CashNews.co

KEY POINTS

- Brazil’s SEC is the first worldwide to have approved a spot Solana ETF

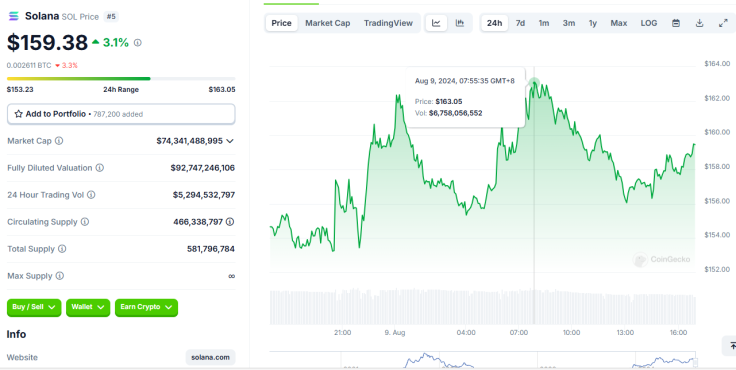

- $SOL’s price broke above $163 at one point Thursday after word spread about the milestone

- The US SEC is yet to approve VanEck’s application for a Solana ETF

Brazil is now the world’s leader in spot Solana ($SOL) exchange-traded funds (ETFs) as it became the first country to give the green light to a $SOL ETF. The news pumped the cryptocurrency’s price in the last 24 hours, giving hope to the community that other crypto ETFs will soon become a reality.

Brazil’s SEC OKs SOL ETF

The Brazilian Securities and Exchange Commission (CVM), on Wednesday, approved the country’s first Solana ETF by QR Asset, local Exame first reported. The ETF will be managed by Vortx, but still has to be approved by Brazil’s stock exchange, B3, before it goes live.

The ETF will track the CME CF Solana Dollar Reference Rate, which is a benchmark established by CF Benchmarks and the Chicago Mercantile Exchange (CME).

“This ETF reaffirms our commitment to offering quality and diversification to Brazilian investors. We are proud to be global pioneers in this segment, consolidating Brazil’s position as a leading market for regulated investments in crypto assets,” said Theodoro Fleury, QR Asset’s manager and chief investment officer, as per a Google translation.

$SOL surges

As the crypto industry picked up the news, Solana prices surged. Data from CoinGecko showed that from trading at around $154 Thursday, the token spiked above $163 at one point before retreating to $159 as of early Friday. The crypto token increased by over 3% in the last 24 hours and has been up by over 10% in the past month.

CoinGecko

Brazil’s crypto market

It is safe to say that Brazil is ahead of some countries in terms of managing and approaching the crypto industry. The Brazilian Senate approved the “Bitcoin law” back in 2022 to establish regulations for the country’s digital assets space, marking a historic milestone in the Brazilian crypto industry.

Brazil’s central bank also continues to work on crypto regulation with public consultation, stating earlier this year that it has been consulting with stakeholders to ensure that the regulatory framework will address issues not covered by the Bitcoin law.

Where does the US stand?

The United States, being the world’s economic leader, is closely watched by other countries for its crypto-related decisions, especially after the very successful launch of U.S. spot Bitcoin ETFs. After the launch of Ethereum ($ETH) ETFs, Ripple CEO Brad Garlinghouse said other crypto ETFs are now inevitable.

Investment management firm VanEck filed with the U.S. SEC late in June for the country’s first spot Solana ETF. The Wall Street regulator is yet to approve the fund.