CashNews.co

There’s a “strange” thing going on in the broader market today, with a small number of large stocks (particularly Nvidia) largely driving market returns. That’s left the Invesco S&P 500 Equal Weight ETF (NYSEMKT: RSP) trailing the market cap weighted SPDR S&P 500 ETF (NYSEMKT: SPY). That’s not an indictment of the Invesco S&P 500 Equal Weight ETF, however. It’s an indication of just how important equal weighting can be to a portfolio.

The Invesco S&P 500 Equal Weight ETF’s unique difference

The S&P 500 index is constructed to be representative of the broader economy, with the roughly 500 stocks in the list selected by human beings based on fair criteria. The list is updated regularly to account for changes like spin-offs, bankruptcies, and the changing shape of the economy overall. The index does a solid job of tracking the stock market.

Image source: Getty Images.

One of the key factors of the S&P 500 is that it uses market cap weighting. This is pretty simple to understand, as the largest companies by market cap are given the largest weightings in the index. It’s a logical choice since the biggest companies will generally have the biggest impact on the economy and the stock market.

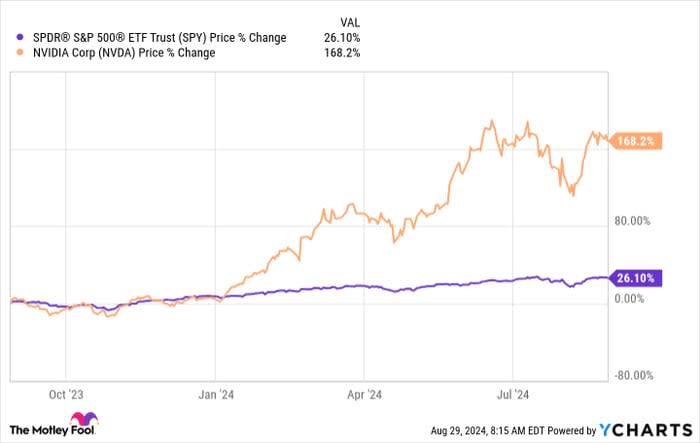

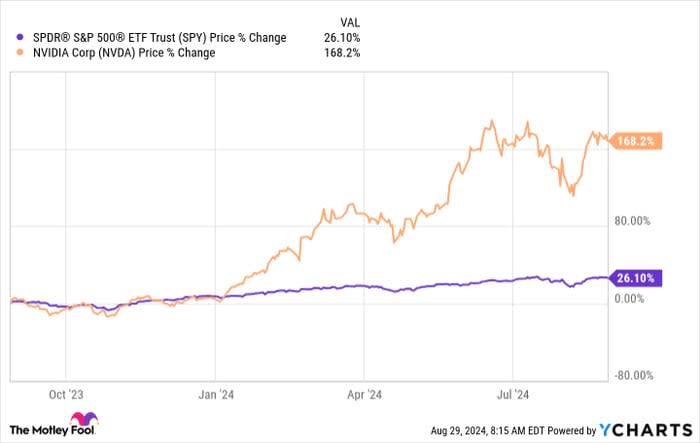

However, there’s an important drawback. The largest stocks are often the most popular ones. For some companies that’s just a factor of their economic scale and industry dominance. But in most bull markets there are stocks that become hugely popular among investors, leading to market caps that stretch the boundaries of valuation. Nvidia is the poster child for this today, with the business news sites hyping up its earnings release as a market-moving event.

SPY data by YCharts

Given the market cap weighting of the S&P 500, Nvidia is, indeed, hugely influential to the overall stock market’s performance as tracked by the S&P 500. The Invesco S&P 500 Equal Weight ETF goes about the weighting issue in a vastly different way, assigning the same weighting to all stocks, and it changes the equation for investors.

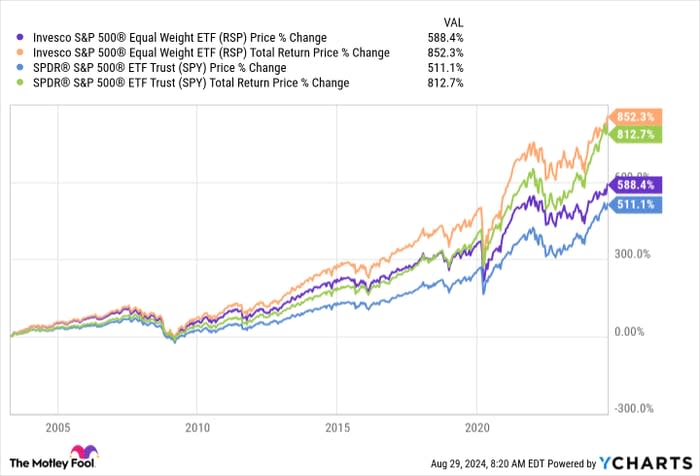

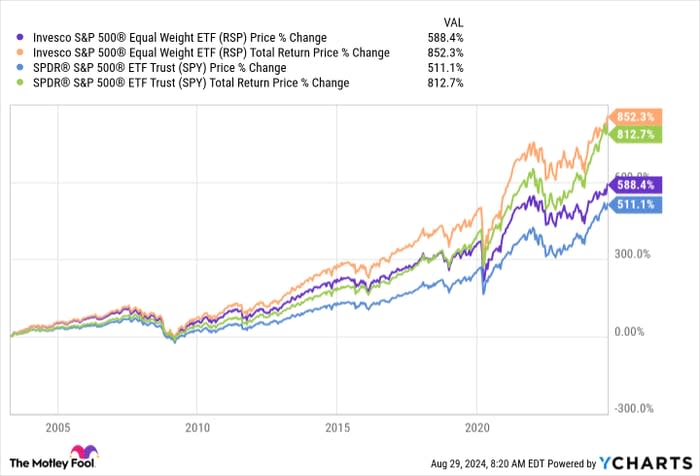

The Invesco S&P 500 Equal Weight ETF is the better performer

It is hard to beat the S&P 500 index, noting that most actively managed mutual funds don’t achieve the feat. And, over the past year, neither has the Invesco S&P 500 Equal Weight ETF. But if you go back to the ETF’s inception, it has performed better than the S&P 500 index (as represented by the SPDR S&P 500 ETF in this case).

RSP data by YCharts

The key is that every security has the same potential to impact the performance of the equal-weight ETF, for both the better and the worse. While there are clearly periods in which missing out on a small number of strongly performing large companies may lead to laggard performance, generally speaking, the benefit of allowing the advances of smaller stocks to be more impactful has clearly been a net benefit. And, conversely, limiting the impact of a few big losers (even if they were once big winners) softens the downside risk. Thus, drawdowns, even bear markets, often aren’t as painful.

You can benefit from equal weighting by purchasing the Invesco S&P 500 Equal Weight ETF. But don’t think that’s the only thing you can do, because you can use a modified equal weighting approach in your stock portfolio. It is as simple as figuring out how many stocks you want to own and dividing that number into your investable assets. What comes out of that math is your “position size.” Invest that amount of money into each stock you buy and all of your positions will be equally weighted upon purchase.

You can leave it at that, allowing winners to run and culling losers (and reinvesting in other stocks) or you can rebalance at some regular interval. Rebalancing is a bit more complicated as an approach, will take more time, and may involve more transaction fees. But it isn’t all that hard to do if you rebalance once or twice a year.

Your portfolio will never be like the Invesco S&P 500 Equal Weight ETF

To be completely fair, you shouldn’t compare your unique, hand-picked portfolio to the Invesco S&P 500 Equal Weight ETF. Your goals and the ETF’s goals are likely to be very different. But that doesn’t mean you can’t copy the most important aspect of the ETF’s approach, which is the equal weighting bit. And given the benefit it has had for the Invesco S&P 500 Equal Weight ETF over the longer term, it seems like an attractive, tested method to help improve your performance, too.

Should you invest $1,000 in Invesco Exchange-Traded Fund Trust – Invesco S&P 500 Equal Weight ETF right now?

Before you buy stock in Invesco Exchange-Traded Fund Trust – Invesco S&P 500 Equal Weight ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Invesco Exchange-Traded Fund Trust – Invesco S&P 500 Equal Weight ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $656,938!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 3, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.