CashNews.co

In a volatile market environment, the steady cash flows and reliable dividends offered by energy infrastructure stocks hold significant appeal for investors. The Alerian Energy Infrastructure ETF (ENFR) is a great way to invest in a basket of these reliable stocks.

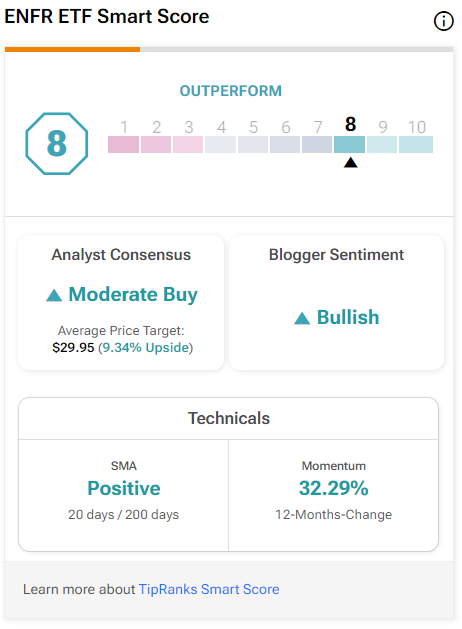

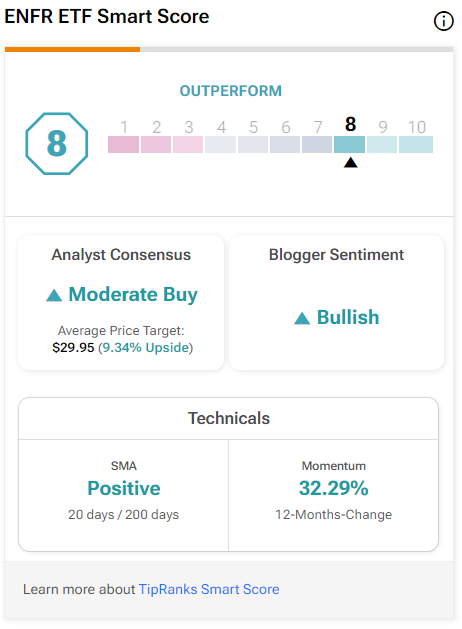

I’m bullish on the ENFR ETF based on its attractive dividend yield of 4.9%, the stability of the energy infrastructure stocks that it owns, and its improving performance in recent years. Plus, the ETF and its underlying holdings receive high marks from TipRanks’ proprietary Smart Score system, as we’ll discuss further in this article.

What Is the ENFR ETF’s Strategy?

According to the fund’s sponsor, “ENFR provides exposure to energy infrastructure companies and holds a broad portfolio of corporations and Master Limited Partnerships (MLPs) listed in the US and Canada.”

While the fund invests in both countries, the United States accounts for the majority of its portfolio with a weighting of 74.1%.

One key difference between the fund and its sister fund, the Alerian MLP ETF (AMLP), is that ENFR invests in both corporations and MLPs (master limited partnerships, a popular form of entity in the world of energy infrastructure companies that come with certain tax benefits), whereas AMLP invests exclusively in MLPs.

These midstream energy infrastructure companies include oil and gas pipelines that charge energy companies a fee for moving oil and gas through their pipelines. They can also include energy storage facilities and processing plants.

These types of businesses are attractive to income investors because they operate like toll roads, charging a flat fee for pipeline usage, which provides them with steady cash flow and makes them less vulnerable to fluctuations in energy prices. Furthermore, many of these companies are earning fees from projects that are already built and do not need to invest as much in new projects.

These factors give them steady, predictable streams of income that allow them to focus on returning capital to their shareholders via dividends and share repurchases.

ENFR Offers Above-Average Dividend

With its diverse portfolio, ENFR ETF provides investors with an appealing 4.9% dividend yield, significantly surpassing the 1.3% yield of the S&P 500 (SPX) and the 3.8% return on 10-year Treasury bonds.

Interest rates have already started to moderate from their 2023 peak, and many market observers believe that we will soon be in a lower-rate environment with the Fed expected to cut interest rates this fall. If this comes to fruition, ENFR’s 4.9% yield could become even more attractive.

Further, ENFR’s yield is higher than that of other popular energy ETFs like the Energy Select Sector SPDR Fund (XLE), which currently yields 3.3%. That’s because an ETF like XLE also includes upstream energy companies (explorers and producers) that may feature lower dividend yields but could potentially offer more growth potential.

A Basket Approach

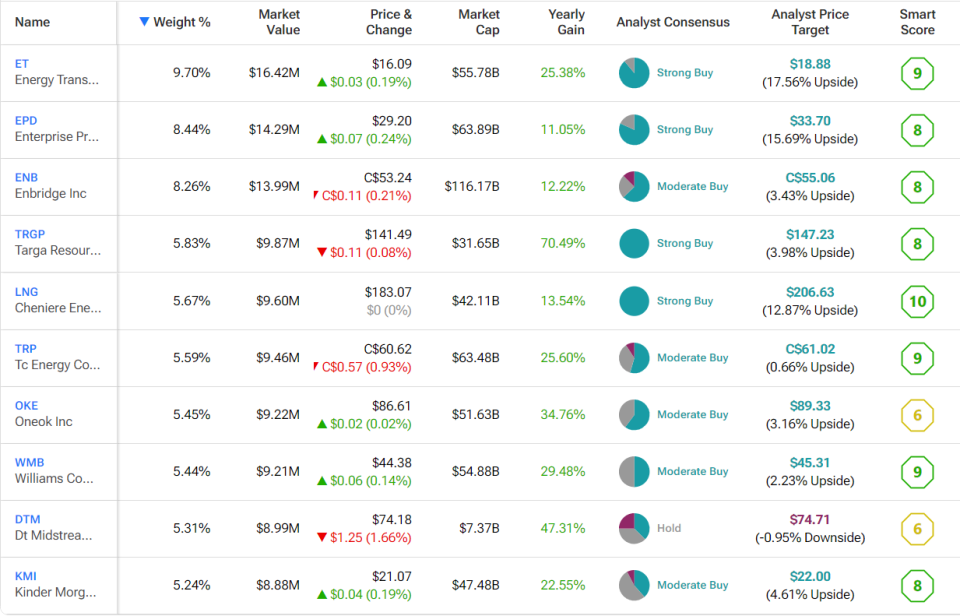

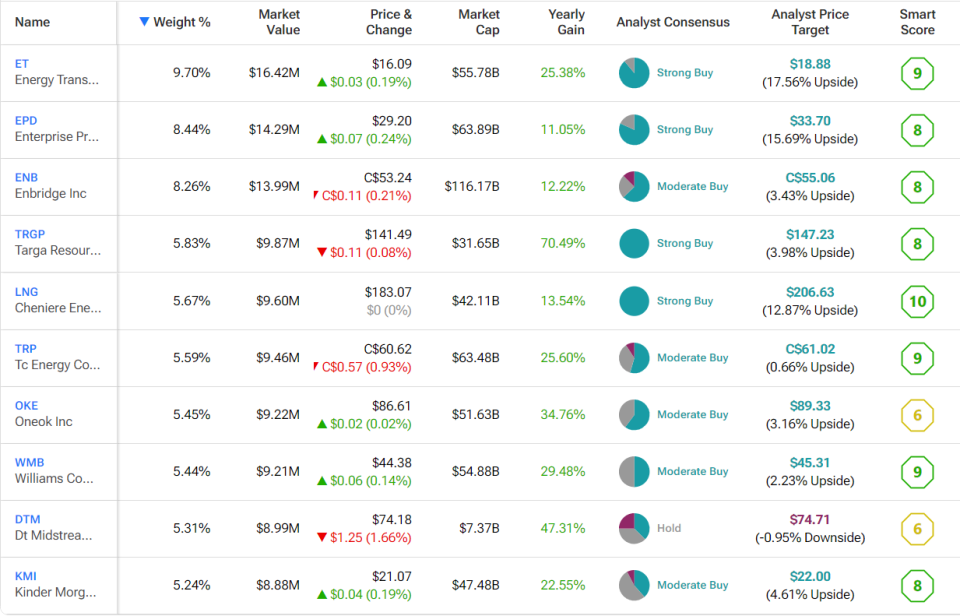

As a targeted play on energy infrastructure, ENFR is not particularly diversified. It holds 25 stocks, and its top 10 holdings make up 65.1% of its portfolio.

However, it does offer investors diversification by holding a basket of these top energy infrastructure stocks, which can generate income from multiple sources. This strategy is attractive compared to owning a single MLP or midstream stock, as it helps mitigate risks associated with individual stocks, such as operational issues or unexpected dividend cuts.

Below, you’ll find an overview of ENFR’s top 10 holdings using TipRanks’ holdings tool.

As you can see, ENFR’s top 10 holdings include well-known energy infrastructure players, such as Enterprise Products Partners (EPD), and Kinder Morgan (KMI).

One thing many of these stocks have in common is that they feature a strong collection of Smart Scores.

The Smart Score is a quantitative stock scoring system created by TipRanks. It gives stocks a score from one to 10, based on eight key market factors. Scores of 8, 9, or 10 are considered equivalent to an Outperform rating. The score is data-driven and does not involve any human intervention.

An impressive eight out of ENFR’s top 10 holdings feature Outperform-equivalent Smart Scores of 8 or above, and the ETF itself features an Outperform-equivalent ETF Smart Score of 8.

Surprisingly Strong Performance

At one point in time, these types of stocks (and ETFs like ENFR) had a reputation for offering tempting dividend yields but underperforming overall.

For example, ENFR’s total annualized return over the past 10 years of 3.6% (as of July 31) admittedly looks fairly underwhelming and is drastically worse than that of the broader market.

But don’t write the fund off because of this alone. ENFR has shown significant improvement recently, with its total annualized return rising to 11.2% over the past five years (as of July 31). In the past three years, the fund’s performance has been even more impressive, boasting a total annualized return of 16.6% (also as of July 31).

As you can see, ENFR’s performance has been on an upward trajectory, and while it previously lagged behind the broader market over the past five and ten years, it has been narrowing the gap. In fact, over the past three years, ENFR has outperformed the Vanguard S&P 500 ETF (VOO), which returned 9.5% annually (as of July 31), with ENFR delivering an impressive 16.6%. Additionally, ENFR has excelled over the past year, with a 31.3% gain compared to the S&P 500’s 17.8%.

This indicates that investors are beginning to see the value of these types of stocks and ETFs, and that they are worth a fresh look if you haven’t checked them out in a while.

How Much Does ENFR Charge?

It’s also worth noting that ENFR charges a fairly reasonable expense ratio of 0.35%. This means that an investor in the fund will pay $35 in fees on a $10,000 investment annually.

This is more expensive than some larger index ETFs, but it is also lower than many other ETFs out there, including ENFR’s sister fund, AMLP, which charges a much higher fee of 0.85%.

Is ENFR Stock a Buy?

Turning to Wall Street, ENFR earns a Moderate Buy consensus rating based on 21 Buys, six Holds, and zero Sell ratings assigned in the past three months. The average ENFR stock price target of $29.65 implies 7.4% upside potential from current levels.

Worth a Fresh Look

I’m bullish on ENFR based on its attractive 4.9% dividend yield, its portfolio of highly-rated energy infrastructure companies, and its strong recent performance. The ETF has not only closed the gap with the broader market but has also significantly outperformed it over the past three years.

For investors who haven’t looked at MLPs, energy infrastructure stocks, and ETFs in a while, it’s time for a fresh look. ENFR offers an effective way to invest in this sector.

Disclosure