CashNews.co

Calamos Investments is hoping to give financial advisors what they want with the new Calamos Laddered S&P 500 Structured Alt Protection ETF (CPSL)which invests in ETFs that provide 100% downside protection in exchange for upside caps on performance.

CPSL, which starts trading Monday, Sept. 9, will debut with four underlying ETFs, but the holdings will expand to 12 as Calamos rolls out a full slate of downside protection funds that have 12-month maturities.

Calamos, based in Naperville, Ill., is tapping into the growing appeal of buffered and defined outcome ETFs that have been described as “Boomer Candy” for their popularity among investors looking to maintain equity market exposure while benefiting from some downside protection.

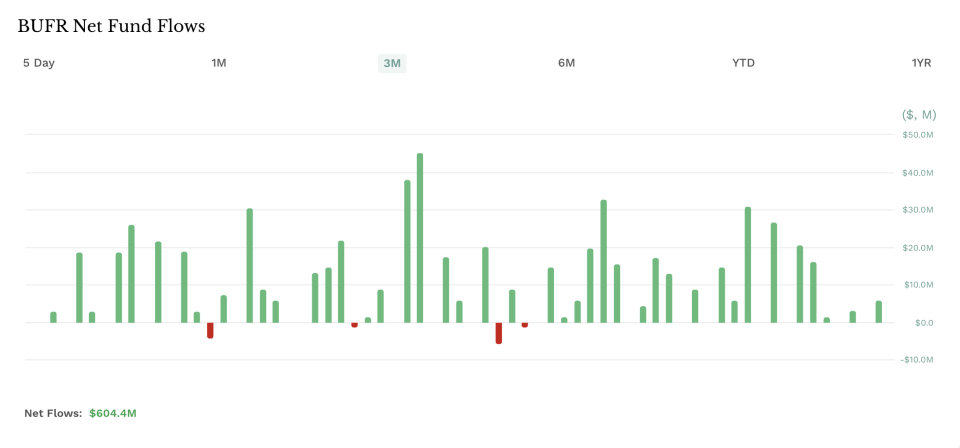

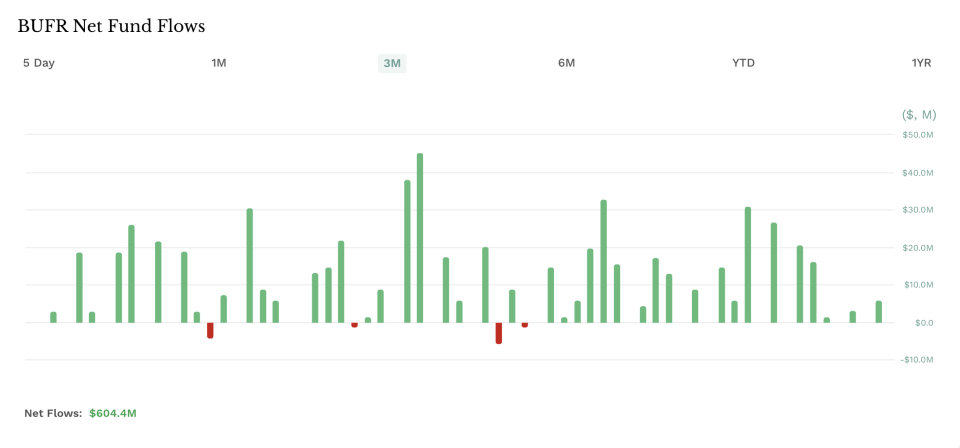

CPSL is similar to the wildly popular $5 billion FT Cboe Vest Fund of Buffer ETF (BUFR), which is a fund of buffer ETFs that offer various levels of downside protection.

CPSL’s Use for Multiple Portfolios

CPSL invests only in ETFs that offer 100% downside protection, but because of the laddered nature of the underlying ETFs, its downside protection will not be 100%.

According to Matt Kaufman, head of ETFs at Calamos, a three-year rolling back test of the strategy showed a maximum peak-to-trough drawdown of 1.9%, which compares to 23.9% for the S&P 500 Index and 16.4% for the U.S. Aggregate Bond Index over the same period.

Kaufman said the appeal among financial advisors is the ability to use CPSL in model portfolios and across multiple client portfolios without having to worry about rolling into new defined outcome ETFs as they mature every 12 months.

“This gives you laddered exposure to all the S&P 500 defined outcome ETFs in the marketplace,” he said. “And you end up with a remarkably similar experience to what you would get by directly owning the underlying ETFs.”

Nate Geraci, president of The ETF Store in Overland Park, Kans., recognizes how a fund like CPSL can help advisors “manage the timing risk associated with implementing these strategies.”

Advisors and investors can simply buy a single ticker to access a series of 100% downside protection ETFs, which could make these more attractive from an ease-of-use perspective,” he added.

That is exactly the point Calamos is betting on with CPSL.

“Some advisors like to use a single month for the 100% downside protection with exact upside cap,” said Kaufman. “But others are looking for a single ticker solution.”

Permalink | © Copyright 2024 etf.com. All rights reserved