CashNews.co

For the most part, if something can make my life easier, I will embrace it. That goes for house chores, traveling, investing, and many other things. One thing that has made investing much simpler and more straightforward is using exchange-traded funds (ETFs).

What used to take a large number of investments and lots of time can now essentially be done with a handful of investments. The stock market is full of thousands of ETFs, each with its own focus and value proposition. However, not all ETFs make sense for everyone. The key is finding the ETFs that match your investment style, goals, and risk tolerance.

The following two ETFs represent both ends of the spectrum for me — one I regularly invest in, and one I’ve been avoiding like the plague.

I’m loading up on this S&P 500 ETF

I consider one ETF the foundation of my stock portfolio: The Vanguard S&P 500 ETF (NYSEMKT: FLIGHT). It was one of my first investments and will likely always be my largest holding. The S&P 500 index, which this ETF tracks, is comprised of the 500 largest companies on the U.S. market, acting as a de facto representation of the U.S. economy. The economy and the S&P 500 don’t correlate directly, but they tend to move in the same direction long term.

For perspective, S&P 500 companies account for around 50% of U.S. corporations’ total profits. Those companies matter a lot, and that’s why I trust putting a sizable portion of my investments in this ETF and relying on the long-term growth of the U.S. economy.

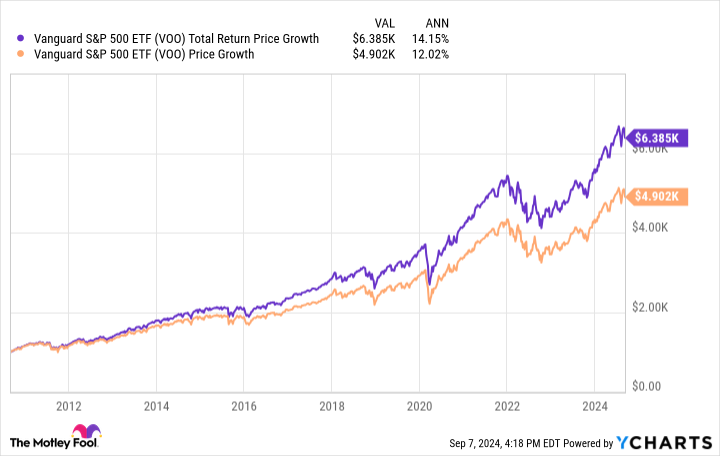

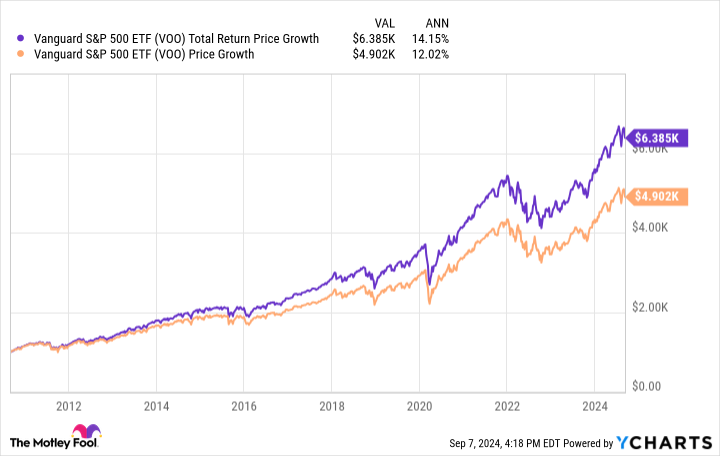

History has shown that leaning on an S&P 500 ETF is the right move for most people. Since it was created in September 2010, this ETF has averaged over 14% annual total returns. Every $1,000 invested then would be worth over $6,300 today.

There are no guarantees in the stock market. However, some investments have stood the test of time. This ETF falls into that category, which is why I’m comfortable using dollar-cost averaging and buying shares every two weeks. It takes a lot of the “work” out of investing.

The one ETF I’m avoiding right now

It pains me to say it, but the Vanguard Information Technology ETF (NYSEMKT: VGT) is the ETF I’m currently avoiding. It pains me because I love tech stocks, and the information technology (tech) sector has easily been the most rewarding over the last decade.

This ETF has even considerably outperformed the S&P 500 over the past decade, returning over 425% compared to the index’s 170%. That lets you know underperformance isn’t the issue. The issue is how much this 318-stock ETF relies today on just three companies.

|

Company |

Percentage of ETF |

|---|---|

|

Apple |

17.21% |

|

Microsoft |

15.83% |

|

Nvidia (NASDAQ: NVDA) |

14.07% |

Data source: Vanguard. Percentages as of July 31.

To be fair, these three companies are some of the best in the world. Still, three companies making up over 47% of the ETF is risky. It’s especially risky at a time when some experts (I use that term loosely) would agree that the stock market is at an elevated risk of a correction.

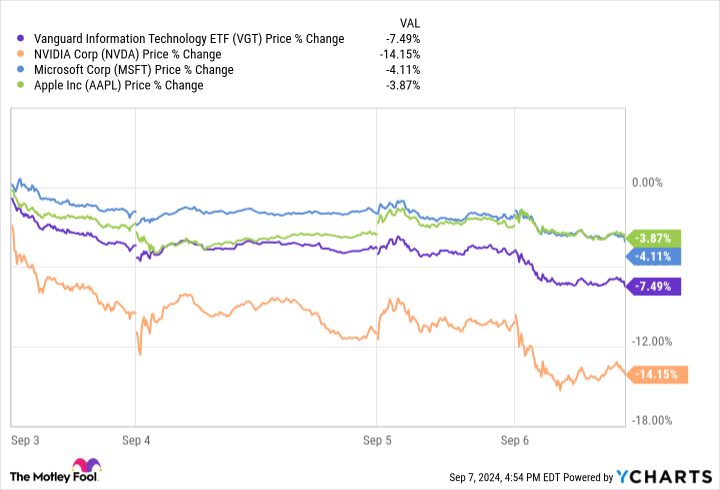

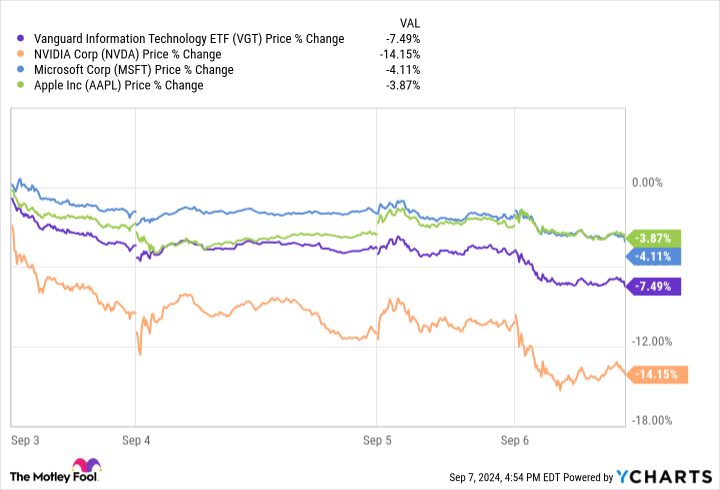

For perspective, let’s look at the four-day workweek after Labor Day, when all three companies finished the week down.

You can’t fully blame these three companies for the ETF’s drop, but you can definitely put a lot of the blame on them, since they make up almost half of the fund. The spark they give the ETF can also be the downer when things aren’t going well. And considering Nvidia lost over $400 billion from its market value in the above week — the most lost in a week by any company in U.S. history — things don’t always go well for even the best companies.

The same companies, with much less risk

I’m a fan of Apple, Microsoft, and Nvidia. This isn’t a direct knock on them, but more so on the high concentration of the Vanguard Information Technology ETF. Many of its top holdings are also in the Vanguard S&P 500 ETF, but with much less exposure and dependence.

Since the S&P 500 is the foundation of my stock portfolio, I try to be mindful of companies that overlap between ETFs. The tech sector already makes up over 31% of the S&P 500, with Apple, Microsoft, and Nvidia being the top three holdings. Adding a tech-specific ETF could make it a little too tech-leaning for my personal preference.

I’d much rather depend on broader economic growth than on sector-specific growth.

Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $662,392!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 9, 2024

Stefon Walters has positions in Apple, Microsoft, and Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Apple, Microsoft, Nvidia, and Vanguard S&P 500 ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Here’s 1 Vanguard ETF I’m Loading Up On and 1 I Wouldn’t Touch With a 10-Foot Pole was originally published by The Motley Fool