CashNews.co

Get Detailed Stock Report

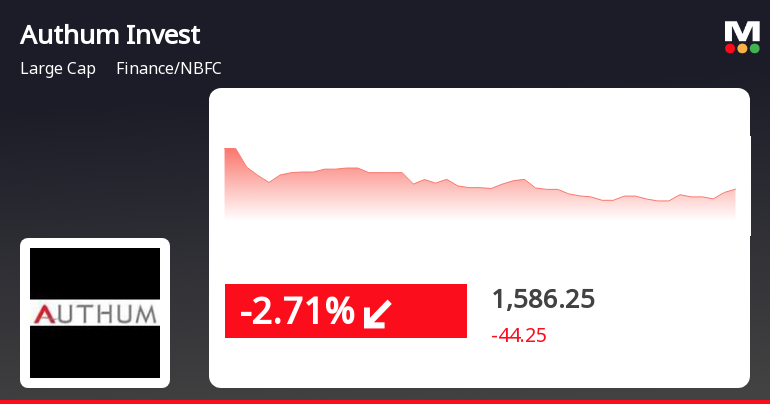

Authum Investment & Infrastructure Ltd, a leading finance and non-banking financial company (NBFC) in the large-cap industry, has recently seen a dip in its stock performance. On October 30, 2024, the company’s stock lost -3.25%, closing at Rs 1575.45.

According to MarketsMOJO, a leading stock analysis platform, the current stock call for Authum Investment & Infrastructure is ‘Hold’. The stock has underperformed the sector by -3.03% and has shown a trend reversal after two consecutive days of gains. The stock also touched an intraday low of Rs 1570.3, a decrease of -3.69%.

While the stock’s moving averages are higher than the 100-day and 200-day averages, they are lower than the 5-day, 20-day, and 50-day averages. This indicates a mixed trend for the stock in the short term.

In comparison to the overall market performance, Authum Investment & Infrastructure’s stock has shown a -3.39% decrease, while the Sensex has only seen a -0.31% decrease. In the past month, the stock has also underperformed the Sensex by -11.65% compared to the Sensex’s -4.96% decrease.

Despite the recent dip in stock performance, Authum Investment & Infrastructure remains a strong player in the finance and NBFC industry. Investors are advised to hold their positions and monitor the stock’s performance in the coming days.