CashNews.co

Over the last 7 days, the Indian market has risen 1.0%, driven by gains in the Financials and Information Technology sectors of 1.4% and 3.2%, respectively. The market is up 45% over the last 12 months, with earnings forecast to grow by 17% annually. In this thriving environment, identifying stocks with strong potential involves looking for companies that are well-positioned within these high-performing sectors and have solid growth prospects.

Top 10 Undiscovered Gems With Strong Fundamentals In India

|

Name |

Debt To Equity |

Revenue Growth |

Earnings Growth |

Health Rating |

|---|---|---|---|---|

|

Bengal & Assam |

4.48% |

1.53% |

51.11% |

★★★★★★ |

|

3B Blackbio Dx |

0.38% |

-0.26% |

-1.39% |

★★★★★★ |

|

AGI Infra |

61.29% |

29.12% |

33.44% |

★★★★★★ |

|

Timex Group India |

14.33% |

17.75% |

59.68% |

★★★★★★ |

|

Knowledge Marine & Engineering Works |

35.48% |

42.61% |

42.95% |

★★★★★★ |

|

Gallant Ispat |

18.85% |

37.56% |

37.26% |

★★★★★☆ |

|

Network People Services Technologies |

0.24% |

81.82% |

86.35% |

★★★★★☆ |

|

Kaycee Industries |

17.35% |

19.50% |

34.62% |

★★★★★☆ |

|

Monarch Networth Capital |

32.66% |

30.99% |

50.24% |

★★★★☆☆ |

|

Abans Holdings |

91.77% |

13.13% |

18.72% |

★★★★☆☆ |

Click here to see the full list of 471 stocks from our Indian Undiscovered Gems With Strong Fundamentals screener.

We’ll examine a selection from our screener results.

Simply Wall St Value Rating: ★★★★★☆

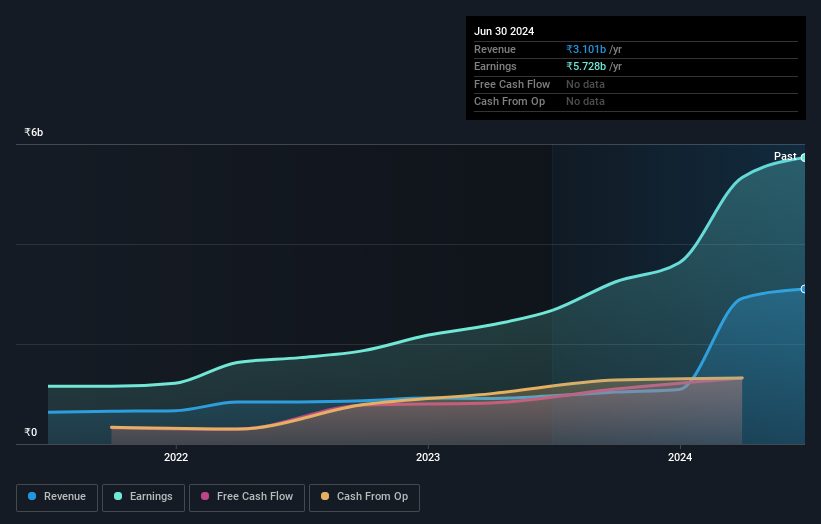

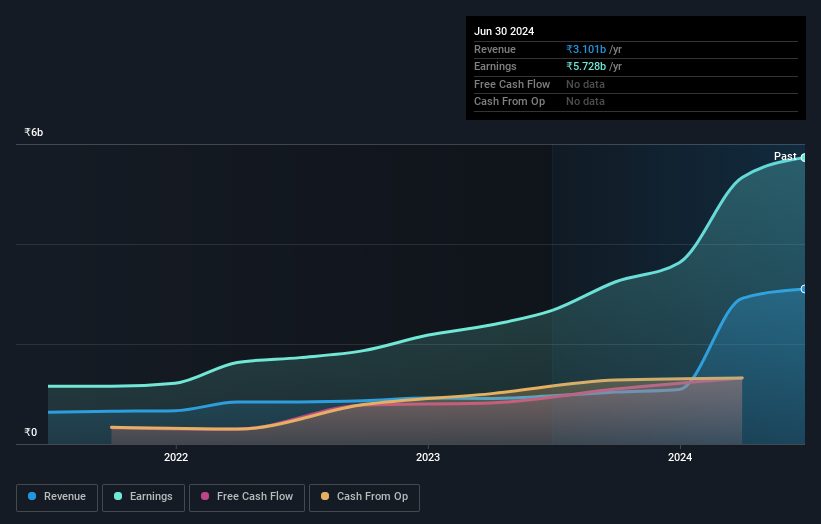

Overview: Anand Rathi Wealth Limited provides financial and insurance services in India with a market cap of ₹160.74 billion.

Operations: The company generates revenue primarily from the sale and distribution of financial products, amounting to ₹8.19 billion.

Anand Rathi Wealth has shown impressive financial health, with its earnings growing 31% annually over the past five years. The company reported a net income of INR 732.39 million for Q1 2024, up from INR 530.61 million a year ago. Additionally, it repurchased 370,000 shares for INR 1.65 billion recently and enjoys high-quality earnings with EBIT covering interest payments by an impressive factor of 52.5x. Revenue is forecast to grow by another 22% annually, highlighting its robust growth trajectory in the capital markets sector.

Simply Wall St Value Rating: ★★★★★★

Overview: Jai Balaji Industries Limited manufactures and markets iron and steel products primarily in India, with a market cap of ₹164.28 billion.

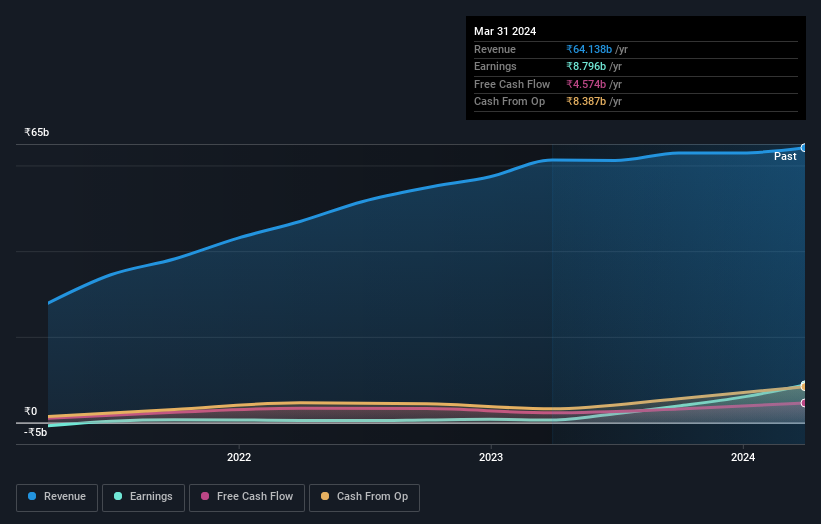

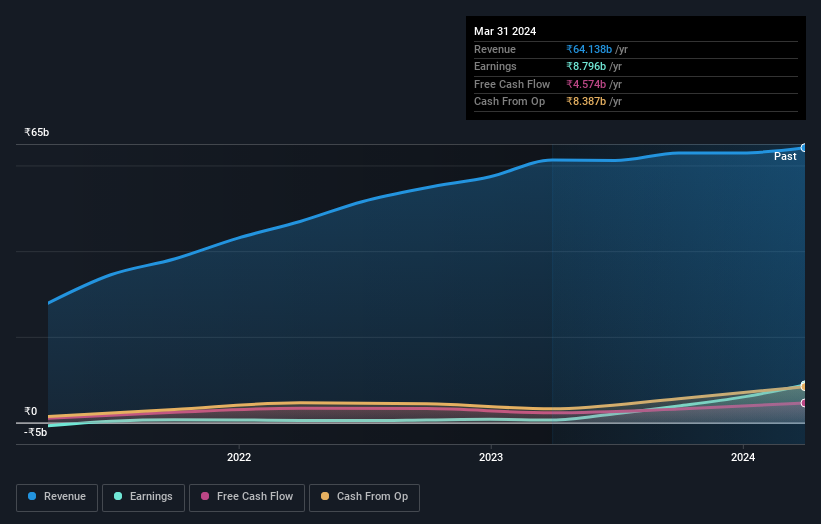

Operations: The company generates revenue primarily from its iron and steel segment, amounting to ₹66.50 billion.

Jai Balaji Industries, a small-cap player in the metals and mining sector, recently reported impressive earnings growth of 344.7%, significantly outpacing the industry average of 17.2%. The company’s net debt to equity ratio stands at a satisfactory 25.4%, indicating prudent financial management. With EBIT covering interest payments by 13.9 times, Jai Balaji’s interest obligations are well-managed. Additionally, their P/E ratio of 17.9x is attractive compared to the Indian market average of 34.3x, making it a compelling investment consideration.

Simply Wall St Value Rating: ★★★★★☆

Overview: Sundaram Finance Holdings Limited operates in investments, business processing, and support services across India, Australia, and the United Kingdom with a market cap of ₹94.62 billion.

Operations: The company generates revenue primarily from investments (₹2.51 billion), domestic shared services (₹105.51 million), and overseas shared services (₹489.78 million).

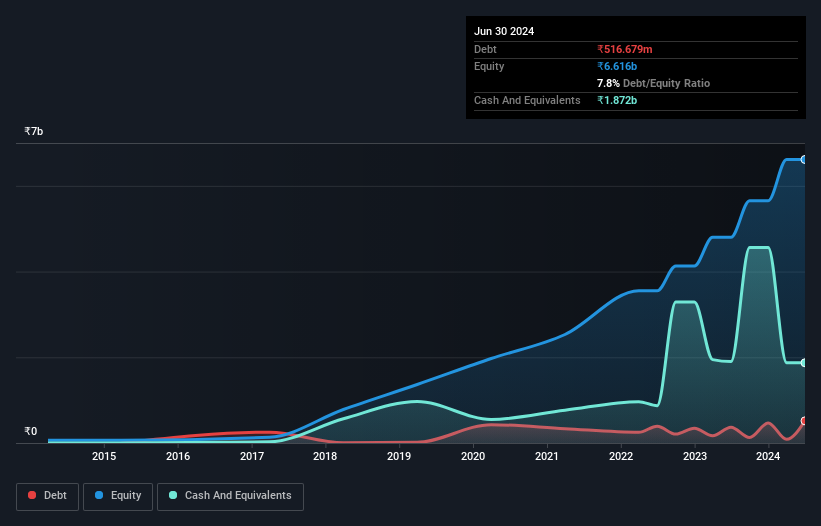

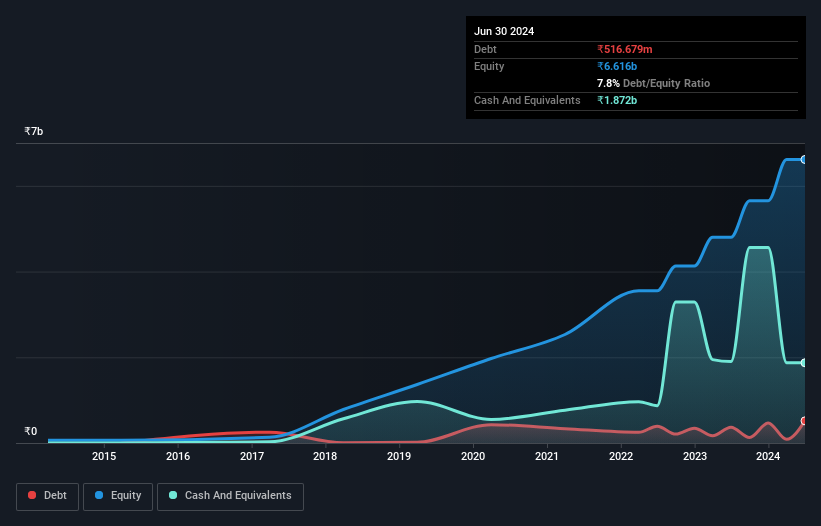

Sundaram Finance Holdings has demonstrated robust financial health, with earnings growing by 114.5% over the past year, outpacing the Auto Components industry’s 20.1%. Its debt to equity ratio has increased modestly from 0% to 0.4% in five years, while maintaining more cash than total debt. The company reported first-quarter revenue of INR 442.78 million and net income of INR 1,103.35 million for June 2024, reflecting strong performance with basic earnings per share at INR 4.97 compared to last year’s INR 3.18.

Turning Ideas Into Actions

Ready To Venture Into Other Investment Styles?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:ANANDRATHI NSEI:JAIBALAJI and NSEI:SUNDARMHLD.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]