CashNews.co

Timing of budget refresh up in the air but more spending ‘clearly in the offing’

Article content

Article content

Article content

As the days get darker, colder and snowier, Canada’s fall fiscal calendar has a significant event missing from it.

All the provinces released their fiscal updates, sticking with the established timing of refreshing their finances in the fall, but the federal Liberal government has been so silent on the subject that one economist is suggesting Canadians might have to wait until after Christmas for a national update.

Advertisement 2

Article content

“It’s not clear when — or even if — it will come before the holidays, but the writing is mostly on the wall,” Rebekah Young, an economist at the Bank of Nova Scotia, said in a note on Wednesday, adding there are even rumours “swirling” that there won’t be a fiscal update at all.

“But don’t discount it yet even if the finance minister remains mum,” she said, noting that the 2019 election and the pandemic pushed the federal fiscal update into December instead of the usual November release.

Young nonetheless took a swing at what she thinks the statement might contain.

“More spending is clearly in the offing,” she said, referring to the Liberals’ recently announced GST holiday and $250 rebate cheques for working Canadians.

The GST portion of that $6.3-billion fiscal stimulus package passed in the House of Commons on Nov. 28.

“The balance and then some is expected before long to keep Canadians from the polls a bit longer,” she said.

The stimulus package is the price the Liberals are paying to retain the support of the New Democratic Party and avert losing a no-confidence vote. But Young thinks the NDP is pushing for even more spending.

Article content

Advertisement 3

Article content

She said the Liberals may add $15 billion in net new spending in the fiscal update while “mostly” adhering to the fiscal guardrails it erected in the spring budget.

“We would find it incredulous if the government were to blow through its own near-term fiscal anchors within a year of setting them as recent economic conditions outperform against expectations,” she said.

In the 2024 budget, Finance Minister Chrystia Freeland pledged — as proof of the government’s fiscal discipline — that government spending would not breach a $40.1-billion deficit in 2023-24.

Recently, however, the Parliamentary Budget Officer warned that the government has likely blown past its own limits. But there are plenty of reasons for the Liberals to hold their “fiscal firepower” in the update.

For example, incoming United States president Donald Trump‘s threatened 25 per cent tariffs on all Canadian goods entering the U.S. are a growth buster.

“The impacts of a second Trump presidency are largely unknowable, but biased to the downside for Canada under most scenarios,” Young said, estimating that the uncertainty that is the president-elect’s hallmark could shrink the Canadian economy by 0.7 per cent over his term. A long-term tariff war could be “multiples worse.”

Advertisement 4

Article content

In an effort to deal with these threats and Trump’s other demands, Young said the Liberals could move up a plan to spend two per cent of gross domestic product (GDP) on defence to 2030 from 2032, at a cost of tens of billions of dollars.

“Spending now risks crowding out strategic investments down the road,” she said.

The budget’s GDP outlook is also clouded by “homegrown” uncertainty around population growth.

“This would call for heightened caution in setting out a fiscal plan,” Young said, adding that a “one percentage point shock to real GDP could erode the budgetary balance by some $25 billion over five years before accounting for any discretionary spending.”

Sign up here to get Posthaste delivered straight to your inbox.

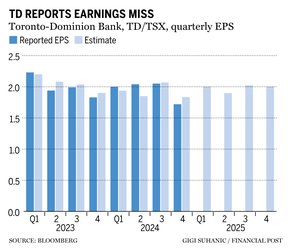

Toronto-Dominion Bank has suspended its medium-term financial targets as it looks to undergo a “broad and detailed” review of its strategies, weeks after being sanctioned in the United States for failing to monitor money laundering activities.

As a result of the strategic review, TD on Thursday said it would be “challenging” to generate earnings growth, so it suspended its targets of seven per cent to 10 per cent earnings per share growth and 16 per cent return on equity. It will update the targets in the second half of 2025.

Advertisement 5

Article content

“We are looking at our business mix, including profitability and risk-adjusted return on capital, and where we need to invest and divest to improve. Everything is on the table,” Raymond Chun, TD’s chief operating officer who is set to succeed current chief executive Bharat Masrani next year, said on a conference call with analysts to discuss the bank’s fourth-quarter results. — Naimul Karim, Financial Post

Read the full story here.

- Today’s data: The U.S. Labor Department and Statistics Canada release jobs numbers for November.

- Earnings: BRP Inc., Laurentian Bank of Canada, Canadian Western Bank

Recommended from Editorial

-

The great wealth transfer might not be all it’s cracked up to be

-

Profit and investment plunge signals trouble for Corporate Canada

Advertisement 6

Article content

Markets are betting on a quarter-point cut to the Bank of Canada’s policy rate next week, which means the prime rate should fall to 5.70 per cent for the first time in more than two years. That’s the good news, writes MortgageLogic.news strategist Robert McLister. The bad news is the leading variable rate discounts from prime are shrinking. Find out more about the best rates for mortgages here.

Hard Earned Truth

In an ongoing series about what the next generation needs to know to build wealth, we offer another hard earned truth: Good debt can boost investment wealth, but beware its bad twin.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Read them here

Financial Post on YouTube

Visit Financial Post’s YouTube channel for interviews with Canada’s leading experts in economics, housing, the energy sector and more.

Today’s Posthaste was written by Gigi Suhanic, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at [email protected].

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Comments