CashNews.co

Overview of the Recent Transaction

On August 30, 2024, FMR LLC (Trades, Portfolio) executed a significant transaction by acquiring 2,234,437 shares of Fidelity Enhanced Mid Cap ETF (FMDE), priced at $31.485 per share. This addition increased FMR LLC (Trades, Portfolio)’s total holdings in FMDE to 6,557,582 shares, representing a substantial 11.21% of the firm’s portfolio in this ETF. The trade reflects a strategic move by FMR LLC (Trades, Portfolio), aligning with its investment philosophy and market outlook.

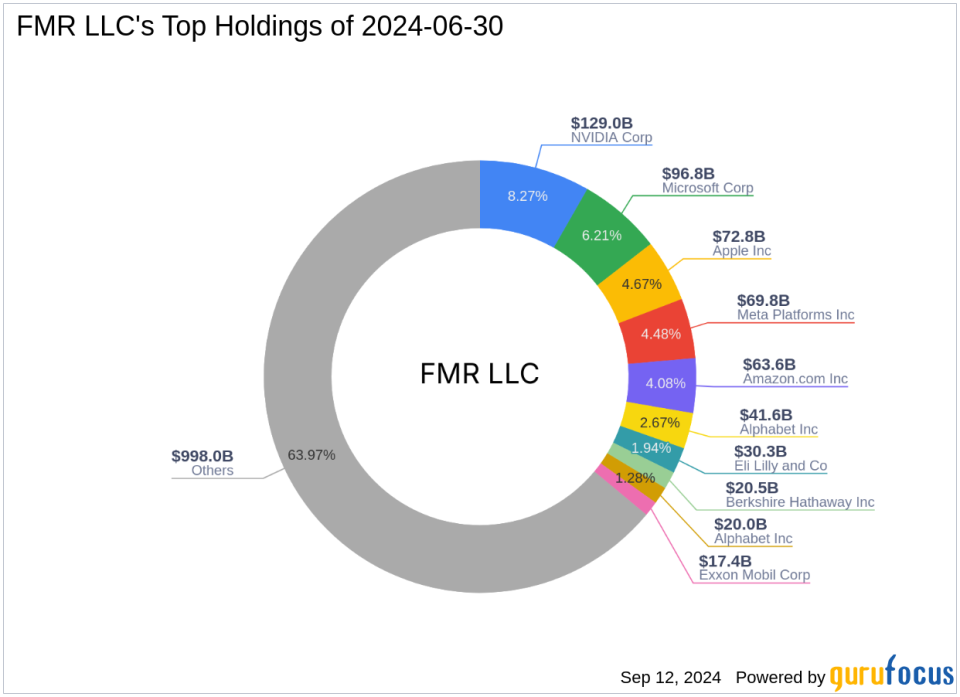

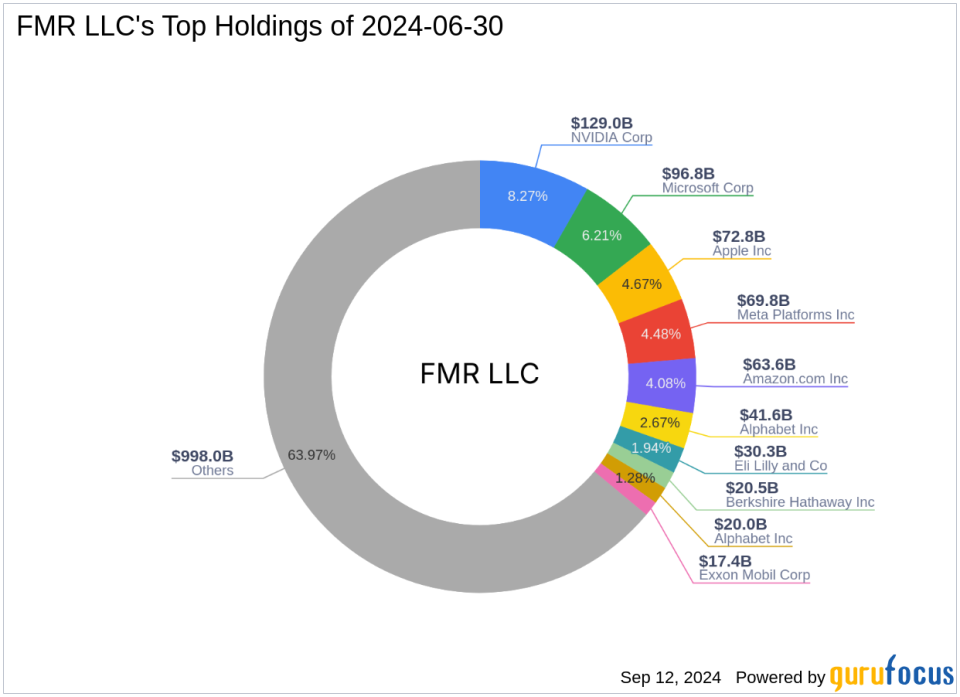

Profile of FMR LLC (Trades, Portfolio)

FMR LLC (Trades, Portfolio), founded in 1946 by Edward C. Johnson II, has grown from a bold mutual fund company into a global financial powerhouse. Under the leadership of various Johnson family members, the firm has pioneered numerous financial products and services, achieving significant milestones such as the creation of the world’s largest mutual fund. Today, FMR LLC (Trades, Portfolio) manages assets totaling $1,559.92 trillion, with a strong focus on technology and healthcare sectors. The firm’s top holdings include giants like Apple Inc (NASDAQ:AAPL) and Amazon.com Inc (NASDAQ:AMZN).

Investment Philosophy of FMR LLC (Trades, Portfolio)

FMR LLC (Trades, Portfolio)’s investment strategy is deeply rooted in innovation and meticulous research, aiming to identify stocks with substantial growth potential. This philosophy is evident in the firm’s recent acquisition of FMDE shares, suggesting a calculated bet on the mid-cap sector’s growth prospects.

Introduction to Fidelity Enhanced Mid Cap ETF (FMDE)

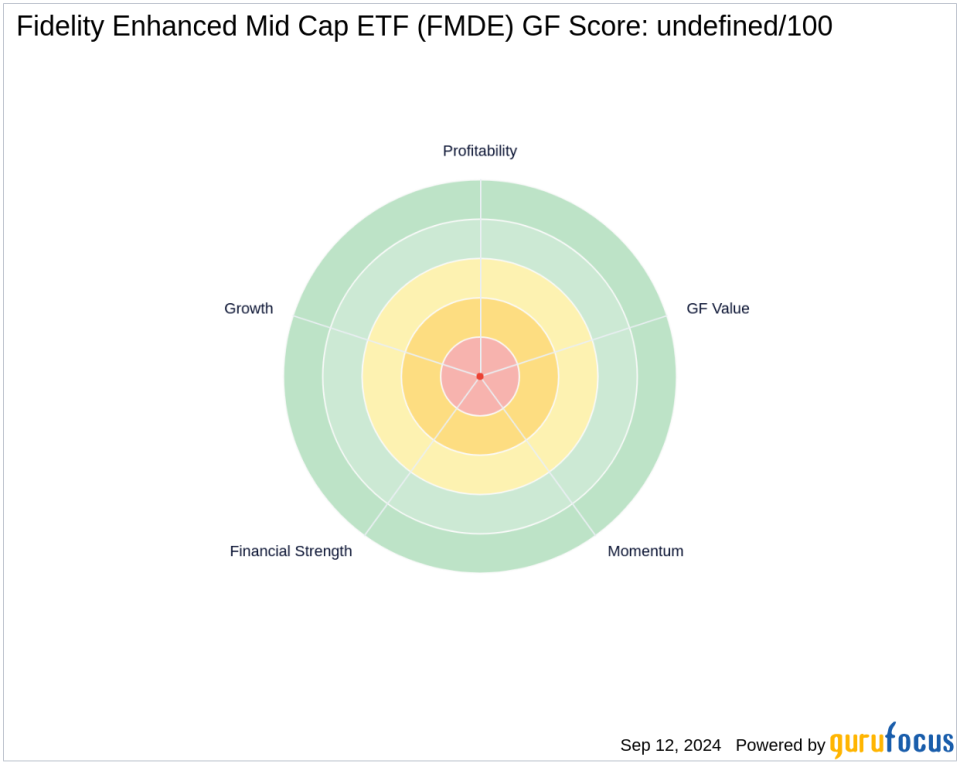

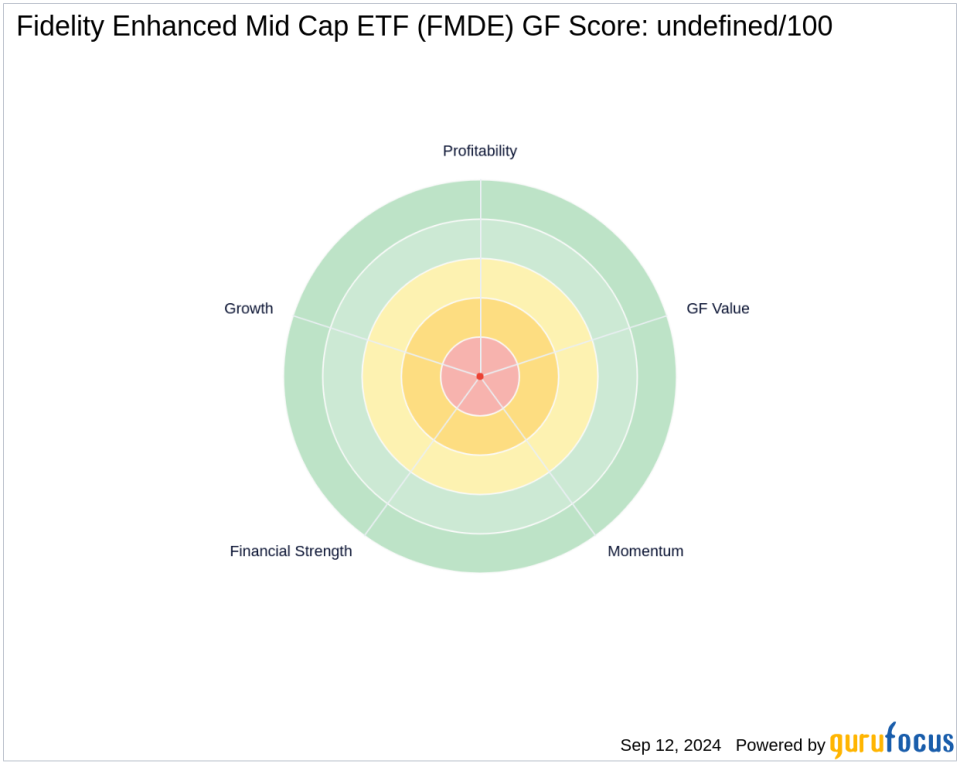

Fidelity Enhanced Mid Cap ETF, symbol FMDE, is a notable player in the financial market with a market capitalization of $1.87 billion. The ETF currently trades at $30.58, slightly below its recent transaction price, and has a PE ratio of 17.21. Despite a year-to-date increase of 12.47% in its stock price, FMDE shows a promising GF Score of 82/100, indicating good potential for outperformance.

Analysis of the Trade’s Impact

The acquisition by FMR LLC (Trades, Portfolio) significantly bolsters its position in FMDE, making up 0.01% of its total portfolio. This move is strategic, reflecting the firm’s confidence in the mid-cap sector’s value and growth prospects. The trade’s timing and scale suggest a bullish outlook for FMDE’s market performance and alignment with FMR LLC (Trades, Portfolio)’s long-term investment strategy.

Market Performance and Strategic Importance of FMDE

FMDE has shown a robust performance with a 22.08% increase since its IPO and a 12.47% rise year-to-date. The ETF’s strong GF Score and rankings in Growth, Profitability, and Momentum support FMR LLC (Trades, Portfolio)’s decision to increase its stake, anticipating further growth and profitability in the evolving market landscape.

Conclusion

The recent transaction by FMR LLC (Trades, Portfolio) to increase its holdings in Fidelity Enhanced Mid Cap ETF underscores the firm’s strategic investment approach and its optimism about the mid-cap sector’s potential. This move aligns with FMR LLC (Trades, Portfolio)’s history of pioneering investment strategies and its focus on sectors poised for significant growth. As the market continues to evolve, this acquisition could play a pivotal role in shaping FMR LLC (Trades, Portfolio)’s portfolio performance and market standing.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.