CashNews.co

jondpatton/E+ via Getty Images

I decided to re-engage with the bond market today by discussing the iShares 5-10 Year Investment Grade Corporate Bond ETF (NASDAQ:IGIB). My instinct tells me that some investors might get ahead of themselves by believing that lower implied interest rates will allow a conducive environment for risky assets. Although I understand the core argument, I think peripheral risk premiums must be considered.

Here are a few reasons why I favor shorter-term investment-grade bonds and the IGIB ETF, in particular.

What IS IGIB ETF?

The iShares 5-10 Year Investment Grade Corporate Bond ETF is an index-tracking fund that aims to invest in U.S. investment-grade bonds with maturities between five and ten years.

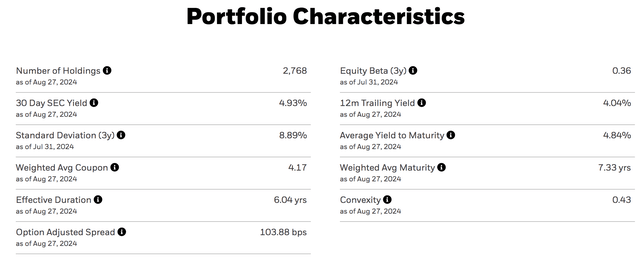

As illustrated below, the fund is broadly diversified, with exposure to more than 2,700 instruments. Moreover, the ETF has weighted average maturity of 7.33 years and an effective duration of 6.04 years, suggesting it has intermediate-term exposure.

Aside: Whenever I refer to “shorter-term exposure,” I mean exposure below ten years, not necessarily short-end exposure of one to five years.

iShares

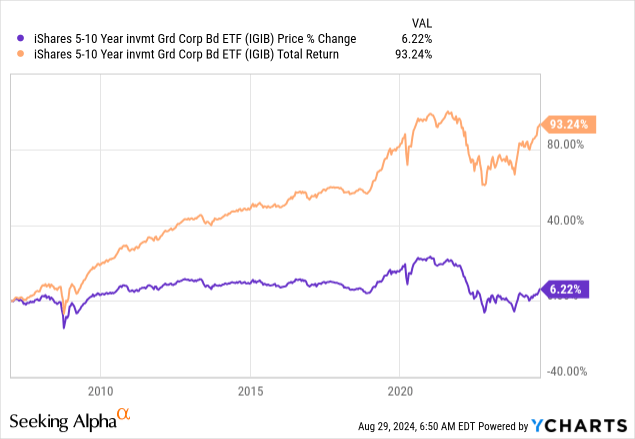

Furthermore, most of IGIB ETF’s returns derive from interest. Nevertheless, its price returns have experienced abrupt changes whenever interest rate volatility has emerged. For example, the ETF surged during the COVID-19 pandemic when interest rates were low.

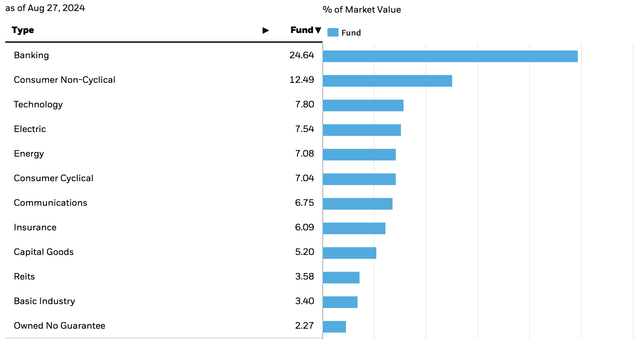

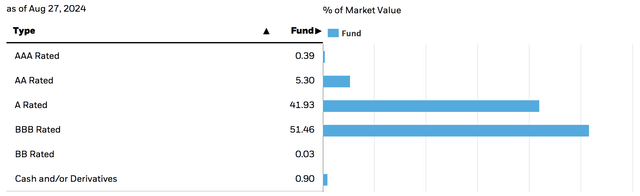

Lastly, here is the ETF’s sectoral and credit-quality breakdown. However, note that the IGIB ETF’s sectoral exposure might change over time.

Sectoral Exposure (iShares) Credit Quality (iShares)

Market Commentary

Let’s discuss a few market-based dynamics, including duration, convexity, and other bits.

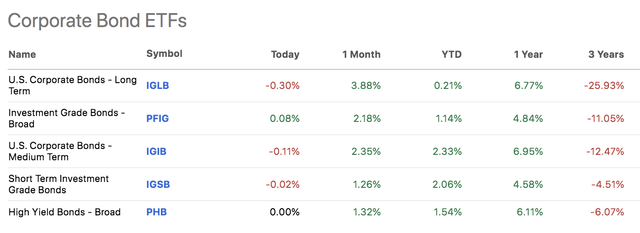

Investors have favored higher-quality, medium-term bonds in the past month. I highlight the past month because talks of an “interest rate pivot” have intensified.

U.S. Bond Returns (Seeking Alpha)

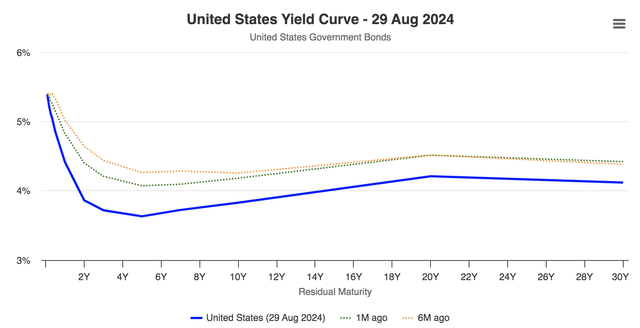

I’m unsurprised by the move toward intermediate-duration bonds, as I believe we might see a steepening on the yield curve. What’s my basis? Talks of an interest pivot paired with economic data such as higher unemployment, lower business confidence, and weaker manufacturing PMI numbers suggest that economic persistence might wane. As such, short- and intermediate-term implied interest rates might lower while longer-term rates steepen.

Why am I not bullish about short-term bonds? I am; kindly visit this link to see my outlook on short-term bonds.

U.S. Yield Curve (worldgovernmentbonds.com)

As seen below, U.S. investment-grade option-adjusted spreads are tight relative to what we have seen in the past years. ING Economic & Financial Analysis recently argued that spreads might stay tight. However, I think we will see a classic inverse relationship between the yield curve and spreads emerge, especially as economic persistence is doubtful.

Investment Grade OAS (St.Louis Fed)

How might the mentioned market-based variables impact the IGIB ETF?

Assuming my assumptions are correct, lower levels in the yield curve and an upward slope might spike the IGIB ETF’s price. I don’t think a concurrent rise in credit spreads will impact the ETF as it is an investment-grade vehicle instead of a high-yield fund. Although receding coupons might occur, I believe the ETF’s price gains will dominate proceedings.

I used IGIB ETF’s duration and convexity to estimate its potential price scenarios.

| Change In YTM | Change In Price |

| -100 basis points | +6.0422% |

| +100 basis points | -6.0378% |

Source: Author’s Work, Data from iShares

Formula Used For Scenario Analysis: Bond Price x -(Effective Duration x Change in YTM) + (0.5 x Convexity x Change in YTM^2)

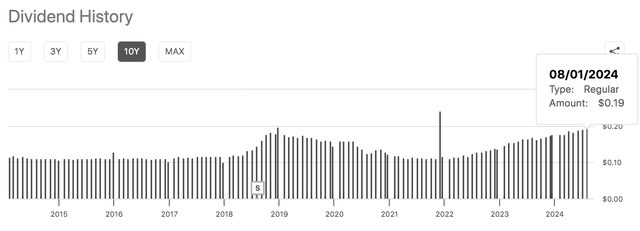

Here is the IGIB ETF’s historical interest, showing that it paid higher amounts in the past few years when interest rates were high. As mentioned, I think we might see lower yields. However, price gains will likely dominate.

Return of Capital (Seeking Alpha)

Side Note: Credit Spreads usually influence investment-grade bonds to a lesser extent than high-yield bonds. Here’s a link to an article delineating credit spreads and their influence on IG and HY bonds.

Credit Migration

Although I deem the influence of credit spread on IG bonds inferior to interest rate risk, credit migration might play a role. In fact, in my experience, a sector-concentrated ETF such as IGIB (nearly 25% of IGIB’s portfolio is banking stocks) can succumb to credit migration.

I collated data about the credit outlook of IGIB’s top ten issuers. Although the ETF is diversified, its top ten issuers provide an indication of IGIB’s general health.

Sources: Respective Company Websites & Moody’s (MCO) – I Used Ratings Of Senior Secured Debt – Moody’s Ratings Were Used.

Counterparty credit risk should ideally be assessed on an instrument basis instead of an issuer basis. Nevertheless, examining the underlying entity provides a solid guidepost. I didn’t identify any worrisome inflection points.

Side note: Moody’s database shows that UBS was assigned a negative outlook in May. However, UBS’s website says that Moody’s rating is “developing,” meaning a new rating is pending. S&P (SPGI) and Fitch think UBS is stable; therefore, I’m giving it the benefit of the doubt.

IGIB ETF’s Expenses and Dividends

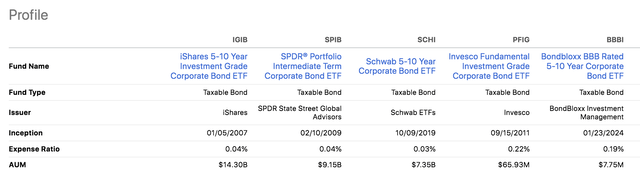

I executed a peers-based analysis to judge the IGIB ETF’s expenses and return of capital. Although my selected peers differ in duration and credit exposure, they share noteworthy similarities.

Peers (Seeking Alpha)

I like the look of IGIB ETF’s expense ratio of 0.04%, which is much lower than SCHI ETF (SCHI), PFIG ETF (PFIG), and BBBI ETF (BBBI). Again, I know that my selected peers have slight differences in exposure. Nevertheless, I deem IGIB ETF’s expense ratio compelling.

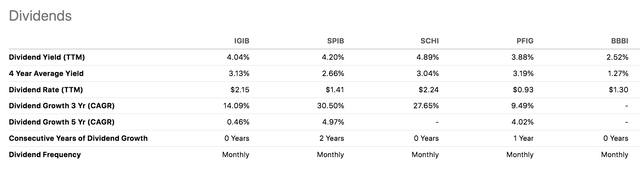

Furthermore, IGIB ETF’s dividend profile seems respectable, with its trailing yield and four-year average dividend yield being best-in-class (on a peer basis).

Seeking Alpha

To conclude this section, I want to look at IGIB ETF’s price-to-net asset value. The vehicle uses a passive strategy to invest in U.S. investment-grade bonds, and, therefore, I’m unsurprised by the close correlation between its P/NAV. Some might argue that the negligible difference between its P/NAV voids an arbitrage opportunity. However, I reiterate the systematic variables discussed earlier because that’s where I see IGIB ETF’s value deriving from.

Limitations Of My Analysis

The bond market is highly unpredictable. As such, my analysis presents an opinion instead of the ground truth. In fact, we might see a much different outcome for IGIB ETF if interest rates and credit spreads were to follow an alternative trajectory.

Furthermore, I assumed that IGIB ETF’s issuer credit ratings conveyed its portfolio’s credit migration risk. However, an issuer’s bond instruments aren’t homogenous. Therefore, a deeper analysis of IGIB ETF’s constituents should probably be executed before consolidating a conclusion.

Concluding Thoughts

Although debatable, I think the iShares 5-10 Year Investment Grade Corporate Bond ETF is set up for price gains, which would exceed a possible reduction in its income component.

In my opinion, the yield curve will level down and slope up, leading to price support for intermediate bonds. However, I prefer investment-grade bonds to high-yield assets as credit spreads might increase.

Lastly, a parsimonious view of IGIB ETF’s expenses and income-based prospects communicates its commendable long-term total return attributes.

I am bullish about IGIB ETF’s prospects.