CashNews.co

Net inflows to globally listed crypto ETFs and ETPs reached a record $59.3 billion as of the end of July, according to data from London-based ETFGI, an independent research and consultancy firm.

The total dwarfs the previous high of $4.1 billion set in 2021. Assets in these products have climbed to $91.7 billion, representing a 506.4% increase from $15.1 billion at the end of 2023, the report said. Net inflows for crypto ETFs and ETPs totaled $13.7 billion in July, ETFGI said.

The report underscores investors’ growing demand for crypto-based funds and the impact of the U.S. Securities and Exchange Commission’s decision to approve the listing of spot bitcoin ETFs on Jan. 10. The first crypto-based ETPs only began trading in 2015, the report noted.

As of July 2024, there were 235 crypto ETFs and ETPs listed globally with 588 listings from 52 providers across 22 exchanges in 16 counties.

The growth in crypto ETF assets comes as the broader ETF industry continues to expand. ETFGI reported that assets invested in ETFs and ETPs listed globally reached a new record high of $11.4 trillion at the end of July.

Crypto ETFs Expand in 2024

In the U.S., spot bitcoin ETFs have generated $18.1 billion in inflows since their debut earlier this year, according to U.K. asset manager Farside Investors. Meanwhile, spot Ethereum ETFs, which began trading in July, have had $478 million in outflows, although the total reflects $2.5 billion in outflows from the Grayscale Ethereum Trust (ETHE). That fund differs from the other spot Ethereum funds because it is a conversion from an existing fund and carries the highest fee by far in this grouping, 2.5%. Ethereum funds are based on the price of ether, the token of the Ethereum smart contracts blockchain and second largest crypto by market value behind bitcoin.

Bitcoin was recently trading at about $62,000, off 2.4% over the past 24 hours. Ether was changing hands just below $2,600, off more than 4% since Monday, same time.

Read More: Bitcoin, Ethereum ETFs Dip, Despite Recent Crypto Gains

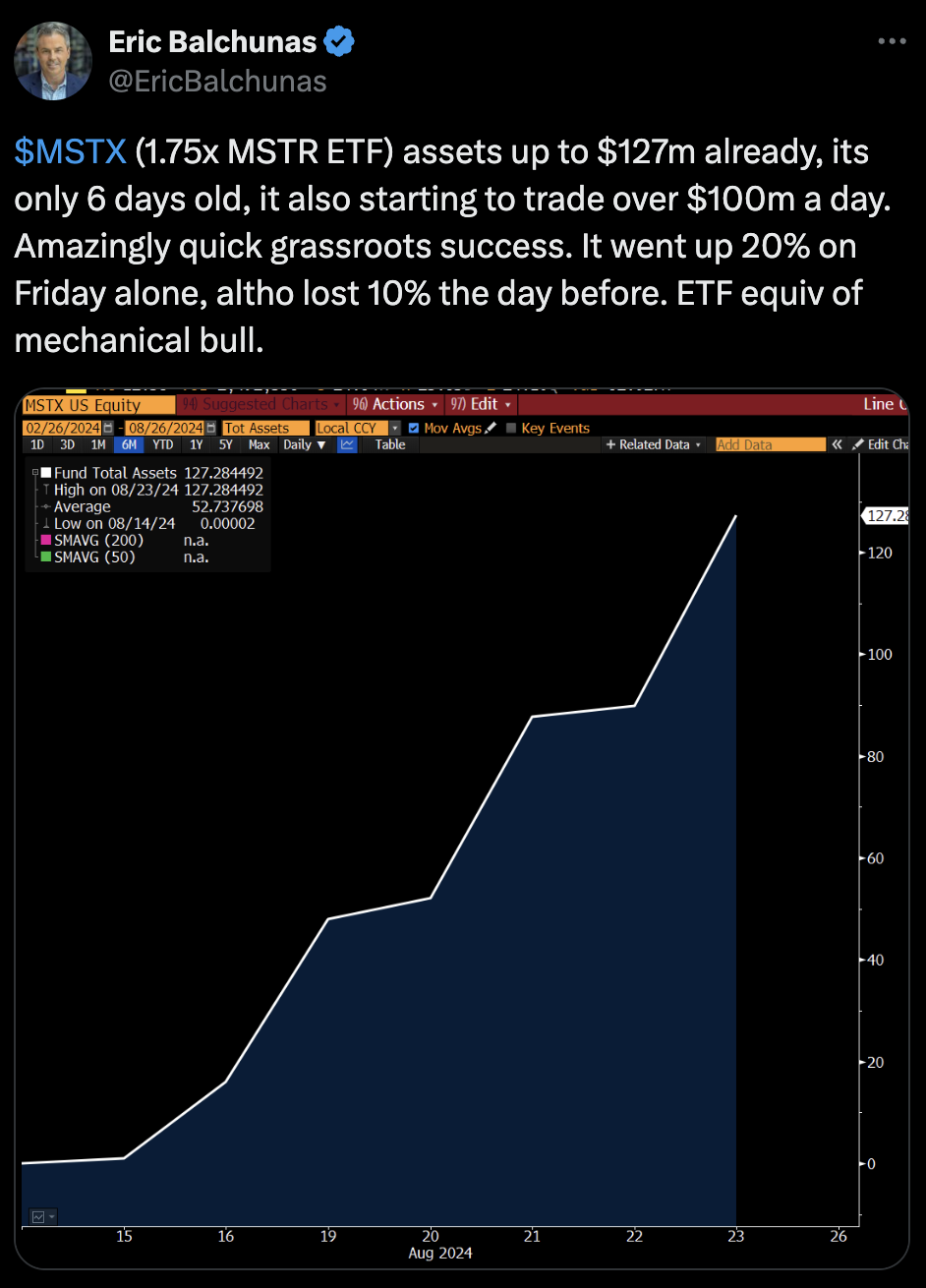

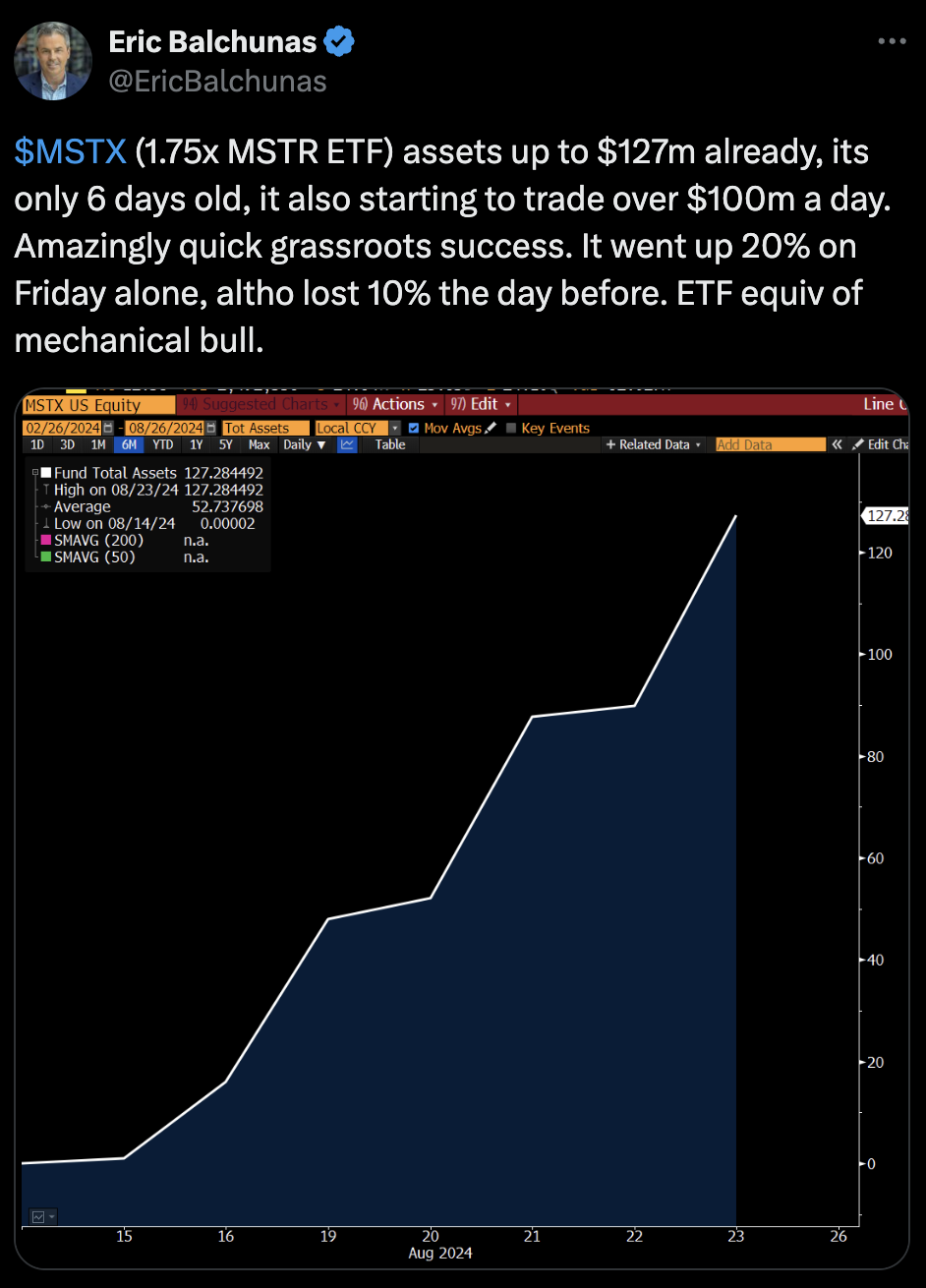

One standout performer in the crypto ETF space has been the Defiance Daily Target 1.75X Long MSTR ETF (MSTX)which seeks to deliver 1.75 times the daily percentage change in MicroStrategy’s share price. Software provider MicroStrategy has become one of the world’s largest holders of bitcoin after changing its focus to invest in the crypto.

MSTX has amassed $127 million in assets within just six days of its debut earlier this month, according to an X post from Eric Balchunas, senior ETF analyst at Bloomberg.

The ETF has been trading at over $100 million volume per day, demonstrating strong investor interest in MicroStrategy and bitcoin. On August 23, MSTX surged by 20% after a volatile week that included a 10% decline the previous day. Balchunas described the ETF as the “mechanical bull” of ETFs due to its high volatility and potential for significant short-term gains and losses.

Global ETF Market Shows Varied Growth

While crypto ETFs have seen rapid growth, other ETF markets are also evolving. In a separate report released by ETFGI today, the ETF industry in Japan gathered net inflows of $268.5 million in July, bringing year-to-date net inflows to over $6 billion.

The Japanese ETF market reached $588.5 billion in assets at the end of July, the second highest on record. The market totals 339 products with 361 listings from 15 providers on two exchanges.

Equity ETFs in Japan reported net outflows of $823.2 million in July, while fixed income ETFs received net inflows of $178.7 million, illustrating the different trends within ETF categories.

ETFGI’s managing partner Deborah Fuhr is a member of etf.com’s editorial advisory board.

Permalink | © Copyright 2024 etf.com. All rights reserved