CashNews.co

For the uninitiated, Bitcoin (CRYPTO: BTC) can be very confusing and complex. But don’t fear — Wall Street has come to the rescue with an exchange-traded fund (ETF), the iShares Bitcoin Trust ETF (NASDAQ: IBIT)as a quick and easy way to gain exposure to the cryptocurrency. Except that the two aren’t the same, and that’s important for investors to understand.

What is Bitcoin?

Bitcoin is a digital currency that has value because the people who own it believe it has value. There is no government that stands behind it, just the people who buy it.

That said, unlike government-backed fiat currency, the crypto is global. As long as you can get on the internet, you can buy and sell it or use it to buy and sell products and services.

But it seems likely that most of the Bitcoin in existence is being traded like a commodity and not used as if it were a common currency. To some extent, that’s because it isn’t a government-backed currency and, thus, isn’t readily accepted by all merchants.

Image source: Getty Images.

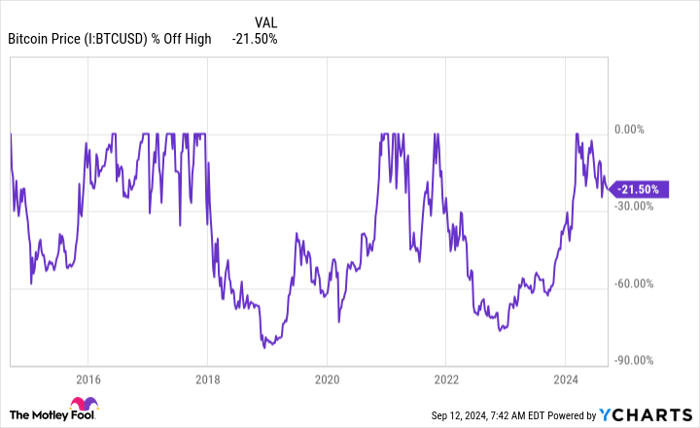

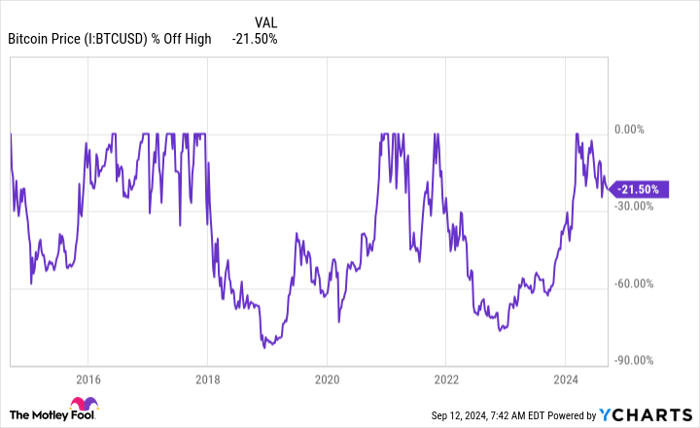

That last point helps to explain the extreme levels of its price volatility. In fact, the chart below is pretty shocking from a price perspective. The digital coin has lost half its value three times since it was introduced. It is currently around 20% below its peak valuation.

If a government-backed currency displayed that kind of volatility, most investors wouldn’t touch it with a 10-foot pole. Only the most aggressive investors (and perhaps gamblers) would get involved.

Bitcoin price data by YCharts.

The big problem with Bitcoin is that emotions drive its value. As anybody who invests on Wall Street knows, emotions can swing dramatically in very short periods of time. That’s basically why there are bull and bear markets.

Still, some view Bitcoin as a safe-haven asset like gold. That’s not unreasonable, given that it exists outside of countries and is beyond Wall Street’s direct reach.

Is the iShares Bitcoin Trust ETF the way to go?

So, for some investors, owning Bitcoin might be viewed as a valuable diversification play. The complexity of buying it, however, could easily put some of those investors off.

Which is where the iShares Bitcoin Trust ETF steps in. It allows you easy exposure to Bitcoin and the ability to buy and sell with ease on a traditional stock market. You might think that’s a winning strategy. Not so fast.

Directly buying Bitcoin, like directly buying gold, offers diversification and the ability to fall back on the asset if the economy were to collapse. But buying the iShares Bitcoin Trust ETF is not the same as buying Bitcoin. As the ETF’s prospectus clearly states, “Although the Shares are not the exact equivalent of a direct investment in bitcoin, they provide investors with an alternative method of achieving investment exposure to bitcoin through the securities market, which may be more familiar to them.”

Step back and think about that for a second: If you buy the iShares Bitcoin Trust ETF, you don’t actually get the benefit of having an asset that lives outside of Wall Street. You can’t spend it. It isn’t a store of wealth. All you get is a security that tracks the price movements of the crypto, which is highly volatile.

And you get to pay a 0.25% expense ratio for the privilege. All in, the iShares Bitcoin Trust ETF looks more like a way to bet on the price movements of Bitcoin than anything else.

There’s nothing wrong with gambling, if that’s what you want to do

If you want to own Bitcoin as a long-term investment and because of its diversification benefits, you should probably do the homework and learn how to buy it directly. That way, you actually own it.

If you are looking to play the price volatility of Bitcoin, which is more akin to gambling than investing, then the iShares Bitcoin Trust ETF could be a great choice for you, given how easy it is to buy and sell.

Just go in knowing that this ETF is not the same thing as owning Bitcoin, and that what you are doing could end with you suffering huge (50%-plus) losses given the volatile history of Bitcoin. And you would have little to show for those losses since you own an ETF and not Bitcoin.

Should you invest $1,000 in iShares Bitcoin Trust right now?

Before you buy stock in iShares Bitcoin Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and iShares Bitcoin Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $715,640!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 16, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.