CashNews.co

Richard Drury

Thesis

The Simplify Market Neutral Equity Long/Short ETF (EQLS) is an equity exchange-traded fund from the Simplify family that came to market mid-2023. We started covering the name at the beginning of 2024, highlighting the fund structure and mechanics while stating the following:

At the end of the day, the strategy is very much dependent on the portfolio manager acumen, and in reality it contains two risk factors via the two chosen names.

In today’s article we are going to check-in on the fund and its performance and set-up since our coverage began, and highlight why EQLS has been a laggard so far in its cohort.

A poor 2024 so far

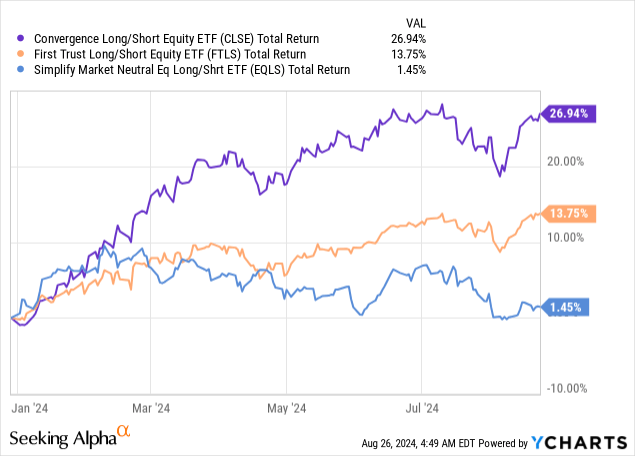

Long/short funds concurrently buy and short pairs of stocks, with the intent to maximize the upside and limit the downside via going long undervalued equities and shorting overvalued ones. As stated in the original article, this hedge fund type strategy is very much dependent on the portfolio manager acumen, and can be quantified via performance:

We have run the above analysis using total return as a metric since EQLS distributes a high dividend. We are going to touch upon that analytic a bit later in the article.

As can be observed from the above chart, we are comparing the fund with the Convergence Long/Short Equity ETF (CLSE) and with the First Trust Long/Short Equity ETF (FTLS). EQLS is the laggard in this cohort, barely being up for the year, while CLSE has outperformed.

The differences in performance are actually quite staggering, with EQLS almost flat for the year after a good first few months, whereas CLSE is up an astounding 26%.

Short Defensives, Long Tech

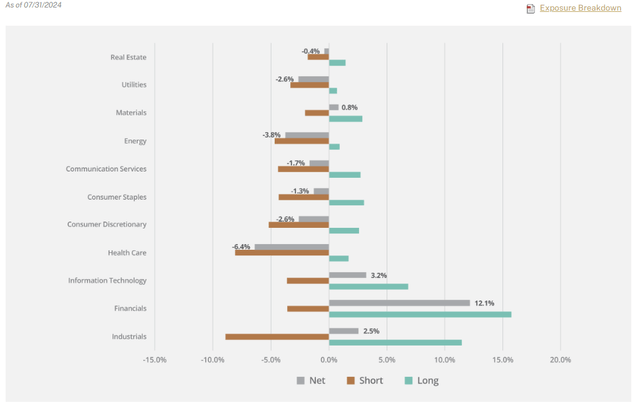

One of the reasons that can explain the underperformance can be found in the sector breakdown that’s present on the manager’s website:

Long / Short / Net Positions (Manager Website)

The fund is net short defensive sectors such as Utilities and Health Care, while net long Information Technology and Financials. Please note that the above chart presents both long, short and net exposures for each sector. Financials, for example, have a long position of 16%, a short position of roughly -4%, for a net of +12.1%.

While we do not know the individual stock positioning in each sector, we can have a look at overall net sector performance for the year to get a sense of how the strategy has performed roughly:

- The utilities sector via XLU is up +19% for the year

- The health care sector via XLV is up +14% for the year

- The information technology sector via XLK is up +16% for the year

- The financials sector via XLF is up +18% for 2024

By doing a rough estimation using sectoral performances and fund reported long/short positioning, we can see why the name is flat for the year. Defensives are up significantly in 2024, trouncing, in some instances, tech performance. Utilities have had a very strong performance via lower rates and the AI revolution, which is projected to generate a significant demand for electric power going forward, thus benefitting utility providers.

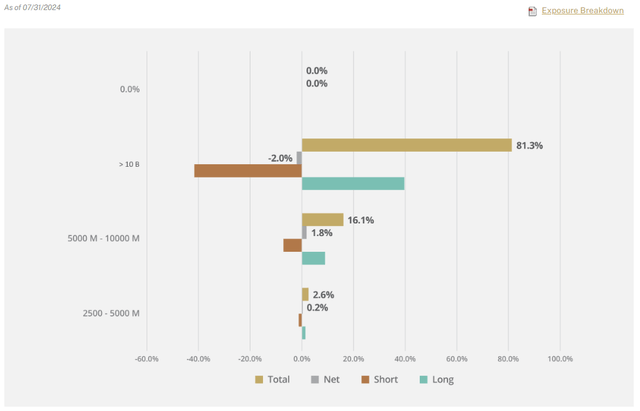

The ETF has numerous breakdowns on its website that provide a flavor for what it does, but does not include the individual pair name relationships. We can see from the parsing provided that the fund usually focuses on large capitalization names:

Cap size (Fund Website)

Most of the relationships entered are for companies with market capitalizations above $10 billion.

Yield analytics

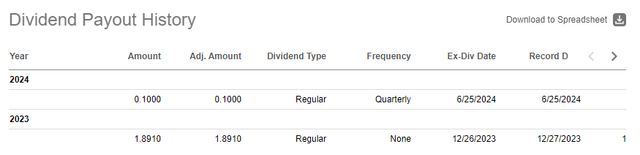

Although it is an equity fund, the vehicle uses total return swaps for its portfolio rather than hold the equities outright, and has started to pay a quarterly dividend:

Dividend (Seeking Alpha)

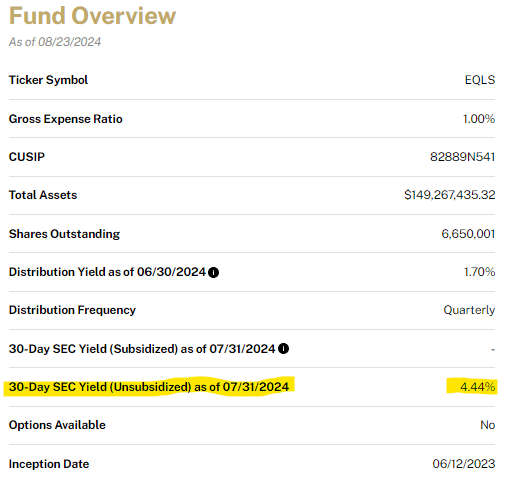

As per its own website, the dividend results in a 30-day SEC yield in excess of 4%:

Fund Overview (Fund Website)

Given the high dividend yield for an equity fund, our return analysis was run using the total return figure rather than just price in order to incorporate the high fund yield.

What is next for EQLS

In finance, there is a very well-known saying that states, “The trend is your friend”. For this hedge fund strategy, the main risk factor lies in the algorithm utilized by the portfolio manager to pick and choose which names to go long and which ones to short. So far, in 2024 the trend has not been a friend for this name.

The fund was positioned aggressively via shorts in defensives and longs in tech and financials, positions which did not play out as expected. While the ETF is not down for the year, it has failed to produce substantial results. We unfortunately expect more of the same for the rest of 2024, with the current trend of sub-par results to continue.

An investor needs to keep in mind that the allocation is dynamic here, and the fund manager can change at any time the positions and pairs it utilizes as their views move in a different direction. However, we have seen from the above charts that more established managers in the long/short space have been able to correctly capture market relationships and enter into more advantageous pair trades.

Conclusion

EQLS is a long/short equity fund from Simplify. The name came to market in mid-2023 and has experienced a quasi-flat 2024, despite its peers posting very robust results. The ETF has suffered from being short defensive names versus long tech and financials, with the pair relationships posting weak results. The fund has started to pay a quarterly dividend that is on the high side at 4.4%, but its appeal should reside with a high total return derived from long/short relationships. This fairly new ETF has not convinced so far, highlighting that the algorithm used by the manager to identify overvalued versus undervalued names is not competitive when benchmarked against its peers. We are on hold for now given the necessity to get a full year of analytics, but the trend is not a friend of this name.