Cash News

Michael Lewis, the financial journalist who wrote a controversial book about the downfall of Sam Bankman-Fried, says the former crypto kingpin’s crime “still makes no sense.”

Bankman-Fried was sentenced to 25 years in prison in March after being convicted of a colossal fraud in which he stole $8 billion of customers’ deposits from his FTX cryptocurrency exchange. Going Infinitethe book that Lewis wrote about Bankman-Fried and the collapse of FTX, was published on the day that jurors were selected for SBF’s trial in October 2023.

At the time of the book’s release, some reviewers criticized Lewis—the author of hugely successful works including The Big Short and Moneyball—for being overly sympathetic to Bankman-Fried, with a Guardian review going so far as accusing him of having developed an “misguided soft spot” for his protagonist.

Lewis pushed back at the time, telling Time that he felt as though he was addressing a “mob.” “Lord knows the very easy, lazy thing to do right now would be to throw Sam under every bus you could, and try to make him seem as bad as possible, because people respond to that,” he said. “But it just wouldn’t be true. It’s not the character I knew. It’s not the situation I knew.”

On Tuesday, The Washington Post published an essay by Lewis in which he continues to wrestle with the character of Bankman-Fried in light of his conviction. Lewis writes that he “still found him interesting” after the trial, saying there remained “messy bits about his case” which made it difficult to categorize like him other famous frauds.

“If he knew he’d orchestrated a giant fraud, why had he devoted so much time and energy to persuading U.S. financial regulators to regulate him? Why hadn’t Sam squirreled away a pile of money in some secret account for himself?” Lewis writes in the essay, which is adapted from the upcoming paperback edition of Going Infinite. “Why hadn’t he followed every other shady crypto dude and fled to Dubai? The answers to these questions were irrelevant to his legal fate. They just cluttered the neat picture lots of people seemed to want to paint of him.”

Lewis also pointed to bankruptcy court filings from FTX in the weeks after Bankman-Fried’s sentencing showing that “against the $8.7 billion in missing customer deposits, FTX was now sitting on something like $14.5 to $16.3 billion.”

“Whatever the exact sum, it was enough to repay all depositors and various other creditors at least 118 cents on the dollar—that is, everyone who imagined they had lost money back in November 2022 would get their money back, with interest,” Lewis writes.

“All the money and more has been found, and it’s not clear whether the people who were most outraged at the outset feel differently,” he added. “The people who have made a living selling into the outrage don’t seem much affected.”

Lewis later remarked on the “strange fact” that no one “guessed Sam’s crime before the market exposed it,” unlike in the case of Bernie Madoff—the late financier behind the biggest Ponzi scheme in history.

“There is a reason for this, I think: The crime made no sense,” Lewis writes of Bankman-Fried’s wrongdoing. “It still makes no sense. The crime was unnecessary to the business in a way that, say, Bernie Madoff’s was not (which is why people guessed Madoff’s crime before it was exposed).”

Lewis added that even though he thinks there are ways Bankman-Fried’s crime “might have been avoided,” that “doesn’t mean I think that Sam Bankman-Fried is innocent.”

The “truth” of Bankman-Fried, as Lewis sees it, is “closer to ‘young person with an intellectually defensible but socially unacceptable moral code makes a huge mistake in trying to live by it’ than ‘criminal on the loose in the financial system.’”

Lewis’ essay comes after the subject of another of his books publicly criticized the effect the book had on him.

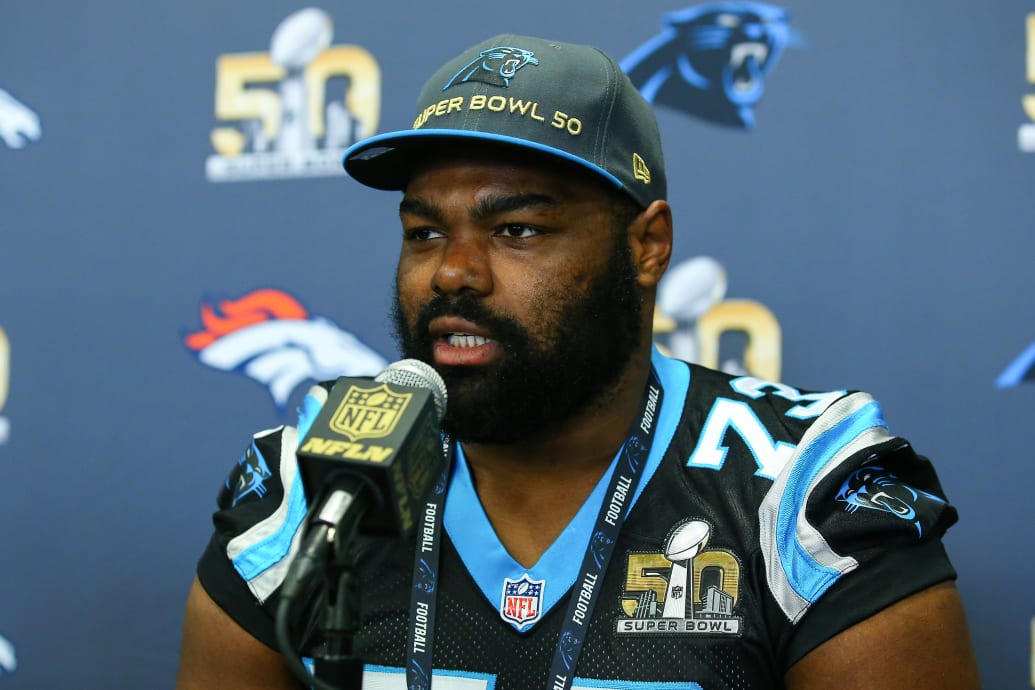

Rich Graessle/Corbis/Icon Sportswire via Getty

Michael Oher, the former NFL star whose story featured in Lewis’ 2006 book The Blind Sidetold The New York Times he felt the book cost him a higher draft position and therefore higher pay by leading people to believe he was stupid. Oher said that impression only grew when the movie adaptation of the book was released three years later.

Oher is now suing Sean and Leigh Anne Tuohy, the couple who took him in during high school, alleging they lied about adopting him while exploiting his story for their own financial benefit.

Speaking to the TimesLewis said the Tuohys “did not steal” Oher’s movie money and defended the couple generally, asserting there’s “not a whiff of possibility the Tuohys are going to milk money off Michael Oher.”

He also responded to claims that certain parts of his book were inaccurate by saying “he was confident that the people who witnessed Oher’s story in real time had provided him with an accurate account,” according to the Times.