CashNews.co

Most investors probably don’t buy the growth-oriented Nasdaq 100 Index for the dividend income, but the latest strategy from Pacer ETFs is designed to change that.

The Pacer Metaurus Nasdaq-100 Dividend Multiplier 600 ETF (QSIX) offers six times the dividend yield of the underlying index, which currently adds up to 4.2%.

That is not a bad yield, especially when coupled with the potential growth of the index.

The dividend boost is accomplished through the purchase of futures contracts going out over the next four years. And in exchange for that extra dividend yield, the QSIX only tracks about 85% of the underlying index, which means a slight lag in growth.

Sean O’Hara, president of Pacer ETFs in Malvern, Pa., said the tradeoff is more than worth it.

“We’re basically deconstructing the price return and the dividend return, and when we put it back together the equity return is lower, but the dividend return is higher,” he said.

With fewer than half the companies in the Nasdaq 100 currently paying a dividend, O’Hara acknowledged that this is not normally the place investors would turn for dividend income.

Will Fast-Growing Companies Pivot to Dividends?

However, he is betting on the fastest-growing companies in the index turning to dividends at some point in the next few years in order to offload some of the cash on their balance sheets.

The ETF’s current formula uses 15% of the index’s beta as collateral to acquire the futures contracts over the next four years to replicate 600% of the annual dividend yield of the Nasdaq 100.

O’Hara believes that alone should be enough to attract investors eager for dividend yield and satisfied with 85% of the equity performance.

But what O’Hara said isn’t factored into the price he’s paying for the dividend futures contracts is the probability of cash-rich non-dividend-payers introducing dividends.

“That is not currently in the dividends futures price, and I think it’s one of the more valuable pieces of QSIX,” he said.

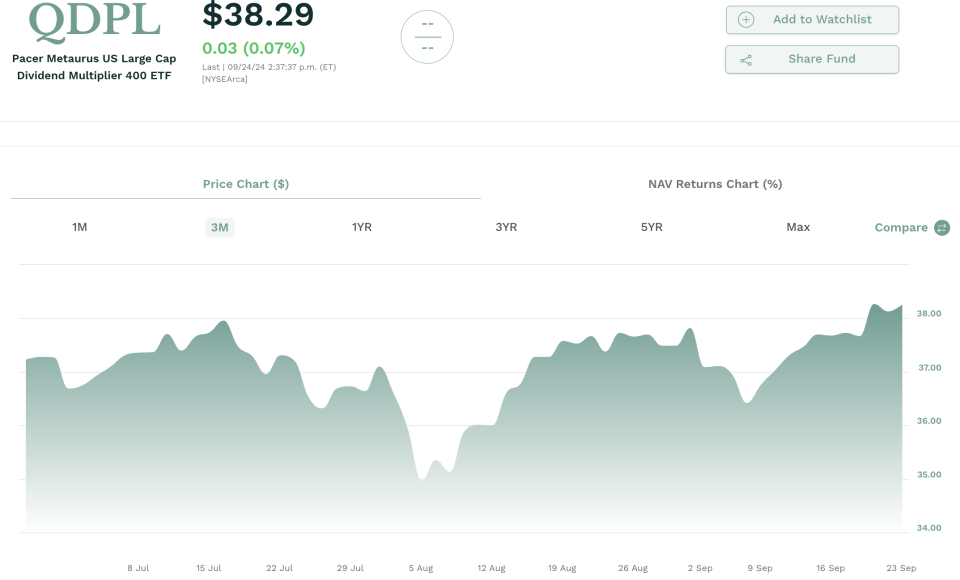

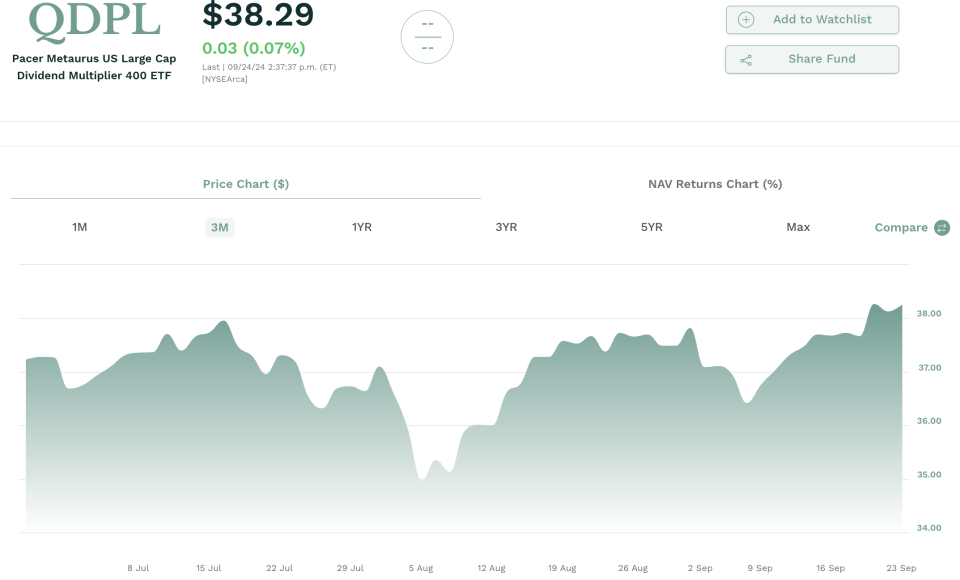

Pacer, which manages nearly $47 billion across 55 ETFs, already has a track record with the strategy through the Pacer Metaurus US Large Cap Dividend Multiplier 400 ETF (QDPL)which offers 400% of the dividend yield of the S&P 500 Index.

Introduced in July 2021, QDPL has grown to more than $500 million.

“We had some success with QDPL, and we thought, ‘where else can we do this?’” O’Hara said.

Permalink | © Copyright 2024 etf.com. All rights reserved