CashNews.co

Image source: Getty Images

Demand for FTSE 250 shares has risen sharply in 2024 thanks to the improving UK economic outlook. This pickup probably isn’t a surprise. Around 60% of the index’s earnings come from Britain.

The UK’s second-most-prestigious index has consequently risen around 7% in value in the year to date, pushing valuations higher. But don’t be mistaken, there are still many great bargains for investors to go hunting for.

Buying cheap shares has two significant advantages. Undervalued stocks can deliver stunning capital appreciation over time as the market wises up to their cheapness and share prices soar.

Value shares also provide investors with a margin of safety. If a company suddenly experiences adverse conditions, the scale of share price losses can be far more limited.

With this in mind, here are two cheap FTSE 250 shares to consider buying today. I’ve also taken a look at a value-focused exchange-traded fund (ETF), which could be an effective way for investors to manage risk.

Solar star

The threat of higher-than-normal interest rates means property and infrastructure companies like NextEnergy Solar Fund (LSE:NESF) remain ultra cheap.

This particular investment fund — which owns more than 100 renewable energy assets mainly in the UK — trades at a 20.2% discount to the estimated value of its assets.

With it also carrying a huge 10.5% forward dividend yield, I think it’s too cheap to ignore.

While they’re not without risk, renewable energy stocks like this have terrific long-term potential. As the climate emergency worsens, demand for their power should rapidly increase. This makes NextEnergy worth serious consideration, and especially at current prices.

Bank on great value

Bank of Georgia Group (LSE:BGEO) offers an excellent blend of low earnings multiples and bulging dividend yields.

For 2024, the emerging markets bank has a price-to-earnings (P/E) ratio that sits at 3.6 times. Its price-to-earnings growth (PEG) ratio of 0.1 sits comfortably inside the value benchmark of 1 and under. Finally, its forward dividend yield’s 6.5%.

Bank of Georgia shares carry more risk than usual as civil unrest in the country picks up. But I think the potential benefits of owning the FTSE 250 share may well outweigh the dangers.

This was underlined by recent financials that showed adjusted pre-tax profit up 11% in the second quarter. Banking product demand continues to soar as Georgia’s economy rapidly grows.

A top ETF

Investing in a value-focused ETF can carry fewer risks than buying individual stocks like those above. I’ve opened a position in the Xtrackers MSCI World Value UCITS ETF (LSE:XDEV) in recent sessions.

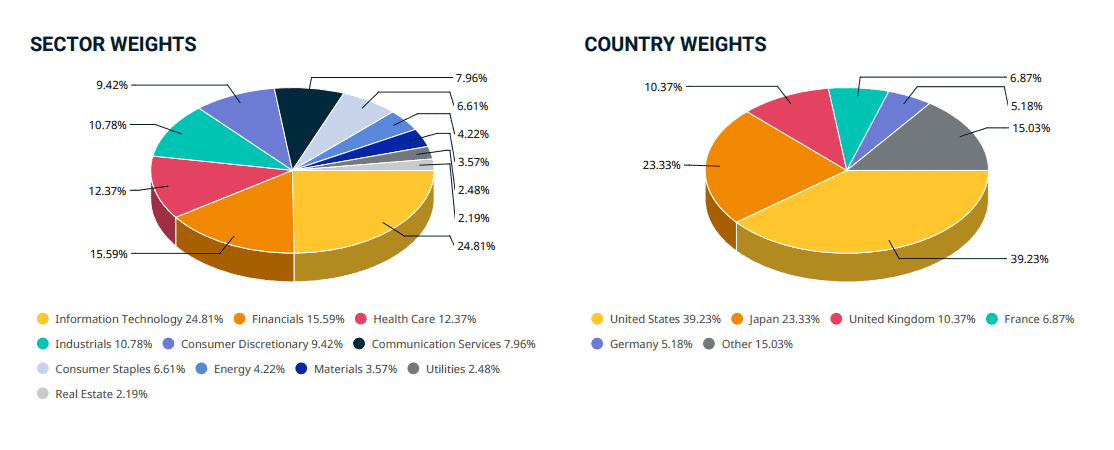

This fund — which tracks the performance of the MSCI World Enhanced Value Index — provides exposure to 400 large-to-mid-cap companies in 23 developed countries. As the graphic below shows, it gives investors a high level of diversification.

With an annual fee of 0.25%, this Xtracker fund’s one of the cheapest of its kind too.

Exposure to tech stocks like Cisco Systems and Intel could see it outperform during tough economic times. But, on balance, I think this will prove to be a top stock to own over the long term.