CashNews.co

Insight into the Investment Moves of a Renowned Value Investor

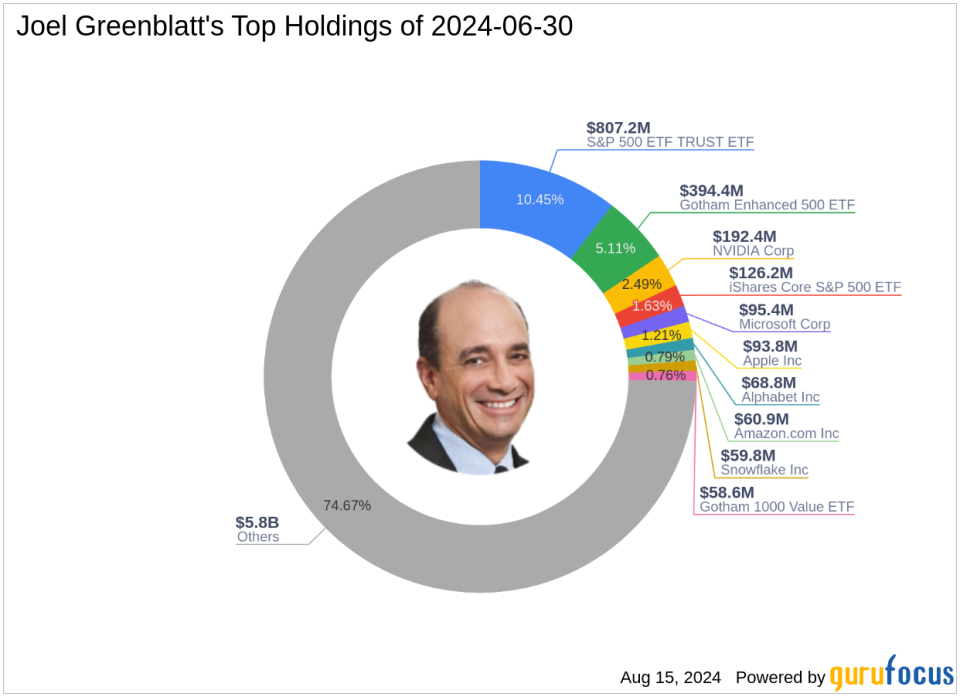

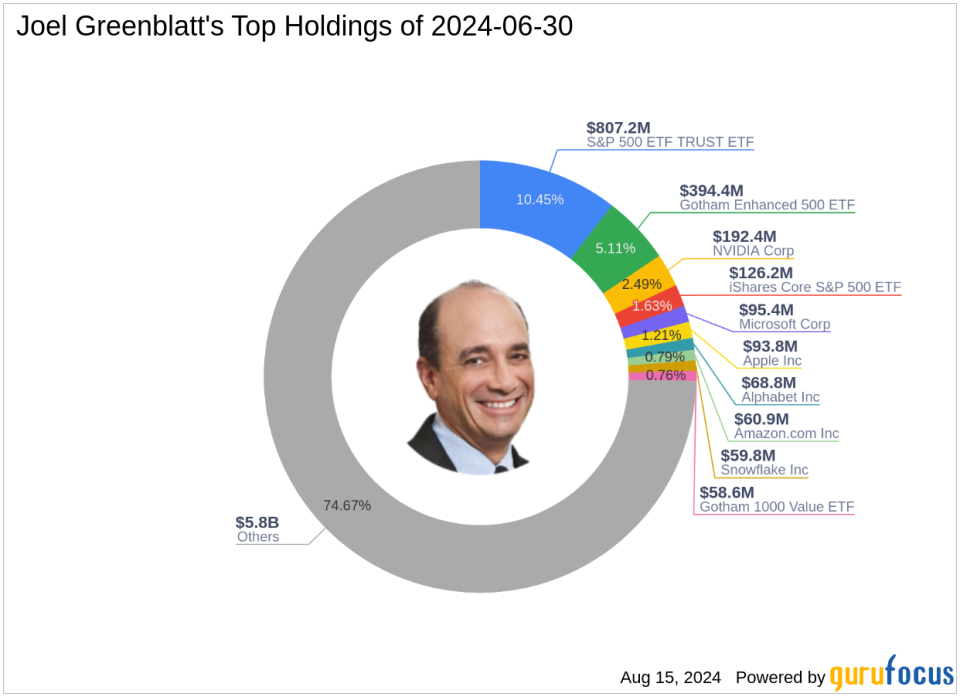

Joel Greenblatt (Trades, Portfolio), a notable figure in the investment world, recently disclosed his 13F filings for the second quarter of 2024. As the founder and managing partner of Gotham Asset Management, LLC, Greenblatt is celebrated for his development of Magic Formula Investinga strategy that aims to identify undervalued stocks. He is also an author and an adjunct professor at Columbia Business School, where he imparts his rich knowledge of the stock market. Greenblatts investment philosophy centers on finding high-quality companies at discounted prices, often focusing on special situations as a source of value.

Summary of New Buys

During the quarter, Joel Greenblatt (Trades, Portfolio) initiated positions in 163 stocks. Noteworthy new additions include:

-

Monday.Com Ltd (NASDAQ:MNDY) with 92,920 shares, making up 0.29% of the portfolio and valued at $22.37 million.

-

Stepan Co (NYSE:SCL) with 168,822 shares, representing 0.18% of the portfolio, valued at $14.17 million.

-

SPDR Portfolio Long Term Corporate Bond ETF (SPLB) with 313,253 shares, accounting for 0.09% of the portfolio and valued at $7.06 million.

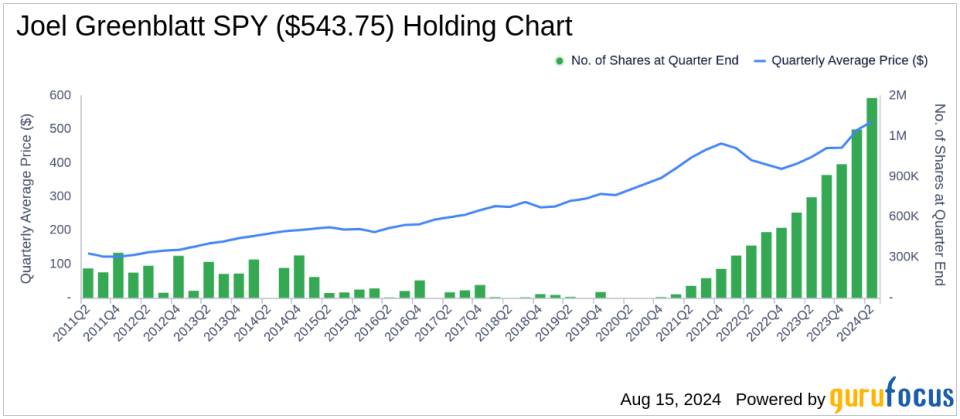

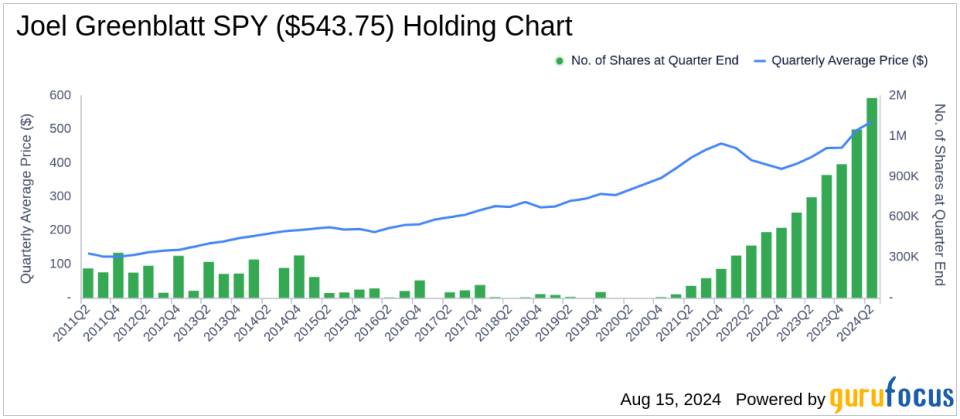

Key Position Increases

Greenblatt also significantly increased his holdings in several stocks, including:

-

S&P 500 ETF TRUST ETF (SPY), adding 234,394 shares, bringing the total to 1,483,153 shares. This represents an 18.77% increase in share count and a 1.65% impact on the current portfolio, totaling $807.16 million.

-

NVIDIA Corp (NASDAQ:NVDA), with an additional 468,564 shares, bringing the total to 1,557,794 shares. This adjustment marks a 43.02% increase in share count, valued at $192.45 million.

Summary of Sold Out Positions

Greenblatt exited 124 positions in this quarter, including:

-

Pioneer Natural Resources Co (PXD), selling all 35,380 shares, impacting the portfolio by -0.14%.

-

QuidelOrtho Corp (NASDAQ:QDEL), liquidating all 114,693 shares, with a -0.08% portfolio impact.

Key Position Reductions

Significant reductions were made in several holdings:

-

Honeywell International Inc (NASDAQ:HON) was reduced by 53,942 shares, a -81.58% decrease, impacting the portfolio by -0.16%. The stock traded at an average price of $201.88 during the quarter.

-

Duke Energy Corp (NYSE:DUK) saw a reduction of 101,564 shares, a -47.94% decrease, impacting the portfolio by -0.15%. The stock traded at an average price of $100.02 during the quarter.

Portfolio Overview

As of the second quarter of 2024, Joel Greenblatt (Trades, Portfolio)s portfolio included 1,408 stocks. The top holdings were:

-

10.45% in S&P 500 ETF TRUST ETF (SPY)

-

5.11% in Gotham Enhanced 500 ETF (GSPY)

-

2.49% in NVIDIA Corp (NASDAQ:NVDA)

-

1.63% in iShares Core S&P 500 ETF (IVV)

-

1.23% in Microsoft Corp (NASDAQ:MSFT)

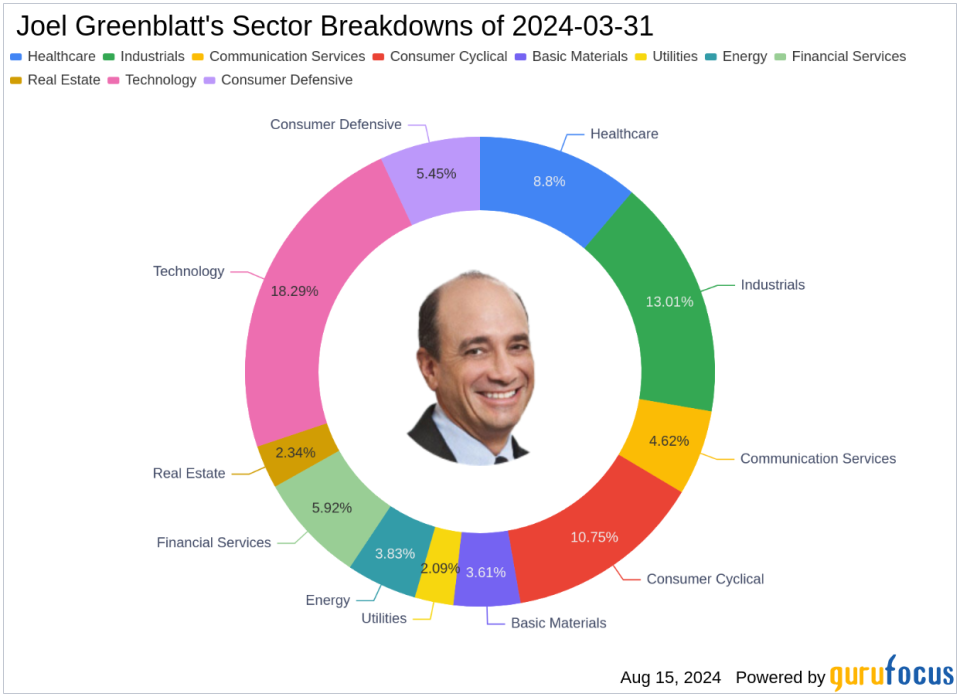

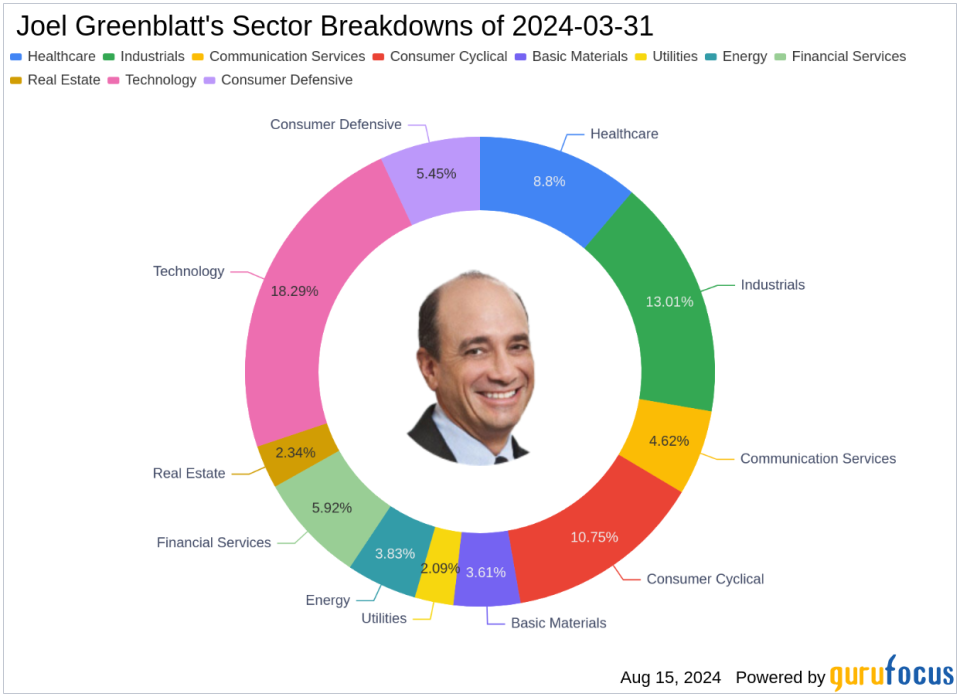

The holdings are predominantly concentrated across 11 industries, including Technology, Industrials, and Consumer Cyclical.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.