Financial Insights That Matter

In December 2024, Texas resident Frank Richard Ahlgren III was sentenced to two years in prison and to pay $1,095,031 in restitution to the United States. Ahlgren was sentenced for an array of tax crimes, including: (a) filing false tax returns related to the sale of $4 million in bitcoin (BTC) that resulted in substantial capital gains; (b) using the sale’s proceeds to purchase a residence; (c) filing a false tax return in 2017 that inflated the price he originally paid for the BTC, underreporting his capital gains, and; (d) failing to report sales of BTC in 2018 and 2019 of more than $650,000 on his tax returns.

The above exhibit is a photograph of the house Ahlgren purchased in Park City, Utah with the proceeds from his BTC sales.

Below, we’ll take a closer look at the case’s significance, analyze how funds moved, and consider the case’s implications for crypto tax investigations with an on-chain nexus.

A precedent-setting case for tax violations

Ahlgren’s conviction and sentencing are meaningful not only for the magnitude of his crimes — the tax loss of which exceeded $1 million — but also because the case represents the first purely crypto-centric tax fraud case. As Lucy Tan, Acting Special Agent in Charge of the Internal Revenue Service-Criminal Investigation (IRS-CI)’s Houston Field Office said, “This case marks the first criminal tax evasion prosecution centered solely on cryptocurrency. As the prices for cryptocurrency are high, so is the temptation to not pay taxes on its sale. Avoid the temptation and avoid federal prison.”

Ahlgren’s tradecraft was varied and sophisticated, yet traceable

According to his sentencing memorandum, Ahlgren used varied and sophisticated tradecraft to conceal the true value of his gains and to obfuscate the flow of funds on-chain, such as the following:

- Moving BTC through multiple wallets: Ahlgren used a swapping service to convert more than 100 BTC in forked funds.

- In-person peer-to-peer (P2P) trades: Ahlgren met an individual in person to exchange approximately 13 BTC for cash, sales which he did not report on his tax return.

- Use of mixers: Ahlgren also used CoinJoin mixers, as well as the popular mixer Wasabi Wallet. Interestingly, as early as 2014, Ahlgren blogged about the anonymity of the Bitcoin network, boasting about the ability to conceal transactions using crypto mixers and eliminating any doubt as to his awareness of his tax violations.

- Other concealment efforts:

- Ahlgren lied to his accountant, stating that he did not have any reportable crypto transactions in order to conceal his gains.

- Ahlgren structured cash deposits to conceal money from crypto transactions. Structuring, often referred to as ‘smurfing,’ refers to making deposits below a certain threshold to avoid triggering reporting requirements.

- In 2018, Ahlgren sold approximately 38 BTC (then worth $398,000) for gold bars to hold the value of some of his crypto.

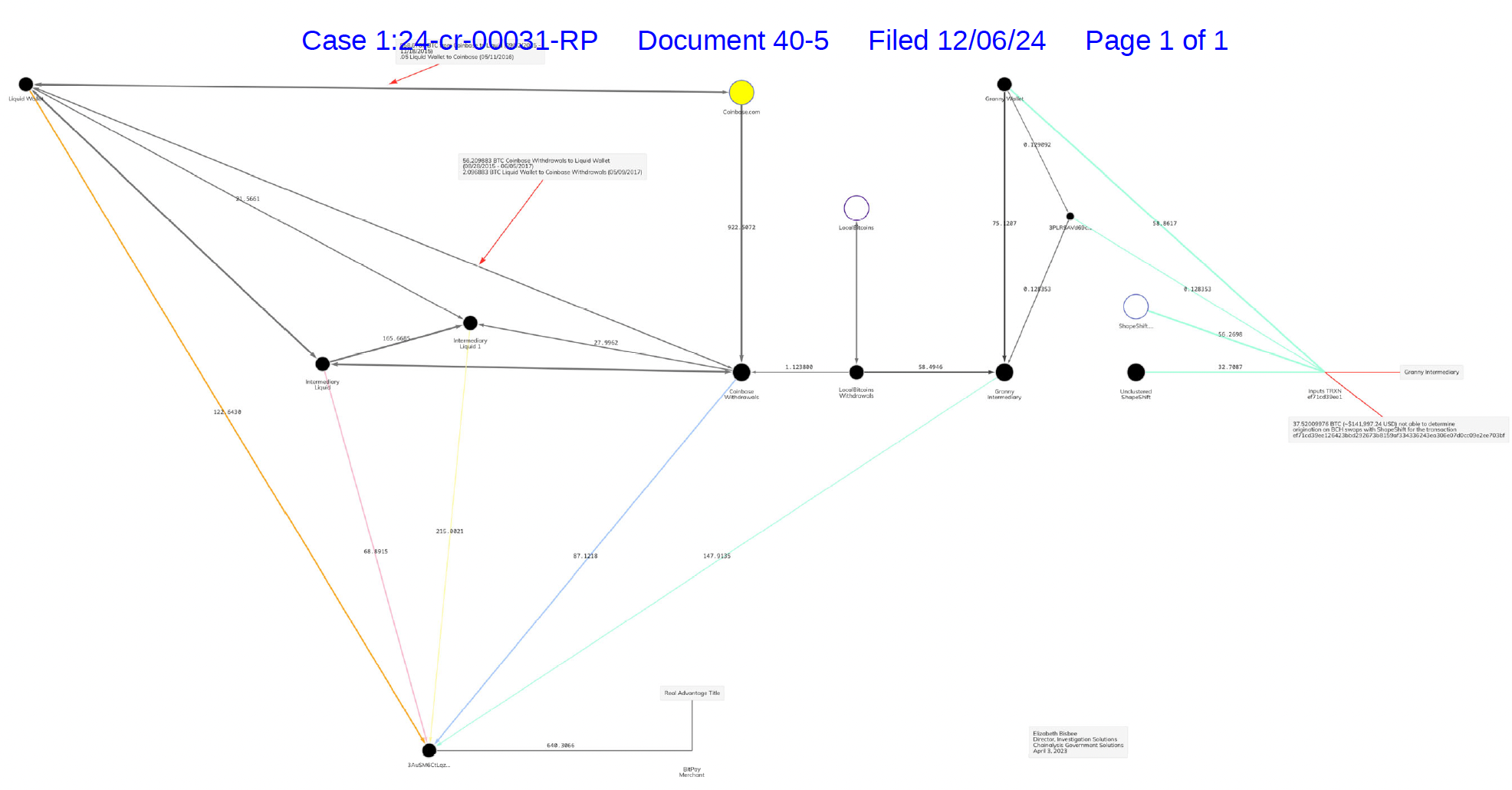

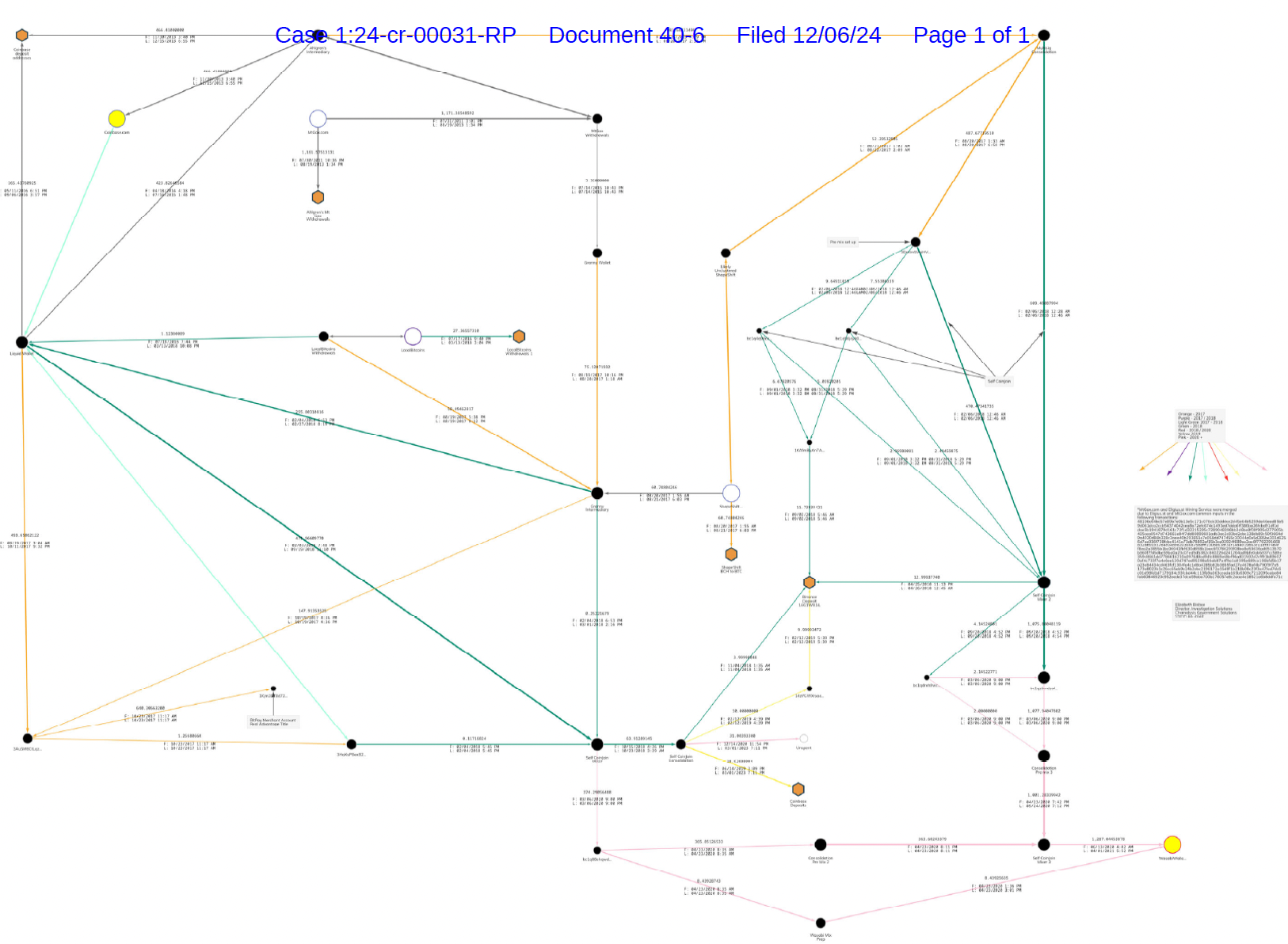

The below exhibits from the prosecution illustrate how Chainalysis experts were able to trace the flow of Ahlgren’s funds using Chainalysis Reactor.

Leveraging Chainalysis, IRS investigators traced the transaction flow from inception to disposition, identifying details such as dates, valuations, and transactional counterparties. This process allowed IRS-CI and Civil to piece together a complex web of crypto activity. The IRS obtained transactional records from multiple exchanges, as well as blockchain data, to cross-reference records provided by Ahlgren.

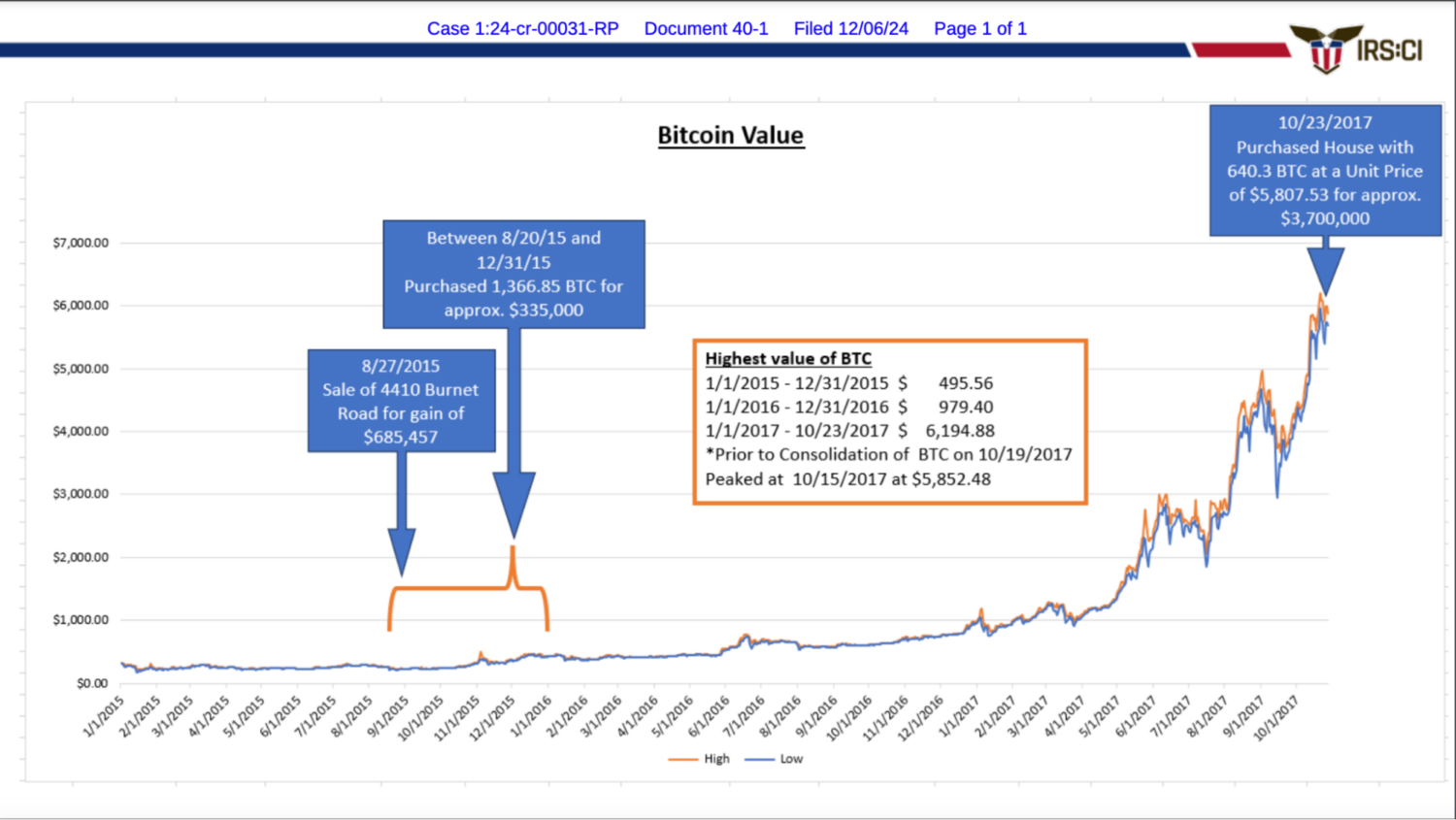

Chainalysis’ expert analysis provided a sequential flow of funds across numerous wallets, assisting in confirming timestamps and valuations. In 2015 — when BTC’s highest value was approximately $495.56 — Ahlgren purchased approximately 1,366 BTC. In 2017, he sold approximately 640 BTC (then worth approximately $5,807.53 per unit) for a total of approximately $3.7 million. To offset the substantial gains on the BTC he sold to purchase his Park City house, Ahlgren filed a return that falsely inflated his cost-basis of the BTC to falsely lower his tax liabilities.

The below chart, leveraging Chainalysis data, shows Ahlgren’s BTC and real estate transactions against the backdrop of BTC’s rise in value over time. With the price of BTC now at historic highs, this case illustrates the power of leveraging on-chain data with off-chain events as a stark reminder to those attempting to conceal their asset gains.

Through the compilation of records and data, along with Chainalysis’ expert report, IRS computed the taxable events based on the IRS digital assets guidance. This close collaboration highlights how Chainalysis can empower the IRS to effectively navigate the complexities of cryptocurrency transactions to ensure equitable tax computations.

Ahlgren case another landmark for Chainalysis prosecutorial support

The Ahlgren case — which IRS-CI included in its 2024 annual report — has meaningful implications not only for the IRS in the United States, but also globally. Although Ahlgren thwarted the authorities for a time from performing some calculations, his conviction and sentencing illustrate how on-chain tax evasion is traceable and has real-world consequences. Beyond the IRS, the case also represents a significant win for the Department of Justice and justice ministries worldwide. A Chainalysis expert provided an expert report and consulting, which not only supported the prosecution, but also resulted in successful sentencing. This is yet another example of Chainalysis providing prosecutorial support, as it did in last year’s landmark Bitcoin Fog case and the 2022 Felton case.

Case portends increased capabilities to combat on-chain tax violations

The Ahlgren case demonstrates the IRS’s ability to effectively pursue complex on-chain crimes, even well after the fact. This includes not only violations stemming from illicit income, such as money laundering proceeds, but also those stemming from legal income, such as tax evasion, falsified or unfiled returns, and/or tax basis cases where investors take measures to hide their capital gains.

IRS-CI is the U.S. Government’s only federal law enforcement agency focusing on all issues relating to tax, including money laundering and Bank Secrecy Act issues. Of its approximately 3,500 employees worldwide, around 2,300 are special agents. IRS-CI investigates potential criminal violations of the Internal Revenue Code and related financial crimes to foster confidence in the tax system and compliance with the law. The IRS is the only federal agency that can investigate potential criminal violations of the Internal Revenue Code.

IRS-CI’s investigation into Ahlgren’s activity simultaneously exemplified its sophistication on crypto investigations and how it is increasing its technological capabilities through close partnerships with companies like Chainalysis.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with the use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.

#1a73e8;">Boost Your Financial Knowledge and Achieve Stability

Discover a growing online community dedicated to delivering financial news, tips, and strategies designed to help you manage money effectively, save smarter, and grow your investments with confidence.

#1a73e8;">Top Financial Tips for Saving and Investing

- Personal Finance Management: Master the art of budgeting, expense tracking, and building a strong financial foundation.

- Investment Opportunities: Stay updated on market trends, learn about stocks, and explore secure ways to grow your wealth.

- Expert Money-Saving Advice: Access proven techniques to reduce expenses and maximize your financial potential.