CashNews.co

PM Images/DigitalVision via Getty Images

Introduction

The current expectation is the FOMC will finally, almost a year after the first hints, cut the Federal Funds Rate. Betting is not if or when but by how much: 25 or 50 basis points. If indeed rates have peaked, long-duration funds or bonds are where investors want to be for both income and the potential for capital gains. That is why I find it interesting that Charles Schwab just launched their Ultra-Short Income ETF (NYSEARCA:SCUS). To show Schwab is playing catch-up, as of 6/30/2024, the Ultrashort Bond Fund category has over $350 billion in assets under management, making it the 4th largest Morningstar category for fixed income funds. Even low fees will make it tough to capture AUM now.

The ETF is too new to rate it against other ETFs with the same strategy, but given where interest should be heading over the near term, the ETF easily qualifies for a Sell rating. Current owners who bought for the safety factors (quality + short-duration debt) can rest easy with this ETF.

Schwab Ultra-Short Income ETF Review

Seeking Alpha describes this ETF as (edited):

The Schwab Ultra-Short Income ETF was launched and managed by Charles Schwab Investment Management, Inc. It invests in the fixed income markets of global region. The fund invests in fixed income securities issued by U.S. dollar denominated debt securities issued by U.S. and foreign issuers, commercial paper, promissory notes, certificates of deposit and time deposits, variable- and floating-rate debt securities, bank notes and banker’s acceptances, obligations that are issued by the U.S. government, its agencies or instrumentalities, corporate bonds, municipal bonds that are rated BBB- or higher by S&P Global Ratings and/or Fitch Ratings, Inc. (“Fitch”), or Baa3 or higher by Moody’s Investors Service, Inc. (“Moody’s”). It seeks to invest in securities with an effective duration of one year or less. The ETF was formed on August 12, 2024.

Source: Seeking Alpha SCUS

SCUS has collected $32m in assets in under two weeks. The ETF will charge investors 14bps, less than most of its competitors.

Schwab states the ETF’s purpose to be invested in investment grade, short-term, US dollar denominated debt securities issued by US and foreign issuers. It will maintain a portfolio duration of one year or less.

This ETF will benchmark against the ICE BofA US 3-Month Treasury Bill Index, which is defined as:

The ICE BofA 3 Month U.S. Treasury Index measures the performance of a single issue of outstanding treasury bill which matures closest to, but not beyond, three months from the rebalancing date. The issue is purchased at the beginning of the month and held for a full month; at the end of the month that issue is sold and rolled into a newly selected issue.

Source: pnc index.pdf

Holdings Review

The ETF is permitted to own the following asset types:

- commercial paper, including asset-backed commercial paper

- promissory notes

- certificates of deposit and time deposits

- variable- and floating-rate debt securities

- corporate bonds

- municipal bonds

- banknotes and banker’s acceptances

- repurchase agreements

- obligations that are issued by the U.S. government, its agencies or instrumentalities, including obligations that are not guaranteed by the U.S. Treasury, such as those issued by the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage

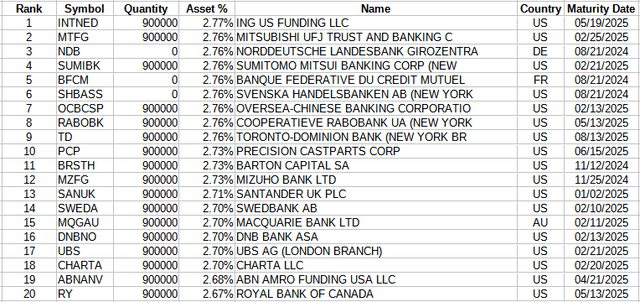

Currently, Schwab is providing no data on what the portfolio’s weighted-average yield or duration are, nor its sector allocations. The total holdings list shows its corporate bonds reflected 10 different industry sectors, with Financials being the largest allocation.

Schwab Asset Management

The ETF currently holds 50 assets, five of which apparently hold cash totalling 13% waiting to be invested into other assets. All assets listed were denominated in USD, so there is no currency risk.

– Schwab Ultra-Short Income ETF

Distributions review

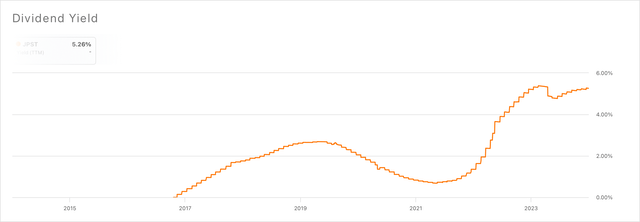

No payment has been made yet and the first might not tell investors much as it could be a partial monthly payment. As a guide, the JPMorgan Ultra-Short Income ETF (JPST) currently yields 5.26%. My concern is what that could drop to if rates take a 200-300bps hit based on how the past yield on the JPST ETF.

Seeking Alpha yield

Portfolio Strategy

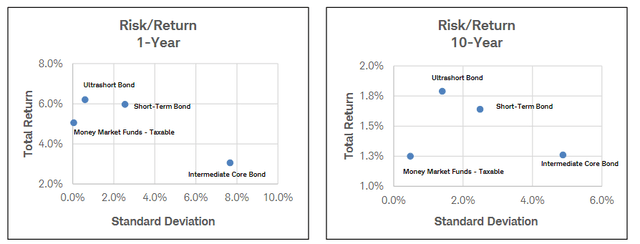

As a low-risk assets class, ultrashort funds meet that test, as shown in the next set of charts; only money-market funds had less risk in either time period.

Schwab Asset Management

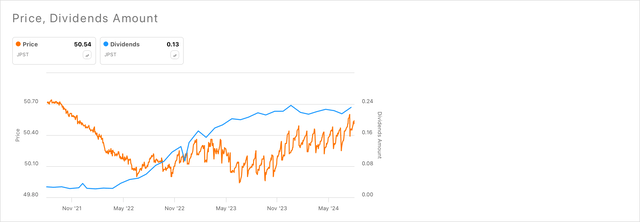

Price will move with the change in the payouts, which are highly correlated to the level of interest rates, with some lag. That is demonstrated again by looking at the JPST ETF.

Seeking Alpha charting

The price for JPST peaked just below $51, bottoming just below $50 as the FOMC pushed up short-term rates. Since the start of 2022, just before rates started climbing, JPST had a CAGR of 3.7%, slightly below what PortfolioVisualizer said investors would have earned staying in cash. In the person’s opinion, that would be the main reason for owning a short-duration ETF, regardless of the asset quality of its portfolio. Even for those investors, the SCUS ETF gets a Hold rating until it proves it is the best in this space. Given where interest should be heading over the near term, the ETF easily qualifies for a Sell rating.

Final Thought

If you are in the camp that rates will soon be dropping along the entire curve, longer duration funds would be where one’s fixed allocation should be directed. Leveraged CEFs should do especially well in that environment, as their leveraging costs will decline with that change in interest rates, especially as seen at the short end of the curve.