CashNews.co

The Medical Instruments industry is again in a transformative phase, thanks to the rapid adoption of generative Artificial Intelligence (genAI) and digital therapeutics, which market watchers expect will take the healthcare industry by storm. In fact, since the beginning of 2023, the industry has been witnessing mass adoption of AI and the Internet of Medical Things in the form of digital healthcare options in hospitals and other healthcare settings.

GenAI has also started to showcase its proficiency across a range of healthcare fields, from time-consuming administrative tasks to critical areas like technological discovery and clinical trials. Meanwhile, strategic consolidations have picked up pace following a drab start to 2024.

However, a deteriorating geopolitical situation, supply chain bottlenecks leading to a tough situation related to raw material and labor costs, freight charges, as well as healthcare staffing shortages, have put the industry in a tight spot again. Industry players like Intuitive Surgical ISRG, Masimo Corporation MASI and Veracyte, Inc. VCYT have adapted well to changing consumer preferences and are still witnessing an uptrend in their stock prices.

Industry Description

The Zacks Medical – Instruments industry is highly fragmented, with participants engaged in research and development (R&D) in therapeutic areas. This FDA-regulated industry comprises an endless number of products, starting from transcatheter valves to orthopedic products to imaging equipment and robotics. Prior to the pandemic, the Medical Instruments space was advancing well in terms of R&D. Among the recent path-breaking inventions, bone growth stimulators, 3D mapping of CT scans, wireless brain sensors and human-brain pacemakers are worth mentioning. During the COVID-19 years, many non-COVID and non-emergency-line innovations were stuck or delayed. However, with the severity of the pandemic easing, the industry players are again more focused on strengthening their pipeline.

3 Trends Shaping the Future of the Medical Instruments Industry

Digital Revolution: Since 2023, there has been an increase in the adoption of genAI within the medical instruments space, with “hyper personalization” being the primary feature of genAI-driven treatment options. Added to this, genAI is rapidly paving the way for efficient operational management within the industry. GenAI, while analyzing vast and complex genetic and molecular data, is expected to help healthcare reach new heights in terms of predictive treatment options and smart hospital systems. Going by an AlphaSense report, in 2024, more companies are likely to experiment with genAI in new ways, such as the use of voice prompts. They will need to acquire new capabilities and talent to reap the full benefits of this technology. Early adopters will have a competitive advantage. An October 2023 report of Precedence Research suggests that the global digital health market size is anticipated to reach around $939.54 billion by 2032, up from $262.63 billion in 2022, at a CAGR of 13.1%.

M&A Trend Continues: The medical instruments space has been benefiting from the ongoing merger and acquisition (M&A) trend. It is a known fact that smaller and mid-sized industry players attempt to compete with the big shots through consolidation. The big players attempt to enter new markets through a niche product. As published in a Medical Device Network report of August 2024, there were 122 M&A deals announced in the second quarter of 2024, worth $21.1 billion. In value terms, it is a 275% jump compared to the year-ago period. In terms of deal volume, it was 19% lower than the second quarter of 2023. The slowdown in volume stemmed from a tremendously volatile global macroeconomic situation, which resulted in restrained venture capital investment. The largest of the deals was the $13.1 billion acquisition of Shockwave Medical by Johnson & Johnson. Another significant acquisition of the quarter was Becton, Dickinson and Company or BD’s purchase of the Critical Care division of Edwards Lifesciences for $4.2 billion.

Business Trend Disruption: Per IMF’s April 2024 World Economic Outlook Update, economic growth is projected to be 3.2% in 2024 and 3.3% in 2025, below the historical (2000–19) average of 3.8%. As per the report, growth is expected to converge in the coming quarters, indicating a slower pace of disinflation in 2024 and 2025. In the United States, the projected growth rate has been revised downward to 2.6% in 2024 (0.1 percentage point lower than projected in April). However, the forecast for growth in emerging markets and developing economies has been revised upward, driven by stronger activity in Asia, particularly China and India. The policymakers, overall, continue to remain concerned about the new commodity price spikes from geopolitical shocks, oil production and regional conflicts in and around the Middle East and Central Asia, including continued attacks in the Red Sea. Further, the report says that higher nominal wage growth, which in some cases reflects the catch-up of real wages, if accompanied by weak productivity, could make it difficult for firms to moderate price increases, especially when profit margins are already squeezed.

Zacks Industry Rank Indicates Encouraging Prospects

The Zacks Medical Instruments industry’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bright near-term prospects. The industry, housed within the broader Zacks Medical sector, currently carries a Zacks Industry Rank #63, which places it in the top 25% of more than 250 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

We will present a few stocks that have the potential to outperform the market based on a strong earnings outlook. But it’s worth taking a look at the industry’s shareholder returns and current valuation first.

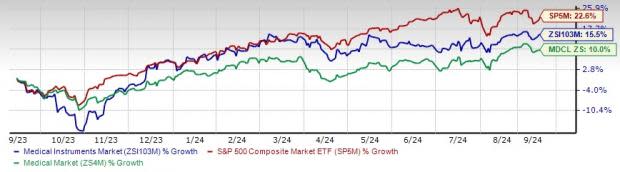

Industry Underperforms S&P 500, Outperforms Sector

The industry has underperformed the Zacks S&P 500 composite but outperformed the sector in the past year.

The industry has risen 15.5% compared with the broader sector’s rise of 10% and the S&P 500’s surge of 22.6% in a year.

One-Year Price Performance

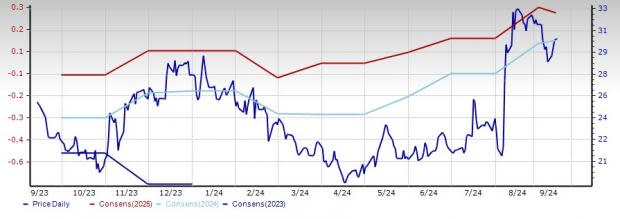

Industry’s Current Valuation

On the basis of the forward 12-month price-to-earnings (P/E), which is commonly used for valuing medical stocks, the industry is currently trading at 33.52X compared with the broader industry’s 23.48X and the S&P 500’s 21.19X.

Over the past five years, the industry has traded as high as 41.66X, as low as 26.46X and at the median of 33.19X, as the charts show below.

Price-to-Earnings Forward Twelve Months (F12M)

Price-to-Earnings Forward Twelve Months (F12M)

3 Stocks to Buy Right Now

Intuitive Surgical: Sunnyvale, CA-based Intuitive Surgical continues to gain from growth in the company’s da Vinci procedure volume, coupled with strong Ion procedure growth. ISRG’s initiative to increase the pricing of procedures should also continue to aid sales growth in 2024. The Launch of da Vinci SP in Europe and da Vinci 5 in the U.S. market should drive system placements higher.

The consensus estimate for this Zacks Rank #1 (Strong Buy) company’s 2024 sales is pegged at $8.1 billion, indicating a 13.7% rise from 2023. The consensus mark for Intuitive Surgical’s 2024 EPS is pegged at $6.67, indicating an improvement of 16.8% from the year-ago period reported figure.

Price and Consensus: ISRG

Fields: Irvine, CA-based Masimo’s focus on patient monitoring and its ongoing research and product development efforts are also impressive. A solid product suite is likely to aid Masimo in solidifying its business globally. A strong liquidity position is an added plus.

The consensus estimate for this Zacks Rank #1 company’s 2024 sales is pegged at $2.1 billion, indicating a 2.4% rise from 2024. The consensus mark for Masimo’s 2024 EPS is pegged at $3.87, indicating an increase of 2.1% from 2024.

Price and Consensus: MASI

Veracyte: San Francisco, CA-based Veracyte continues to witness strong growth momentum on a robust display of strength in the testing business using its established diagnostic platform. The company’s comprehensive Afirma solution’s differentiation is leading to market share gains owing to its quality and performance. The new GRID ROU tool is gaining strong interest from physicians, while MolDX’s finalization of an expanded local coverage determination for Afirma reinforces the company’s competitive position. The Decipher Prostrate test is also making strides, achieving a “Level 1B” designation in the updated NCCN guidelines and advancing on the reimbursement front.

The Zacks Consensus Estimate for Veracyte’s 2024 sales is pegged at $437 million, indicating a 21% rise from 2023. The consensus estimate for VCYT’s adjusted earnings is pegged at 14 cents per share, a 113.7% projected jump from 2023. Veracyte sports a Zacks Rank #1 currently. You can see the complete list of today’s Zacks #1 Rank stocks here.

Price and Consensus: VCYT

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Masimo Corporation (MASI) : Free Stock Analysis Report

Veracyte, Inc. (VCYT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research