CashNews.co

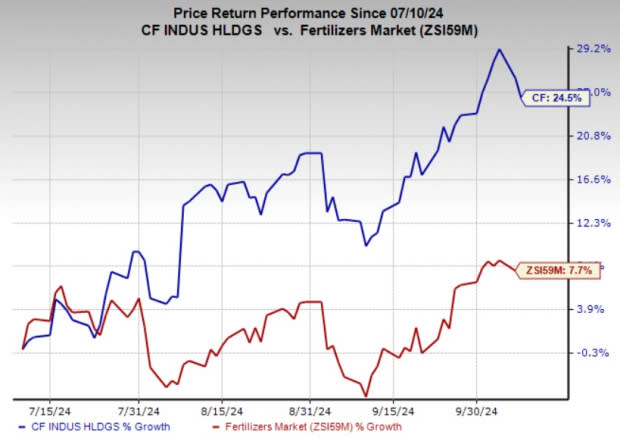

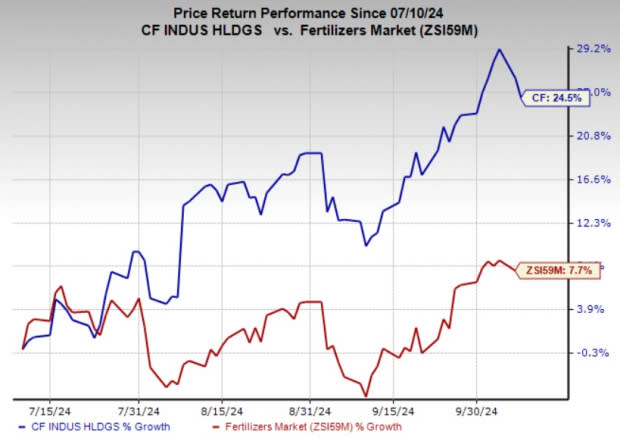

CF Industries Holdings, Inc.’s CF shares have gained 24.5% over the past three months, outperforming the Zacks Fertilizers industry’s rise of 7.7%. It is well-placed to benefit from higher nitrogen fertilizer demand in major markets and lower natural gas costs.

We are positive about CF’s prospects and believe that the time is right for you to add the stock to the portfolio as it looks promising and is poised to carry the momentum ahead.

Let’s see what makes CF stock an attractive investment option at the moment.

Image Source: Zacks Investment Research

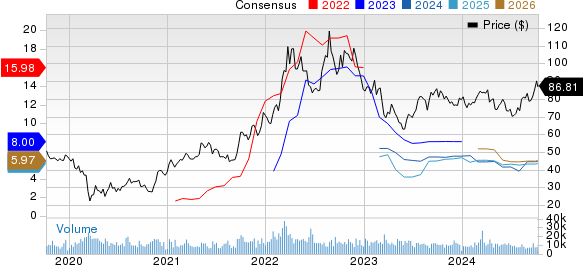

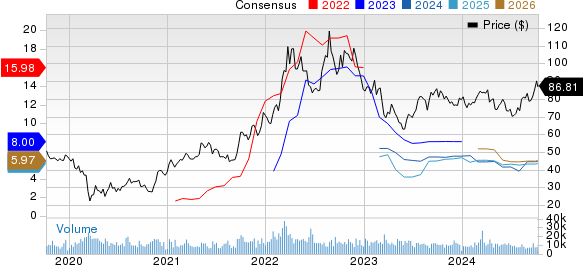

CF’s Earnings Estimates Northbound

Earnings estimates for CF have been going up over the past 60 days. The Zacks Consensus Estimate for 2024 has increased by 21.4%. The consensus estimate for the third quarter of 2024 has also been revised 60% upward over the same time frame. The favorable estimate revisions instill investor confidence in the stock.

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

Superior Return on Equity (ROE) for CF Stock

ROE is a measure of a company’s efficiency in utilizing shareholders’ funds. ROE for the trailing 12 months for CF Industries is 13%, above the industry’s level of 8.6%.

CF’s Stock Valuation Looks Attractive

CF’s shares are currently trading at a level that is lower than the industry average, suggesting that the stock still has upside potential. Going by the EV/EBITDA (Enterprise Value/ Earnings before Interest, Tax, Depreciation and Amortization) multiple, which is often used to value fertilizer stocks, CF is currently trading at a trailing 12-month EV/EBITDA multiple of 7.43, cheaper compared with the industry average of 10.4.

CF Stock Gains on Healthy Nitrogen Demand, Lower Gas Costs

CF Industries is benefiting from the rising global demand for nitrogen fertilizers, which is driven by significant agricultural demand. Industrial demand for nitrogen has also recovered from the pandemic-related disruptions. Global demand is expected to remain strong in the near future due to recovering industrial demand and farmer economics.

High levels of corn planted acres and low nitrogen channel inventories are expected to drive demand for nitrogen in North America. Demand for urea is also likely to remain strong in Brazil and India. Demand in India is expected to be driven by an uptick in domestic production on the back of higher operating rates and favorable weather conditions.

CF, on its second-quarter call, said that it anticipates the global supply-demand balance to remain positive over the near term, driven by nitrogen import requirements for Brazil and India until the end of the year, as well as sustained wide energy spreads between North America and high-cost production in Europe.

The company also stands to benefit from lower natural gas prices. It saw a decline in natural gas costs in the second quarter of 2024. The average cost of natural gas fell to $1.90 per MMBtu in the quarter from $2.75 per MMBtu in the year-ago quarter. Lower natural gas costs led to a decline in the company’s cost of sales. The benefits of reduced gas costs are expected to continue in the third quarter.

CF remains committed to boosting shareholders’ value by leveraging strong cash flows. The company repurchased 8.3 million shares for $652 million in the first half of 2024, including 4 million shares for $305 million in the second quarter. The current $3 billion share repurchase program had around $1.9 billion remaining at the end of the second quarter. CF returned $832 million through dividends and share repurchases during first-half 2024. Earlier this year, the company also announced a 25% increase in quarterly dividend to 50 cents per share.

CF Industries Holdings, Inc. Stock Price and Consensus

CF Industries Holdings, Inc. price-consensus-chart | CF Industries Holdings, Inc. Quote

CF’s Zacks Rank & Other Key Picks

CF currently carries a Zacks Rank #1 (Strong Buy).

Other top-ranked stocks in the Basic Materials space are IAMGOLD Corporation IAG, Cabot Corporation CBT and Axalta Coating Systems Ltd. AXTA, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for IAMGOLD’s current-year earnings has increased by 45.4% in the past 60 days. IAG beat the consensus estimate in each of the last four quarters with the average surprise being 200%. Its shares have shot up roughly 109% in the past year.

The consensus estimate for Cabot’s current fiscal year earnings is pegged at $7.07 per share, indicating a year-over-year rise of 31.4%. The consensus estimates for CBT’s current-year earnings has increased by 4.3% in the past 60 days. The company’s shares have rallied roughly 59% in the past year.

The Zacks Consensus Estimate for Axalta Coating’s current year earnings is pegged at $2.07, indicating a rise of 31.9% from year-ago levels. The Zacks Consensus Estimate for AXTA’s current year earnings has increased 2.5% in the past 60 days. The stock has gained around 31% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CF Industries Holdings, Inc. (CF) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

Iamgold Corporation (IAG) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research