CashNews.co

Artificial intelligence has dominated the stock market since early last year. The Invesco QQQ Trust ETF (NASDAQ: QQQ)a popular technology-leaning exchange-traded fund (ETF), has been arguably one of the best stocks for AI-focused investors. The ETF tracks an index of 100 prominent companies trading on the Nasdaqoffering investors instant diversification.

In other words, you don’t have to pick specific AI stocks; buy the Invesco QQQ instead and wait for the winners to rise to the top. The ETF has outperformed the broader market for years.

However, technology stocks felt a recent jolt; a burst of market volatility created one of the sharpest sell-offs in recent memory. While the market has rebounded somewhat since then, there could easily be more turbulence ahead as the election approaches and recession worries cloud the horizon. It’s a departure from the relatively smooth ride investors have enjoyed.

No, it doesn’t feel good when stock prices drop, but here are two reasons this recent sell-off is actually beneficial over the long term.

1. A sell-off can reel in valuations

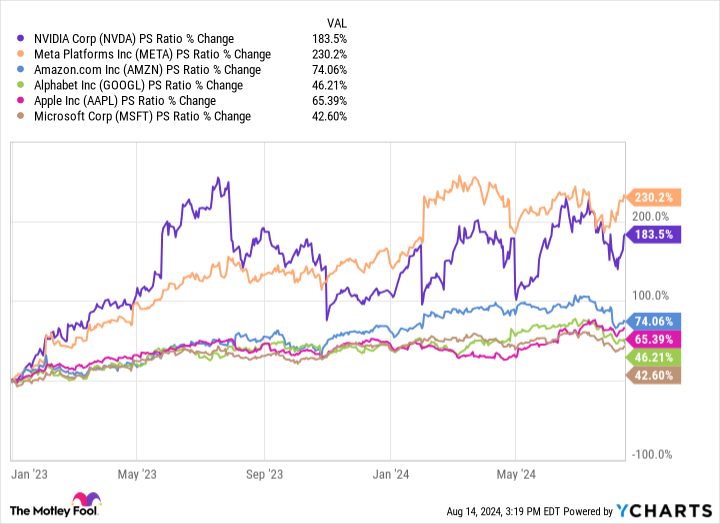

The past 18 months have been remarkable for AI stock investors. The Invesco QQQ is up a whopping 78% since January 2023. A handful of large technology companies, the “Magnificent Seven” stocks, have helped drive these returns, but their share prices are rising faster than the underlying businesses are growing. Below, you can see that the price-to-sales ratios for this group have increased tremendously since the AI craze started in January 2023:

These six stocks, Nvidia, Microsoft, Apple, Amazon, Meta Platformsand Alphabetcombine for roughly 40% of the Invesco QQQ. They may have helped lead the ETF higher, but it can go both directions.

Excellent companies often command higher valuations, but stocks can get riskier the higher these valuations rise. Crashes can happen when valuations set impossibly high expectations, and then something happens that sends investors running for the exits. That’s not to say that big technology stocks (and the Invesco QQQ by extension) are at that point, but the sell-off is healthy because it can reel valuations back in and lower these risks.

2. It’s great for dollar-cost averaging

As much as some might try to tell you, nobody can truly predict what the stock market will do. Trying to time buying and selling in the stock market is equivalent to throwing darts blindfolded.

That’s why dollar-cost averaging is a great investment strategy. Instead of trying to guess, investors buy stocks slowly and often over extended periods. That could mean buying every week, month, or however you feel is best for your budget. Sometimes, you’ll buy when the price is up or down, but the goal is to average out to somewhere in between. Your investment won’t be at the absolute bottom, but it prevents you from buying at the worst possible time.

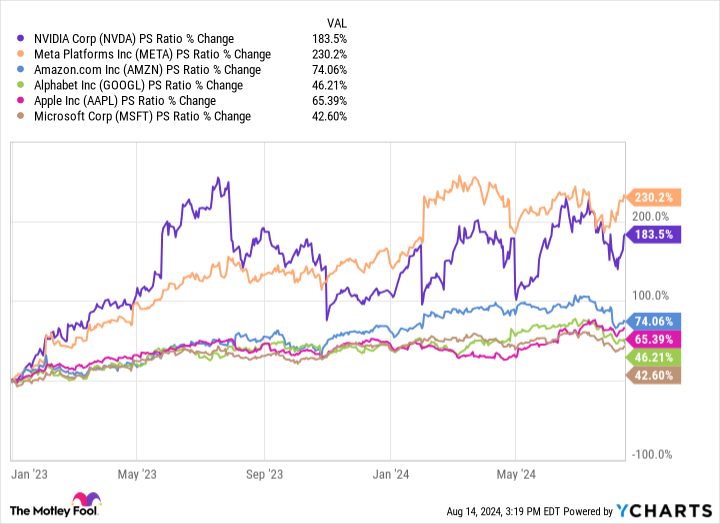

The Invesco QQQ has risen steadily for the past 18 months. Outside of the recent sell-off, the ETF has only dropped 10% or more from its high once, and that was a short-lived dip back in 2023:

Those with a dollar-cost average strategy have bought at increasingly higher prices for the past 18 months. A sell-off is an opportunity to acquire cheaper shares and maybe even lower your average cost. An old investing cliche says the stock market is the only place people run out of the store when items go on sale. The Invesco QQQ is a top-notch technology ETF that is a strong choice for any AI-focused investor. If you’re investing in a bright AI future, welcome a sell-off with a smile and open arms.

Should you invest $1,000 in Invesco QQQ Trust right now?

Before you buy stock in Invesco QQQ Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Invesco QQQ Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $763,374!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 12, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

2 Reasons the Invesco QQQ ETF Sell-Off Is Good for AI-Focused Investors was originally published by The Motley Fool