CashNews.co

As Germany’s DAX index continues to show resilience with a 1.70% gain amid hopes of upcoming interest rate cuts from the European Central Bank, investors are increasingly looking for growth opportunities in companies with strong insider ownership. In this context, identifying stocks that combine robust growth potential with high levels of insider investment can be particularly compelling given the current market optimism and economic conditions.

Top 10 Growth Companies With High Insider Ownership In Germany

|

Name |

Insider Ownership |

Earnings Growth |

|

pferdewetten.de (XTRA:EMH) |

26.8% |

70.6% |

|

Stemmer Imaging (XTRA:S9I) |

25.8% |

23.2% |

|

Deutsche Beteiligungs (XTRA:DBAN) |

39.4% |

63.5% |

|

Exasol (XTRA:EXL) |

25.3% |

117.1% |

|

NAGA Group (XTRA:N4G) |

14.1% |

78.3% |

|

Alelion Energy Systems (DB:2FZ) |

37.4% |

106.6% |

|

Stratec (XTRA:SBS) |

30.9% |

20.1% |

|

Redcare Pharmacy (XTRA:RDC) |

17.7% |

50.1% |

|

elumeo (XTRA:ELB) |

25.8% |

120.2% |

|

Your Family Entertainment (DB:RTV) |

17.5% |

116.8% |

Click here to see the full list of 22 stocks from our Fast Growing German Companies With High Insider Ownership screener.

We’re going to check out a few of the best picks from our screener tool.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hypoport SE develops and markets technology platforms for the financial services, property, and insurance industries in Germany, with a market cap of €1.74 billion.

Operations: The company’s revenue segments include €157.97 million from the Credit Platform and €66.89 million from the Insurance Platform.

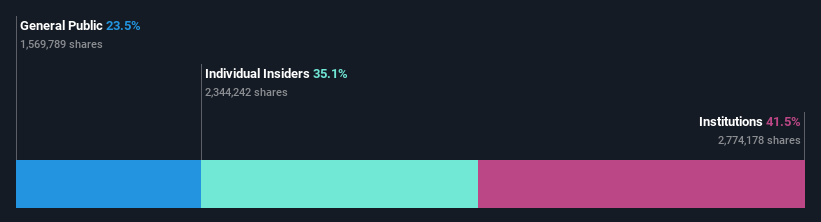

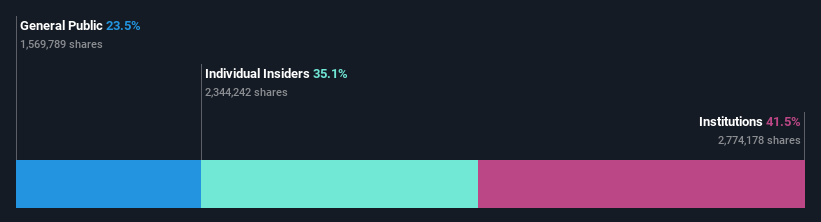

Insider Ownership: 35%

Earnings Growth Forecast: 35% p.a.

Hypoport SE, a growth company with high insider ownership in Germany, recently reported strong earnings for Q2 2024 with sales of €110.62 million and net income of €2.4 million, reversing a previous loss. Revenue is forecast to grow at 12.5% annually, outpacing the German market’s 5.1%. Earnings are expected to increase by 35% per year despite some volatility in share price and low future return on equity projections (10.3%).

Simply Wall St Growth Rating: ★★★★☆☆

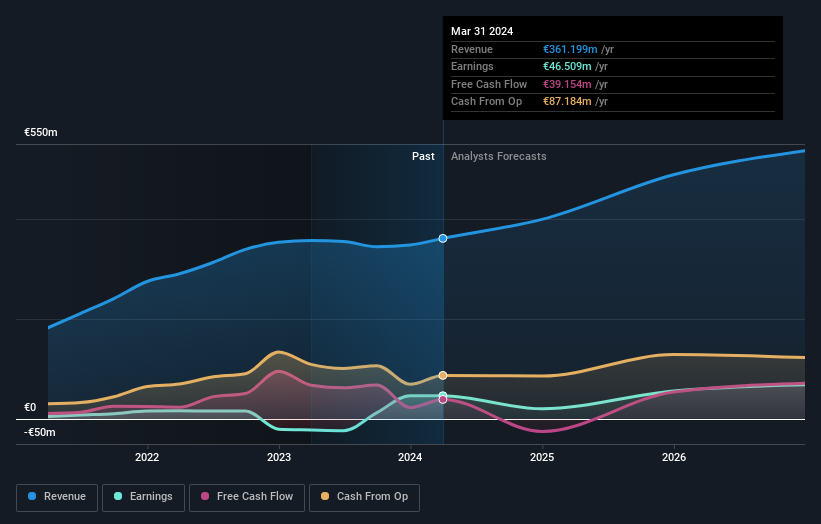

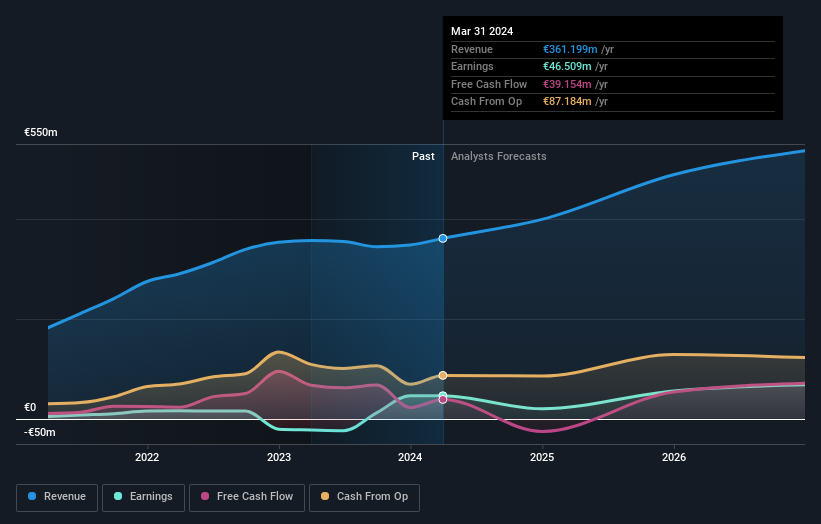

Overview: Verve Group SE operates a software platform for the automated buying and selling of digital advertising space in North America and Europe, with a market cap of €555.35 million.

Operations: The company’s revenue segments include Demand Side Platforms (DSP) generating €51.53 million and Supply Side Platforms (SSP) contributing €318.35 million.

Insider Ownership: 25.1%

Earnings Growth Forecast: 20.5% p.a.

Verve Group SE, with substantial insider ownership, is experiencing significant growth and strategic changes. The company raised its 2024 revenue guidance to €400-€420 million and appointed Alex Stil as Chief Commercial Officer to enhance its demand-side business. Recent successful debt financing of €65 million will reduce annual interest costs by at least €10 million. Despite past shareholder dilution, earnings are forecast to grow significantly at 20.52% per year, outpacing the German market’s average growth rate.

Simply Wall St Growth Rating: ★★★★☆☆

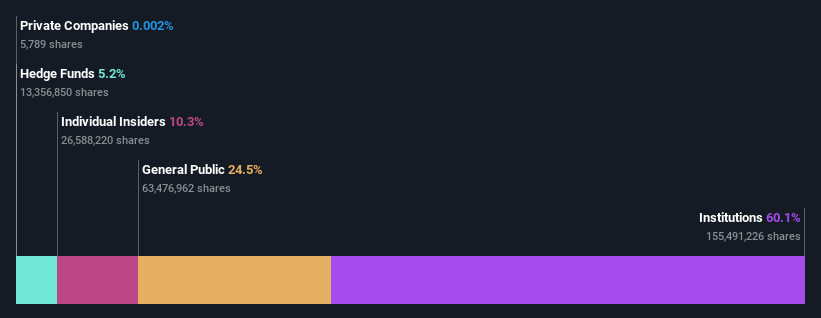

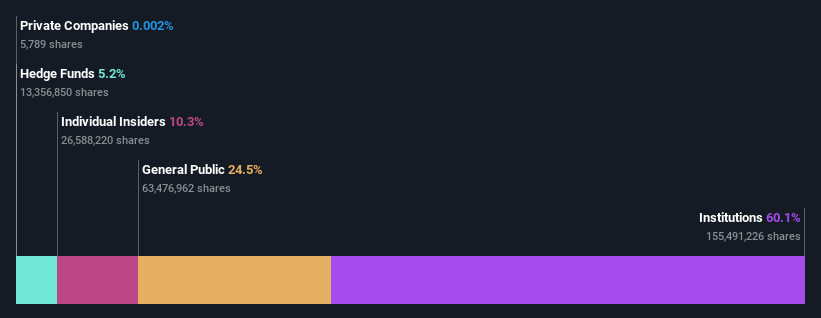

Overview: Zalando SE operates an online platform for fashion and lifestyle products, with a market cap of approximately €6.36 billion.

Operations: Revenue segments for the company include Reconciliation at -€0.28 billion and Segment Adjustment at €10.49 billion.

Insider Ownership: 10.4%

Earnings Growth Forecast: 24.6% p.a.

Zalando SE, a growth company with high insider ownership, has shown robust earnings growth of 84.3% over the past year and is trading at 57.1% below its estimated fair value. Earnings are forecast to grow significantly at 24.63% per year, outpacing the German market’s average. Recent Q2 results reported sales of €2.64 billion and net income of €95.7 million, reflecting strong performance compared to the previous year’s figures.

Turning Ideas Into Actions

Searching for a Fresh Perspective?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include XTRA:HYQ XTRA:M8G and XTRA:ZAL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]