CashNews.co

Rex Shares in collaboration with Tuttle Capital Management is moving into the second tier of leveraged single-stock ETFs with T-Rex 2X Long NFLX Daily Target ETF (NFLU).

The ETF, which started trading Friday, is the first to offer 200% exposure to the daily price movement of Netflix Inc. (NFLX).

“In the leveraged single-stock ETF space, the low-hanging fruit with names like Tesla, MicroStrategy and Nvidia is already gone, but as the space broadens, we want to think of the next tier of names,” said Matthew Tuttle, chief executive officer at Tuttle Capital Management in Greenwich, Conn.

“The second tier ETFs won’t get to $4 billion, but this is the kind of fund that could get to $100 million,” he added.

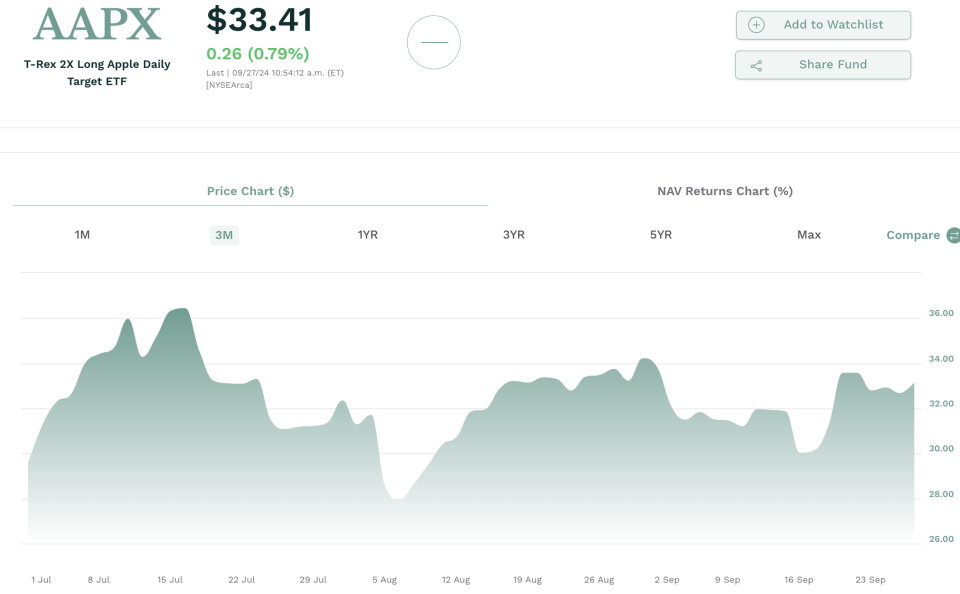

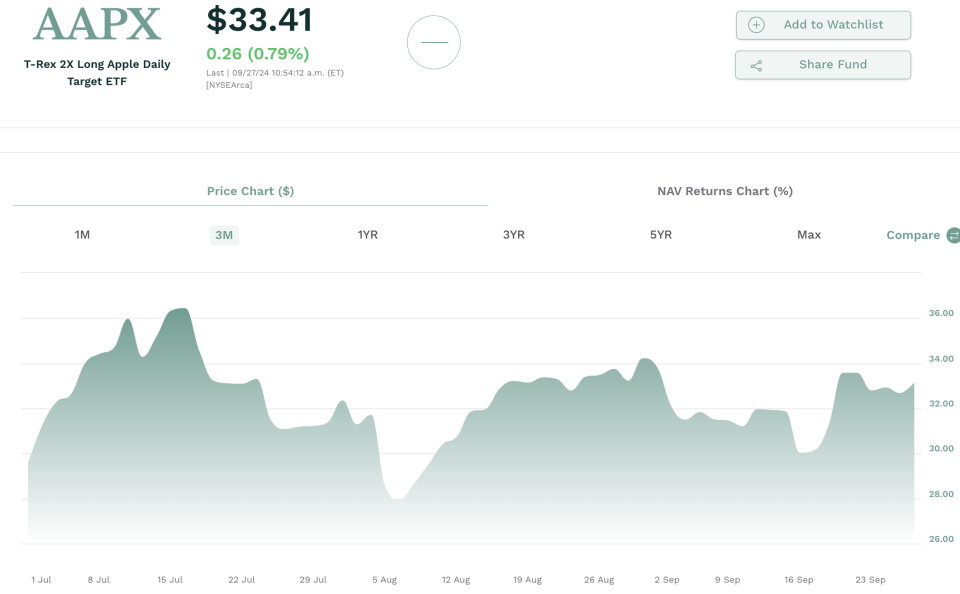

NFLU represents the twelfth ETF joint venture between REX Shares and Tuttle, which includes the T-Rex 2X Long Apple Daily Target ETF (AAPX), the T-Rex 2X Long Alphabet Daily Target ETF (GOOX) and the T-Rex 2X Long Microsoft Daily Target ETF (MSFX).

While many of the single-stock ETFs in the T-Rex suite include both a leveraged long and inverse version, that is not yet the case with Netflix, although an inverse version has been filed with the Securities and Exchange Commission.

“You don’t fight the Fed, and with rates moving lower the demand that we see in these products is on the long side, especially the ones that aren’t as volatile,” Tuttle said. “With the Fed lowering rates that doesn’t get me thinking bear market.”

Tuttle Capital Management, which has eight ETFs on its own, clearly sees a wide-open opportunity in the single-stock ETF arena. In June, the partnership with Rex Shares filed with the SEC for 44 single-stock ETFs, half of which are leveraged long and half of which will offer inverse exposure to the underlying stocks.

The first single-stock ETFs were introduced less than two years ago in December 2022.

Permalink | © Copyright 2024 etf.com. All rights reserved