CashNews.co

As the European market experiences a boost in sentiment with hopes of upcoming interest rate cuts by both the Federal Reserve and the European Central Bank, Germany’s DAX has seen a notable uptick. Amid this optimistic backdrop, investors are increasingly interested in high-growth tech stocks that can capitalize on favorable economic conditions and technological advancements. When selecting promising stocks in this environment, it is crucial to consider companies with strong innovation capabilities, robust financial health, and strategic positioning within their industry.

Top 10 High Growth Tech Companies In Germany

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

Ströer SE KGaA |

7.39% |

29.86% |

★★★★★☆ |

|

Voice Imaging |

13.34% |

23.20% |

★★★★★☆ |

|

Exasol |

14.66% |

117.10% |

★★★★★☆ |

|

NAGA Group |

25.85% |

78.32% |

★★★★★☆ |

|

medondo holding |

34.52% |

71.99% |

★★★★★☆ |

|

ParTec |

41.16% |

63.31% |

★★★★★★ |

|

Northern Data |

32.53% |

68.17% |

★★★★★☆ |

|

cyan |

27.51% |

67.79% |

★★★★★☆ |

|

Ruben |

59.40% |

73.87% |

★★★★★☆ |

|

asknet Solutions |

20.06% |

74.86% |

★★★★★☆ |

Click here to see the full list of 48 stocks from our German High Growth Tech and AI Stocks screener.

Here’s a peek at a few of the choices from the screener.

Simply Wall St Growth Rating: ★★★★★☆

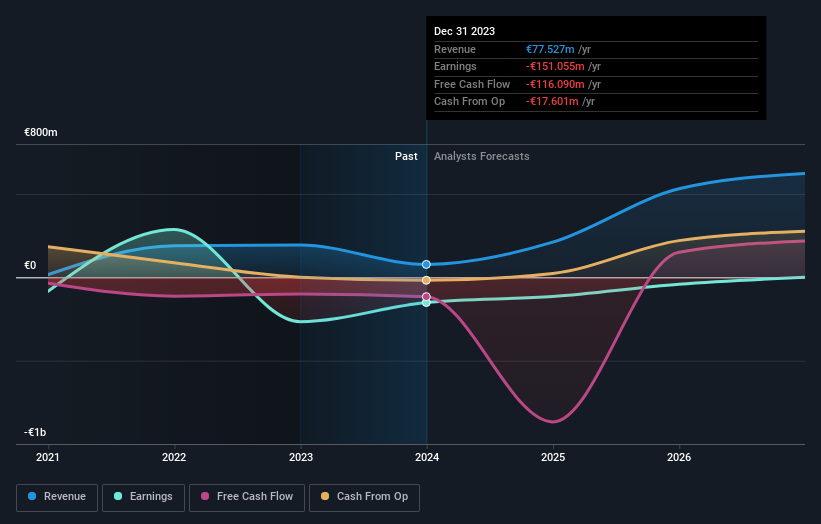

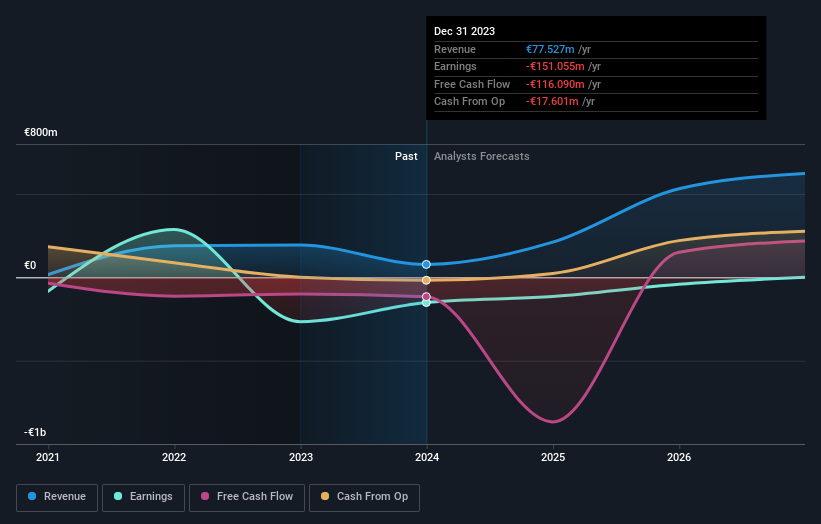

Overview: Northern Data AG develops and operates high-performance computing (HPC) infrastructure solutions for businesses and research institutions worldwide, with a market cap of €1.65 billion.

Operations: Northern Data AG focuses on high-performance computing (HPC) infrastructure, generating revenue primarily from Peak Mining (€156.13 million), Taiga Cloud (€22.13 million), and Ardent Data Centers (€31.46 million). The company also engages in various other business functions contributing €46.31 million to its revenue stream, though it faces a consolidation adjustment of -€178.50 million.

Northern Data’s ambitious growth trajectory is underscored by its forecasted revenue increase of 32.5% annually, significantly outpacing the German market’s 5.1%. The company’s R&D expenses highlight its commitment to innovation, with a substantial investment that aligns with its goal to triple revenues in fiscal year 2024, targeting €200 million to €240 million. Despite a net loss of €151.06 million in 2023, Northern Data’s strategic focus on AI and cloud computing positions it well for future profitability and industry leadership.

Simply Wall St Growth Rating: ★★★★☆☆

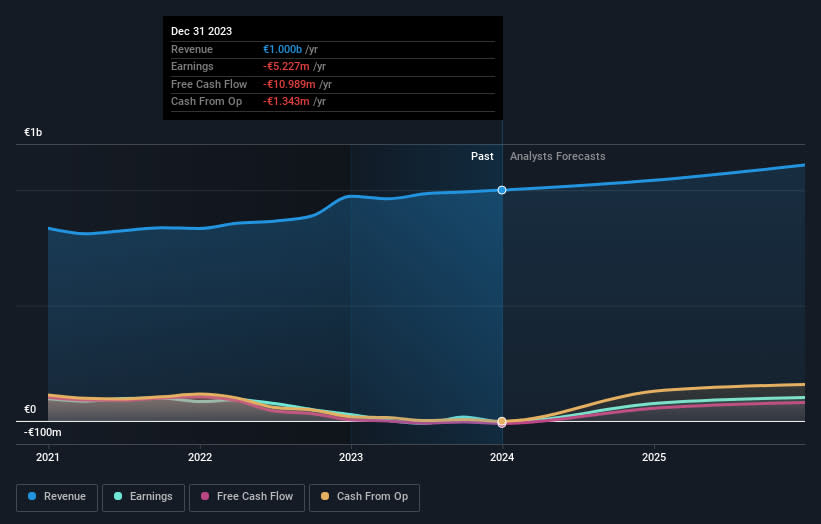

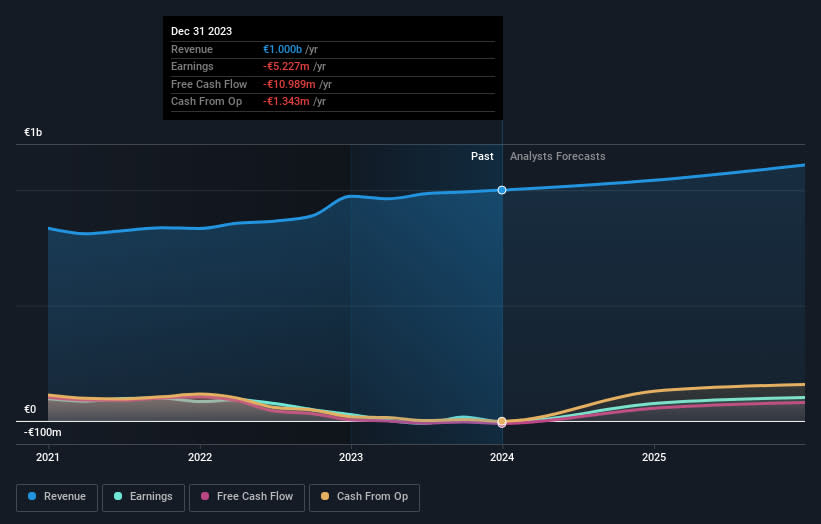

Overview: Software Aktiengesellschaft offers software development, licensing, maintenance, and IT services across Germany, the United States, and internationally with a market cap of €2.68 billion.

Operations: Software Aktiengesellschaft generates revenue through three primary segments: Digital Business (€597.13 million), Professional Services (€156.57 million), and Adabas & Natural (A&N) (€246.59 million).

Software AG’s forecasted annual revenue growth of 5.2% slightly surpasses the German market’s 5.1%, indicating steady progress in a competitive landscape. With earnings expected to grow by an impressive 87.88% annually, the company’s focus on innovation is evident through its significant R&D investments, which have historically been robust. Recent special calls highlight their commitment to enterprise-grade connected assets and device management at scale, emphasizing their strategic pivot towards high-demand segments in software solutions and connectivity services.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Verve Group SE operates a software platform for the automated buying and selling of digital advertising space in North America and Europe, with a market cap of €572.12 million.

Operations: Verve Group SE generates revenue primarily from its Supply Side Platforms (SSP) segment, contributing €318.35 million, and Demand Side Platforms (DSP), contributing €51.53 million. The company focuses on the automated buying and selling of digital advertising space across North America and Europe.

Verve Group SE recently raised its 2024 revenue guidance to €400 million – €420 million, reflecting strong growth prospects. The company’s earnings are forecasted to grow at an impressive 20.5% annually, outpacing the German market’s 19.8%. With a significant investment in R&D, which accounts for approximately 12.9% of its revenue, Verve is enhancing its product offerings and market presence. Additionally, the recent bond issue at a yield of Euribor + 4.88% will save Verve around €10 million annually in interest costs.

Turning Ideas Into Actions

Ready To Venture Into Other Investment Styles?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include DB:NB2 HMSE:SOW and XTRA:M8G.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]