Financial Insights That Matter

Company background

REC is a prominent “Maharatna” (big or great jewel) public sector enterprise in India, primarily engaged in financing and promoting power sector projects across the country. It commands a market share of around 20% in power sector financing.

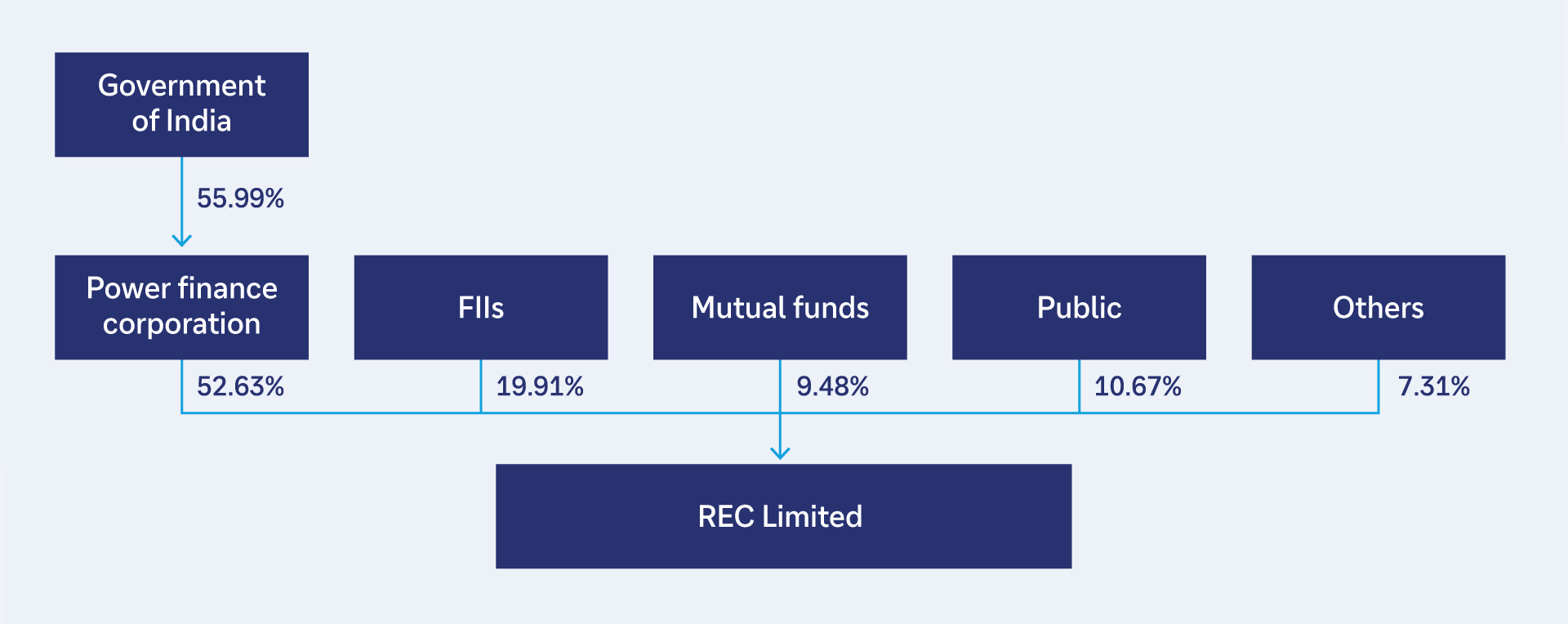

Figure 1: REC relationship with the Indian government

The company was established in 1969 under the Ministry of Power, Government of India. Initially, its primary objective was to finance and promote rural electrification projects. Over the years, REC has expanded its mandate to include financing power generation, transmission, and distribution projects, as well as renewable energy projects – with an aim to grow its renewable loan book portfolio of 9% to 30% by the end of 2030. In 2022–23, REC expanded the business portfolio with lending to the non-power infrastructure and logistics sector, including roads/highways, airports, metro rail networks, healthcare infrastructure and ports. In addition, REC has been appointed as the National Program Implementing Agency for the ‘PM Surya Ghar Muft Bijli Yojana’, which aims to install rooftop solar systems on 10 million residential households by March 2027, targeting a total renewable energy capacity of 30GW.

With a market capitalisation of €16.24bn (as of Dec 2024) and rated BBB- / Stable by Fitch and Baa3 / Stable by Moody’s, REC is a listed sovereign NBFI providing financial services to state, centre and private infrastructure companies for the creation of India’s infrastructure assets.

As an NBFI, REC provides financial assistance to state electricity boards, state governments, central and state power utilities, independent power producers, rural electric cooperatives, and private sector utilities. The company’s financial products include long-term loans, short-term loans, and debt refinancing.

Key functions and services include project financing – where REC provides loans for thermal, hydro, and renewable energy projects, including solar, wind and biomass. It also finances the development and enhancement of transmission and distribution networks to ensure efficient power delivery. Its loan book stood at €57bn in March 2024, with the portfolio consisting of conventional power generation, transmission, distributions projects and renewable energy. As of 31 March 2024, the asset portfolio is well diversified with no single borrower representing more than 10% of the portfolio. Foreign currency borrowings contribute 29% of the company’s overall borrowings, 99% of which are hedged until maturity. The company states, “It is expected that foreign currency borrowings shall continue to constitute 30% to 35% of incremental funding requirements of REC.”

#1a73e8;">Boost Your Financial Knowledge and Achieve Stability

Discover a growing online community dedicated to delivering financial news, tips, and strategies designed to help you manage money effectively, save smarter, and grow your investments with confidence.

#1a73e8;">Top Financial Tips for Saving and Investing

- Personal Finance Management: Master the art of budgeting, expense tracking, and building a strong financial foundation.

- Investment Opportunities: Stay updated on market trends, learn about stocks, and explore secure ways to grow your wealth.

- Expert Money-Saving Advice: Access proven techniques to reduce expenses and maximize your financial potential.