate steer to economic conditions,” he said in an analysis.

The barometer fell to 55 in September from 56.8 the month before, still over the 50 no-change mark, but Brown said the reading points to annualized gross domestic product (GDP) of roughly one per cent in the third quarter, well off the Bank of Canada forecast of 2.8 per cent.

Article content

Advertisement 3

Article content

“The details were downbeat,” he said, adding that the number of small businesses experiencing “insufficient demand” rose to 53.3 per cent last month.

“That seems to suggest that the output gap (the difference between what an economy is creating and its potential) is far larger than 1.25 per cent of GDP, as the Bank of Canada estimates,” Brown said.

That’s not all the economist found in the CFIB report to make him think the Bank of Canada needs to increase the size of its next interest rate cut.

Projections by small firms for prices and wages as well as the number of businesses experiencing labour shortages have all fallen below pre-pandemic peaks.

Job vacancy data from Statistics Canada reinforced the tightening labour picture. Vacancies fell by 4.1 per cent to 526,900 in July, the third consecutive monthly decline and down by nearly half from the peak reached in May 2022, the agency said.

Brown estimated the job vacancy rate is now at three per cent, which is below the 2019 average of 3.2 per cent.

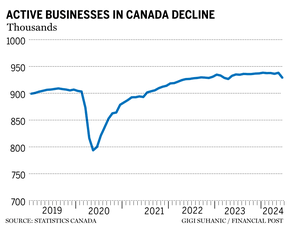

A decline in the number of small businesses created last month was the third warning sign to flash at Brown. The number of active businesses in Canada fell the most since the pandemic, declining by five per cent in June, Statistics Canada said.

Advertisement 4

Article content

“The soft pace of third-quarter growth, combined with the host of worrying indicators elsewhere, leads us to think that the (Bank of Canada) will enact 50 basis point cuts at both the October and December policy meetings,” he said.

The Bank of Canada’s remaining meetings for 2024 will be held on Oct. 23 and Dec. 11.

Brown said markets are currently pricing in one 50-basis-point cut “with 75 basis points priced in across the two meetings” to the end of the year.

Sign up here to get Posthaste delivered straight to your inbox.

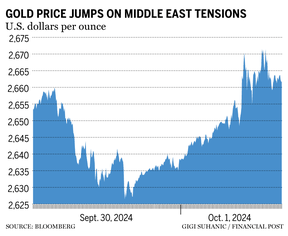

The persistent rally in stocks was knocked for a loop Tuesday as investors retreated to safer corners of the market when the conflict in the Middle East intensified.

Haven assets were bid up with bonds, oil, gold and the U.S. dollar all advancing after Iran fired a barrage of missiles at Israel following an advance of armed forces into Lebanon. The United States is actively supporting preparations to defend Israel, according to an earlier report.

Gold climbed above US$2,670 an ounce during the trading day while oil briefly topped US$71 a barrel.

“Markets are in wait and see mode,” said Kathleen Brooks, research director at XTB. “The next 24 hours will be critical to see how far this situation escalates and whether the rush to safe havens was justified.” — Bloomberg

Advertisement 5

Article content

- Today’s data: U.S. ADP employment report for August, weekly mortgage applications

- Earnings: Levi Strauss & Co., Novagold Resources Inc., Anaergia Inc.

Recommended from Editorial

-

Don’t crack the champagne yet — 2% inflation ain’t what it used to be

-

Toronto ranks fifth in the world for risks of real estate bubble

A 62-year-old woman is in estate planning mode. She has a whole life policy she bought 34 years ago with paid-up dividends and sweet cash and life insurance values. She is wondering if she needs to top up her life insurance principal to cover any tax liabilities after her death? She also wonders, can she even do that? Read FP Answers for expert advice.

Advertisement 6

Article content

Build your wealth

Are you a Canadian millennial (or younger) with a long-term wealth building goal? Do you need help getting there? Drop us a line at [email protected] with your contact info and your goal and you could be featured anonymously in a new column on what it takes to build wealth.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Read them here

Today’s Posthaste was written by Gigi Suhanic, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at [email protected].

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Comments