Financial Insights That Matter

A report by the CEEW Green Finance Centre (CEEW-GFC) says 60% of municipal bonds by value issued so far could have been labelled green but were not, missing cost-saving and investor opportunities. It recommends targeted reforms and structured support to help municipalities access climate finance at scale.

Municipal green bonds could mobilise up to INR 20,000 crore ($2.5 billion) by 2030, unlocking critical funding for civic and climate-resilient urban growth in India, according to a new independent report released today by the CEEW Green Finance Centre (CEEW-GFC).

The report, Unlocking Green Finance for India’s Urban Local Bodies Through Municipal Green Bondsfinds that nearly 60% of municipal bonds issued over the last decade could have been labelled green but were not. This represents a missed opportunity that could have led to lower borrowing costs and dedicated climate-focused investors.

Green bonds, designed to finance environmentally beneficial projects, are gaining traction in India. The report states that four of the seven municipal bond issuances in the last decade, amounting to INR 694 crore ($85 million), have been green-labelled.

“The key challenge with municipal bonds is fostering sustainable borrowing and repayment habits among urban local bodies. For municipal bonds to thrive, we must create a pipeline of accessible finance for smaller municipalities with minimal entry barriers, ring-fenced funding, and small sovereign guarantees,” said D. Thara, Additional Secretary in the Ministry of Housing and Urban Affairs, at the launch of the report. “Bonds are not the only solution. Structured project-linked loans and innovative financing models, such as a municipal bond lite approach inspired by PM SVANidhi, could empower municipalities to secure and repay smaller loans efficiently. To unlock this potential, the ecosystem must drive this shift from the ground up, attracting small investors and enabling the development of such ‘citizen bonds.”

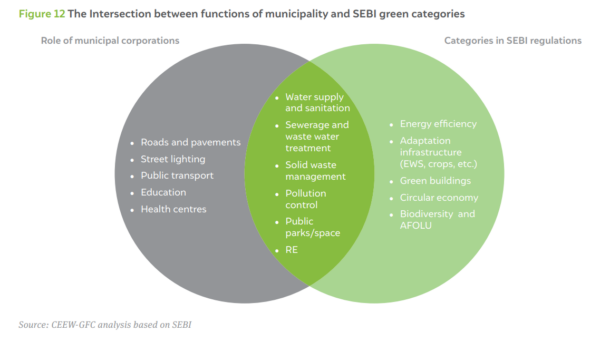

Municipal bonds are an emerging financial instrument for Indian cities, enabling them to fund critical infrastructure such as water supply systems, sewage treatment plants, drainage networks, and renewable energy projects. While the market for larger municipal bonds has the potential to reach $3 billion by 2030, CEEW-GFC’s analysis suggests that up to 83% of this could be green, translating to a potential $2.5 billion.

Green bonds are attracting interest due to their lower borrowing costs—around 50 basis points less than non-labelled bonds—and potential government incentives like tax benefits and interest subsidies. However, uptake remains slow due to low municipal creditworthiness, outdated financial practices, and limited institutional capacity. Despite their potential, India’s municipal bond market remains underdeveloped, with only 50 issuances worth INR 6,933 crore ($850 million) since 1997.

Dr Dhruba Purkayastha, director, Growth and Institutional Advancement, CEEW, said“Municipal green bonds are a viable channel to raise long-term capital for urban climate action, but unlocking their potential will require coordinated efforts between municipalities, state governments, regulators, and investors. Strengthening municipal creditworthiness by improving revenue streams and standardising reporting practices will help attract institutional investors and reduce borrowing costs for cities. The green finance raised will also need to be invested in coping with climate change.”

Gagan Sidhu, Director, CEEW Green Finance Centre, said, “While India has made important strides in municipal bond market development, the transition to green bonds needs targeted action. Municipalities must first strengthen their financial and institutional capacity by improving their fiscal health and increasing transparency. Additionally, interventions at both the centre and state level could further catalyse municipal green bond issuances. Mechanisms to pool projects at the state level, and extension of monetary incentives under the AMRUT scheme are two examples of such interventions.”

Ghaziabad set the trend for municipal green bonds in India with its INR 150 crore ($18 million) issuance in 2021 for sewage treatment infrastructure. Indore followed in 2023 with an INR 244 crore ($30 million) issuance to finance a 60 MW solar plant, setting a precedent for renewable energy financing. Ahmedabad and Vadodara further advanced the market in February 2024, raising INR 200 crore ($24 million) and INR 100 crore ($12 million), respectively, for water treatment and climate-resilient urban services. These examples demonstrate that Indian cities are able to attract green-focused investment if the regulatory frameworks and incentives are in place.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: [email protected].

Popular content

#1a73e8;">Boost Your Financial Knowledge and Achieve Stability

Discover a growing online community dedicated to delivering financial news, tips, and strategies designed to help you manage money effectively, save smarter, and grow your investments with confidence.

#1a73e8;">Top Financial Tips for Saving and Investing

- Personal Finance Management: Master the art of budgeting, expense tracking, and building a strong financial foundation.

- Investment Opportunities: Stay updated on market trends, learn about stocks, and explore secure ways to grow your wealth.

- Expert Money-Saving Advice: Access proven techniques to reduce expenses and maximize your financial potential.